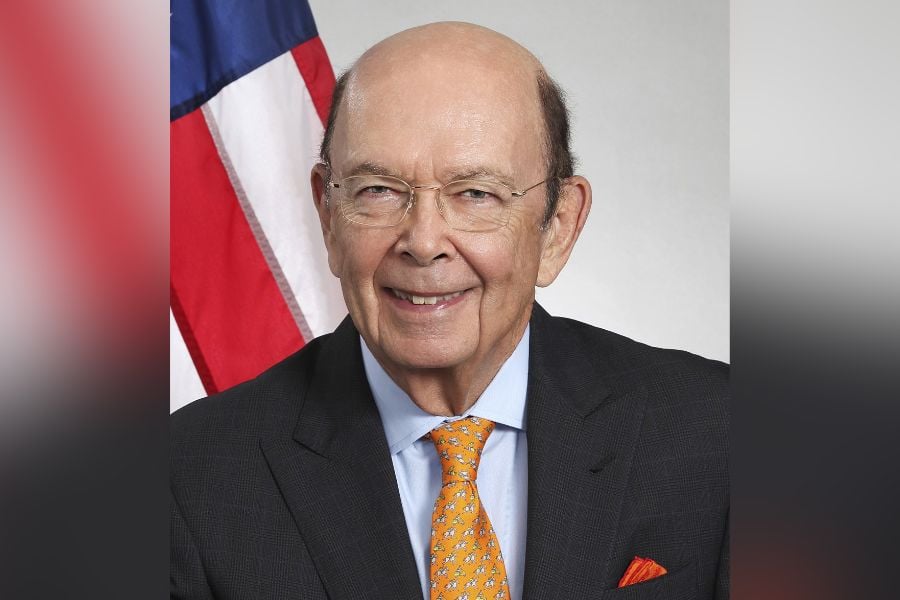

Former Secretary of Commerce Wilbur Ross is one of the few Americans to reach the highest of heights both on Wall Street and in Washington. And now he’s opening up about his amazing journey to the pinnacles of power in his new book Risks and Returns.

“It feels very good because I think the anecdotes of my life have messages that could be helpful to people in their lives and in their careers,” said Ross in an interview with InvestmentNews.

In his autobiography, Ross recounts his trip from a modest New Jersey upbringing through his achieving billionaire status. It was not a straight shot to the top, however, as Ross lost his father while studying as an undergraduate at Yale, forcing him to pay for his college and graduate educations.

“When my father died as I was a teenager, I then had to put myself through school, through Yale, then through Harvard Business School,” said Ross. “I learned from that experience that ultimately, only you can hold yourself back. If you really work hard and have some ability, you can get very, very far.”

Ultimately, Ross found his way to Wall Street and made a fortune as a distressed investor, first at NM Rothschild & Sons, before leaving in 2000 to start his own shop WL Ross & Co. While working at those two firms, Ross became known as the “King of Bankruptcy” for his ability to acquire and restructure failed companies and later sell them for a profit after their operations improved.

Ross says his first real job on Wall Street was liquidating a venture capital company, an experience that taught him how to work with banks and how to keep a company alive until it could either be rehabilitated or sold.

Later on in Ross's career, Michael Milken invented deliberate junk bonds, thereby creating a whole new class of securities. Once that market was created, Ross says he quickly saw the potential for bankruptcy investing and “that's when I really lurched into it.”

Still, Ross disavows the idea that success on Wall Street comes naturally, and without extensive tutelage. In the book he writes: “Successful investors are made, not born.”

“I had some very good mentors over the years,” said Ross.

In 2006 Ross sold his business to Invesco, elevating him to billionaire status. It was tremendous timing for Ross as the financial world would fall apart only two years later during the Great Financial Crisis.

“Timing is clearly important on Wall Street because the average stock probably has a price range of 30 percent in a given year. So if you hit it at the wrong point, you can be 30 percent down in no time at all,” said Ross. “But timing is important in my business, in the distressed business, in another regard. You try to get to things that's the nadir of their business cycle. So that in addition to your turnaround business cycle turnaround can help you.”

In 2017, at age 79, Ross left Wall Street for Washington to become commerce secretary in the Donald Trump administration. The pair knew each other from an Atlantic City bond deal gone sour and where they happened to be on opposite sides of the negotiating table.

“When the Trump Taj Mahal mortgage bonds defaulted, the holders hired me to try to get them their money back out. We had pretty tumultuous sessions, and ultimately it worked very well,” said Ross. “Interestingly, the big bond holder was Carl Icahn. And he and I both ended up endorsing Trump years later when he ran. Because when you encounter someone under those adverse circumstances, you really find out what they're made of.”

In fact, Ross was one of the few appointees that actually lasted Trump’s entire administration.

“That's because there were no surprises for me with him,” said Ross. “He was a very complicated personality, very smart person. But very complicated and very demanding. Well, since I knew that before coming in, it didn't surprise me a bit when I encountered it.”

Looking back, Ross views his time in Washington as working in “basically a dysfunctional system.” He says there are lots of mid-level bureaucrats who are well-trained, very capable, and have good ideas. However, because there is no reward for taking a chance and winning – but real punishment for making a mistake – he says government workers tend to be very timid. And as a result, he says they "resist change to the utmost degree."

“That's bad because the economy keeps changing. The world keeps changing. And it's not that the people are bad. They're just prisoners in this apparatus,” said Ross.

Now that he’s out of government, he is still active in the market, although not as active as he once was.

“I think the economy is probably due to slow down somewhat. It was booming for quite a while. The only interruption was Covid, and now it seems to have more than fully recovered from Covid. So at some point, it runs out of steam,” said Ross.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound