Federal Reserve Chair Jerome Powell is set to deliver the largest back-to-back rate increase in decades on Wednesday, with investors seeking signs he is open to shifting to smaller moves from September.

The Federal Open Market Committee is expected to raise rates by 75 basis points for a second straight meeting — the most aggressive tightening since the 1980s. The decision will be announced at 2 p.m. in Washington. No quarterly forecasts will be released, and Powell will hold a press conference 30 minutes later.

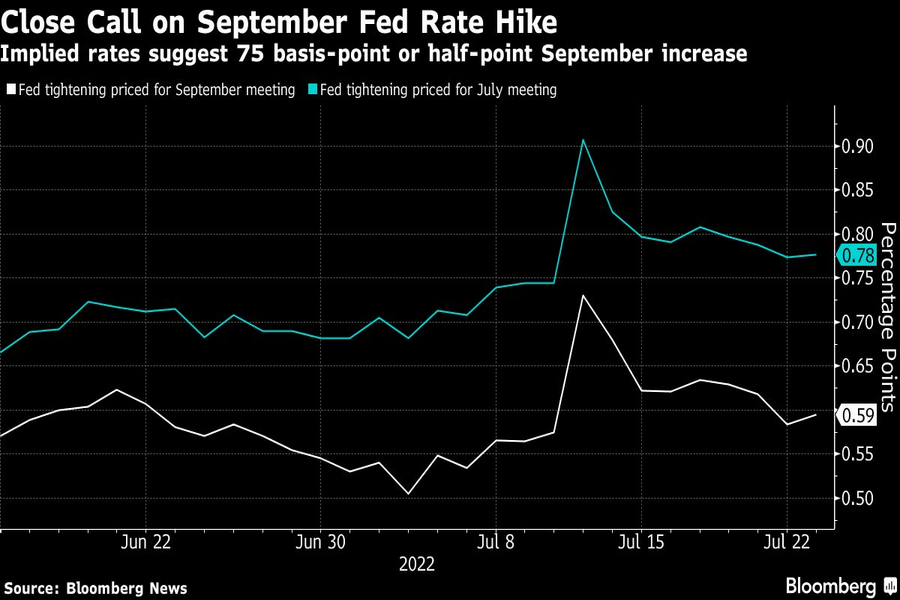

The Fed chief could suggest he’s open to downshifting to a half-point hike in September, following signs of slower economic growth and falling commodities prices that could cool inflation over the summer.

“The outcome of this meeting is set in stone, so the question is what will happen next,” said Aneta Markowska, chief U.S. financial economist at Jefferies LLC. “The entire press conference is going to be about clues for the September meeting.” She said a half-point hike then would be “an appropriate base case but obviously data-dependent.”

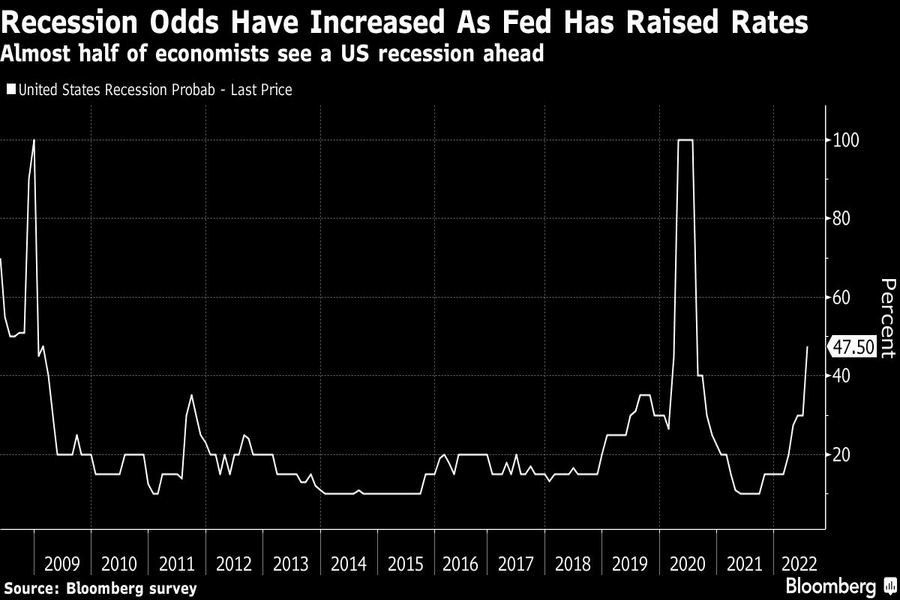

Powell is trying to curb the hottest inflation in 40 years amid criticism he was slow to respond to rising prices last year, roiling financial markets as investor worry the Fed could trigger a recession.

A 75 basis-point hike would lift the Fed’s benchmark to a 2.25% to 2.5% target range, equaling its estimate of the neutral rate that neither stimulates nor restricts growth. Powell could cite reaching neutral to suggest a reason for moving more gradually going forward.

In June, Powell said a 50- or 75 basis-point increase was most likely for the July meeting. He could repeat that guidance, suggest only a 50 basis-point hike is on the table, or keep his options open.

“Powell faces a communication challenge at the meeting: He needs to affirm the Fed’s determination to crush inflation while not further spooking the market, which has priced in a pessimistic future. We expect Powell to steer markets to expect a 50 basis-point rate hike in September and underscore the significance of policy rates reaching the committee’s estimated neutral rate.”

— Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger (economists)

The Fed’s 1.5 percentage-point hikes in two meetings would be the largest concentrated increases in rates since the early 1980s when Paul Volcker was chairman and battling sky-high inflation.

Markets are fully pricing in a 75 basis-point hike Wednesday, though there’s an outside risk of a surprise. Nomura economists see a 100 basis-point increase to show resolve after consumer prices rose 9.1% in June. A few view a half-point move as more likely, reflecting a recent softening in growth.

But the vast majority of Wall Street is looking for 75 basis points after Governor Christopher Waller, a leading hawk, endorsed a move of that size, and others expressed skepticism of a larger move.

The FOMC statement is likely to note that U.S. growth has slowed, reflecting a moderation in consumer spending and housing as well as widespread anecdotal reports of slowing demand.

Second-quarter expansion is estimated in a Bloomberg survey of economists at 0.4% and the Atlanta Fed’s tracking estimate suggests a negative number, which would be a second straight contraction that some economists consider a sign of recession. The government report will be released on Thursday.

Still, the FOMC statement may note bright spots, including “robust” jobs.

“They will have to recognize that the economy has slowed significantly,” said Matthew Nest, global head of active fixed income at State Street Global Advisors. While there are also signs inflation may soften, officials will want to wait to see “the whites of the eyes of inflation” coming down before they are ready to ease up, he said.

The FOMC is expected to retain its language pledging ongoing rate increases, without specificity on the size of the adjustments.

Kansas City Fed President Esther George is likely to dissent for a second straight meeting in favor of a half-point move. She has warned that moving rates too quickly could cause market stress and blow the Fed off course.

While most economists expect just one dissent, a few believe there could be a second. New voters include Boston Fed President Susan Collins and Michael Barr, sworn in earlier this month as vice chair for supervision.

The Fed is likely to reiterate its plans to shrink its massive balance sheet, phasing in its reductions to an eventual pace of $1.1 trillion a year. Economists project that will bring the balance sheet to $8.4 trillion by year end, dropping to $6.5 trillion in December 2024. No announcement is expected on sales of mortgage-backed securities.

Powell will continue to sound unwavering against inflation and may repeat that he’s willing to accept some pain to ensure Americans’ view of higher prices doesn’t become embedded as lasting.

“The name of the game is defending inflation expectations,” said Derek Tang, an economist at LH Meyer, a Washington policy-analysis firm. “Until they are assured expectations won’t break to the upside, they don’t have the luxury of slowing down or showing weakness.”

Still, his guidance could suggest there’s a path to somewhat less aggressive hikes. In June, he said of 75 basis-point hikes, “I do not expect moves of this size to be common.”

Markets are betting on the prospect of rate cuts as soon as the second quarter next year. Powell could push against that, or note that the Fed will be “nimble” and respond to incoming data. He will have an opportunity to update any signal for September at the Kansas City Fed’s Aug. 25-27 policy retreat in Jackson Hole, Wyoming.

“We will have two additional payroll reports before the September meeting — a lot can happen, and that’s why I would not put too much emphasis, signal-wise, on Powell’s comments at the press conference,” said Thomas Costerg, senior U.S. economist at Pictet Wealth Management.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound