It’s too soon to call an end to America’s worst bond-market collapse in at least half a century.

Treasuries resumed losses on Thursday with yields surging more than 15 basis points, a day after Federal Reserve Chair Jerome Powell sought to soften the blow of the largest rate hike since 1994 by saying he didn’t expect moves of that size to become the norm.

Investors also dumped European bonds after a surprise Swiss rate hike, putting Germany’s five-year yield on track for its biggest jump since 2011. Meanwhile, U.K. debt pared declines even after the Bank of England raised rates as expected and hinted at bigger moves ahead.

Some signs suggest the market is yet to face its biggest challenge. Powell said it’s too soon to declare victory over inflation that’s surged to a four-decade high — or even see much evidence of an economic slowdown that would contain it. And policy makers boosted expectations for where the Fed’s benchmark rate will end next year to a median of 3.8% from 2.8% previously. Five predicted it would exceed 4%.

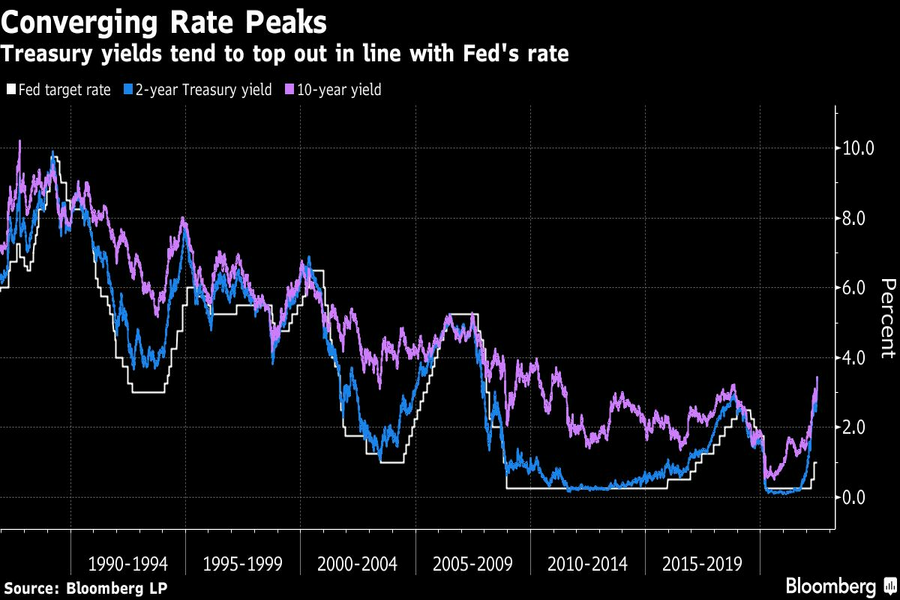

Such a path would almost certainly increase what are already Treasuries’ worst losses since at least the early 1970s, and spur another leg higher in rates. Two- and 10-year Treasury yields — both now around 3.4% — have tended to peak in line with the Fed’s benchmark, making investors eye 4% as the next milestone to test.

“It’s very clear the Fed will do whatever it takes to forcefully reduce inflation and the terminal rate is going to be closer to 4% and maybe even go higher,” said Peter Yi, director of short-duration fixed income and head of credit research at Northern Trust Asset Management. “The Fed is on a path to higher rates and even as Powell tried to downplay another 75 basis points hike next month, he said rates are still extremely low.”

Two-year yields resumed their swift increase, rising as much as 20 basis points to 3.39% Thursday, after a 24 basis-point drop Wednesday had offered some respite. The yield curve flattened as long maturities rose less. U.S. stock futures also pointed lower, after the S&P 500 Index gained 1.5% Wednesday to snap a five-day losing streak.

The market has been extremely volatile, and many investors say 10-year yields are likely to push up to levels not seen since 2010. While Powell said the bank is “absolutely determined” to keep inflation expectations anchored to 2%, a bond market proxy for the anticipated five-year inflation rate edged up as much as 9 basis points Wednesday to 3.03%.

“A 4% yield on the 10-year note is not out of bounds,” said Charles Curry, managing director and senior portfolio manager of U.S. fixed income at Xponance Inc., which oversees about $15 billion assets. “There’s going to be starts and stops in yields along the way as the Fed gets to that terminal value, which in our mind is high 3%s and possible 4% given inflation.”

In Europe, bonds slid once more after the Swiss National Bank unexpectedly joined the rate-hiking party with a 50 basis-point move Thursday. It had been expected to leave borrowing costs on hold. German yields mirrored the move in Treasuries, rising more than 15 basis points, while Italian debt lost early gains to follow suit.

The era of rock-bottom yields that’s now abruptly ending was fueled by years of stimulus from central banks in the wake of the 2008 financial crisis, a period when policy makers faced little pressure because inflation remained relatively tame.

But the dynamics are reversing starkly worldwide, with consumer prices surging and central banks unwinding the massive bond portfolios they amassed by injecting cash into the financial system through so-called quantitative easing. The last major holdout, the Bank of Japan, is being challenged by traders to raise its cap on bond yields.

Any shift from the BOJ, which also meets this week, could add further headwinds to the U.S. Treasury market, given that it has benefited from an influx of foreign buyers as yields were below zero overseas. But Japanese investors have been selling foreign bonds for much of this year, a trend that may accelerate if the BOJ allows yields to push higher.

George Goncalves, head of U.S. macro strategy at MUFG, said an increase in the BOJ’s yield cap from 0.25% to 0.5% would likely spur a U.S. 10-year “yield spike of 50 basis points,” though he said any such move could provide a buying opportunity.

Where Treasury yields will peak, however, is ultimately dependent on the direction of the economy and whether the Fed is able to bring inflation down. While yields have marched higher this year, the gap between short- and long-term rates has narrowed or inverted periodically, indicating expectations that rate hikes will slow growth or bring on a recession as soon as next year.

“You could see at a point that rates go much higher before the Fed arrests this inflation until the inversion of the curve as they ultimately cause a recession,” said Xponance’s Curry.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound