The financial markets breathed a collective sigh of relief following Tuesday's midterm elections, as voters did as predicted.

In fact, much of the 7% gain by the S&P 500 this year has been attributed to an anticipation of a more balanced Congress, and the prospect of Washington gridlock.

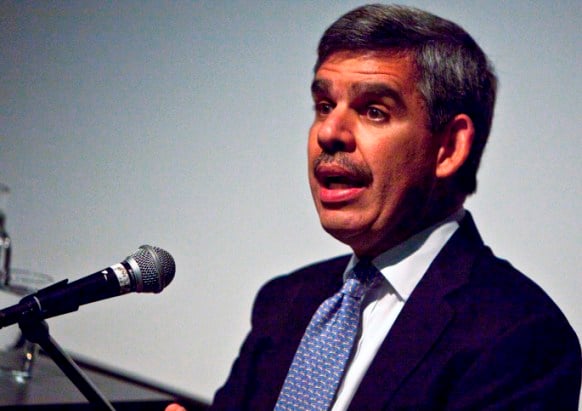

“The possibility of the Republicans' winning the House was largely priced in, but the jury is still out on whether the split in the two chambers of Congress will help or hinder economic growth and job creation,” said Mohamed El-Erian, chief executive and co-chief investment officer of Pacific Investment Management Co. LLC, a $1 trillion asset management company.

“The uncertainty relates to the basic characterization of the economy,” he added. “Will animal spirits be ignited just by reversing the intrusion of government or does the economy require meaningful reforms to deal with structural rigidities, debt overhangs and the malfunctioning of the housing market?”

For many, the market's reaction leading up to the power-shifting midterm elections was an example of buying on the rumors. But it's still too early to know if the second half of that adage — to sell on the news — will come to fruition.

“Leading up to the election, we noticed that most of the companies negatively affected by health care reform, for example, had been doing better, which suggests an anticipation of a slowing regulatory process,” said Peter Tuz, president of Chase Investment Counsel Corp., a $1.5 billion asset management firm.

However, he added, the other side of the Republican campaign — to cut spending and to control the size of government — could hurt companies that do business with the government.

“We'll have to see whose ox gets gored,” he said.

Even if a more balanced Congress means gridlock, as most pundits are predicting, it is at least something Wall Street can factor in. And in reality, that's what the markets really want, according to Paul Schatz, president of Heritage Capital LLC.

The firm has $64 million under management and oversees on a discretionary basis another $100 million.

“The markets are the greatest discounting mechanism in the world, and the election gets the element of uncertainty out,” Mr. Schatz said. “This election was bullish for corporate America because it's pretty clear now that with a split in Congress, the tax policy can't get any worse than it has been the past two years.”

(To see why billionaire investor Ken Fisher thinks the election will dramatically boost the prices of large cap stocks

, click here.)

In many respects, the financial markets' anticipation of the election is comparable to the anticipation of the second round of quantitative easing by the Federal Reserve Board, which is expected to be announced today.

“Bonds have been selling off ever since August when the Fed started floating the idea of a second round of quantitative easing,” Mr. Schatz said.

The primary objectives behind the Fed's strategy to buy at least $500 billion worth of Treasury bonds is to prevent deflation, make exports more attractive, devalue U.S. debt obligations and drive investors into riskier assets such as stocks.

“Quantitative easting is bad for bonds, and that moves investors higher up on the risk structure because stocks are looking less bad than bonds,” said Karl O. Mills, president and chief investment officer at Jurika Mills & Keifer LLC.

“Gridlock in the short term looks good for the markets, as does quantitative easing,” he added. “But the economy actually needs major solutions, because long-term, the U.S. economy is in a deep hole."