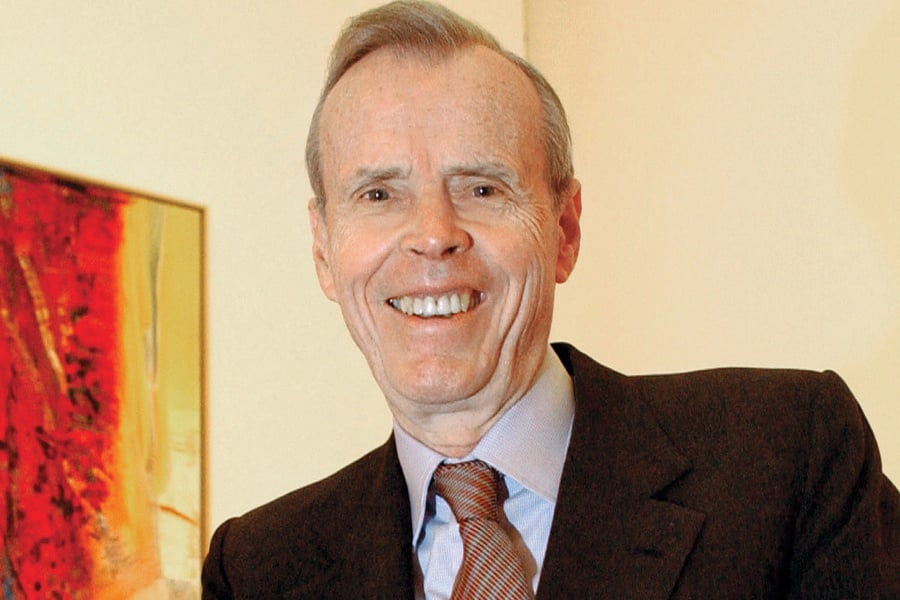

A Wall Street veteran who led Paine Webber for 20 years until its $16 billion sale to UBS in 2000, Mr. Marron was also active most recently in the independent broker-dealer business.

Donald Marron, the financier who led Paine Webber Inc. for 20 years until it was sold to UBS AG in 2000 and who went on to buy and sell independent broker-dealers over the past decade, has died. He was 85.

He died of a heart attack in New York, according to his wife, Catie Marron. She said her husband was heading out on Friday evening to a party for some of his staff and planned to come home after about 30 minutes to watch "The Irishman" with her and their son William. He never made it home.

"It was very fast," Mrs. Marron said. "It's my worst nightmare."

Don Marron, a lifelong New Yorker, had a Wall Street career spanning seven decades and was very active in the modern art world and philanthropy. He's best known for leading Paine Webber and selling the firm to Swiss giant UBS. His wife said he was "deeply" proud of how he handled the aftermath of that deal.

"People often lose jobs in mergers like these," Mrs. Marron said. "Don made sure that he held people's jobs and lives in place. He had options to sell to other places, but chose this route."

He founded at least three New York-based companies: investment bank D.B. Marron & Co., economic data provider Data Resources Inc. and private-equity firm Lightyear Capital.

It was through Lightyear Capital that Mr. Marron entered the IBD business, buying three ING broker-dealers in 2010 and rechristening them Cetera Financial. Two years later, he bought Genworth Financial Investment Services before selling Cetera in 2014 for $1.15 billion in cash to real estate investor Nicholas Schorsch's firm, RCS Capital.

"We did Cetera and expanded the retail network space dramatically," Mr. Marron said in an interview with InvestmentNews in 2015. "We had a very good management team, and we wanted to be in that business again because that's the future," he said, pointing to long-term trends of baby boomers retiring and the move from defined benefit plans to defined contribution plans as drivers for the need of financial advice.

Mr. Marron pulled off another big deal when Lightyear and a Canadian pension fund bought Advisor Group, a network of four broker-dealers with 5,200 advisers from the AIG Group in 2016. Lightyear sold a 75% interest in Advisor Group to Reverence Capital Partners earlier this year.

As head of Mitchell Hutchins, Mr. Marron led the firm's 1977 merger with Paine Webber. Three years later, he was named chief executive of the company, marking the start of a tenure highlighted by acquisitions, growth in brokerage accounts and his fierce defense of the firm's independence.

Mr. Marron was considered "a prodigy in his field," according to a 1980 Wall Street Journal profile published when he was named Paine Webber's CEO. He shielded the firm from fads like junk bonds and derivatives, and, after attempting to steer it in the direction of an investment bank, refined its focus on serving wealthy individuals.

When Mr. Marron joined in 1977, Paine Webber had about 2,270 brokers in 137 offices, according to a New York Times article that year. By the time of parent Paine Webber Group Inc.'s sale to Zurich-based UBS in July 2000, it was the fourth-largest U.S. brokerage with more than 8,500 brokers in 385 offices and 2.7 million customers.

Its focus on clients with at least $500,000 to invest provided the firm with steady, fee-based income. Averaging $186,500, its accounts were the largest in the industry.

The acquisition also boosted UBS's U.S. client assets to 49% of its total from 4%, making it the world's biggest wealth manager. In return, Paine Webber's clients would have greater access to European securities and research.

"This is the right merger, with the right partner, at the right time," Mr. Marron, who also served as Paine Webber's chairman, said at the time of the deal.

Donald Baird Marron was born July 21, 1934, in Goshen, N. Y. His father, Edward Joseph Marron, was a professional writer, according to the 1977 New York Times article.

Raised in New York's Washington Heights neighborhood, he graduated from the Bronx High School of Science at age 13. In 1951, he dropped out of the City University of New York's Baruch College to join the New York Trust Co.'s research department.

"He was bright enough to skip grades," Mrs. Marron said. "He started working at 17 to support his family."

Mr. Marron started D.B. Marron & Co. in 1959. He sold Data Resources, co-founded in 1969 with Harvard University economist Otto Eckstein, to McGraw-Hill for $103 million in 1979.

He served as chairman of UBS America from 2000 to 2003. He was also chairman of Lightyear Capital, the New York-based private equity firm he founded in 2000, and which has raised $3.5 billion in capital, according to its website.

Standing 6 feet 6 inches tall, Mr. Marron had a high profile in many ways. He was on the board of directors of the New York Stock Exchange from 1974 to 1981; a co-chairman of the National Commission on Retirement Policy, the non-partisan group that was tasked with finding ways to keep Social Security solvent; and, at the start of the George W. Bush administration, was mentioned as a candidate for Treasury secretary.

He was also a trustee of New York University, giving $40 million in 2013 to start the Marron Institute on Cities and the Urban Environment; a trustee of the Center for Strategic and International Studies; and a member of the board of overseers at Memorial Sloan Kettering Cancer Center.

An avid art collector, Marron built up a large corporate collection of mainly American modern works, first at Mitchell Hutchins and then at Paine Webber. Canvases by Claes Oldenburg, Chuck Close and Andy Warhol festooned the walls at Paine Webber's headquarters in midtown Manhattan.

"You have to have an office, so why not look at a Jasper Johns rather than a reproduction?" Mr. Marron said in a 1999 interview with Fortune magazine.

"He got involved before the huge escalation in prices," Mrs. Marron said.

Mr. Marron was elected president of the board of the Museum of Modern Art in 1985, serving until 1991. He was also a life trustee. In 2002, he donated 44 works from the post-merger collection to the midtown Manhattan museum.

An advocate for the homeless, he supported the Coalition for the Homeless, created in 1981 to provide direct services to men, women and children without shelter in New York City's five boroughs.

He married his first wife, the former Gloria Swope, in 1961. They had two children, Jennifer Ann Marron and Donald Baird Marron Jr., an economist who was acting director of the Congressional Budget Office during the administration of George W. Bush.

Mrs. Marron was chairwoman of the New York Public Library from 2004 to 2011. They married in 1985 and had two children, Serena and William.

"Every single bone in his body was decent. He was very close with his family," Mrs. Marron said. "One of his favorite things to do was to come home and have a drink with me in front of the fireplace. As a father and husband he was deeply loved."