Investors can "breathe a sigh of relief" as Fidelity Investments matched rivals instead of escalating a recent price war, according to Morgan Stanley.

[

More: Fidelity eliminates commissions on online trades]

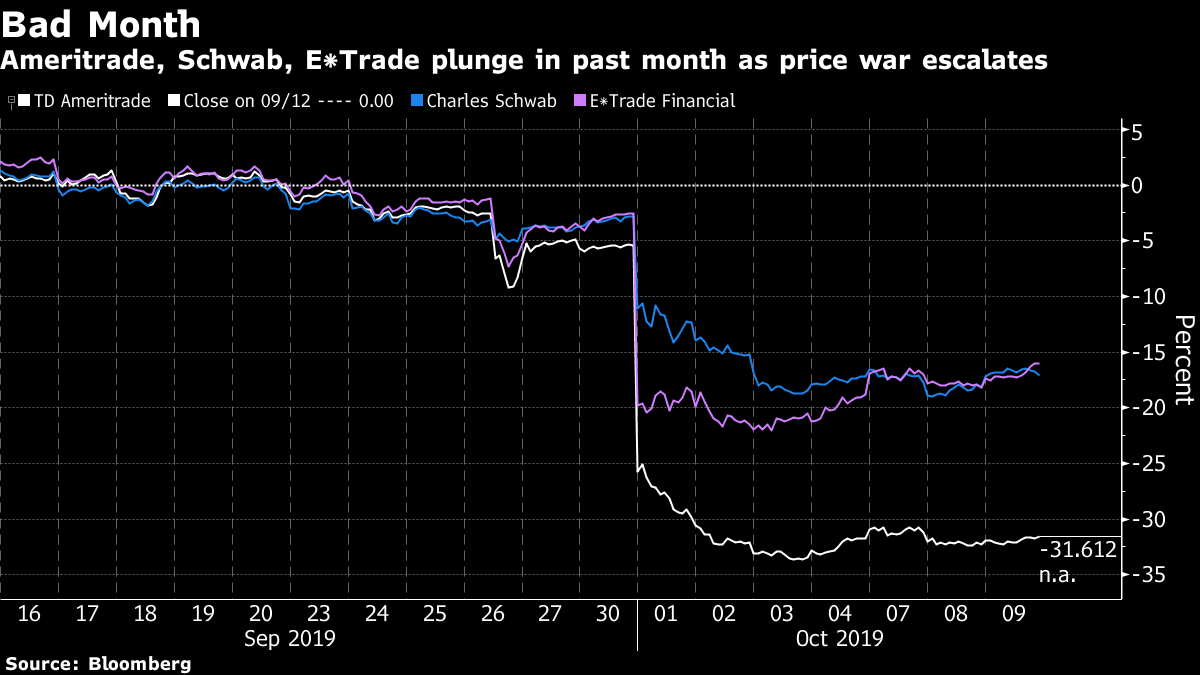

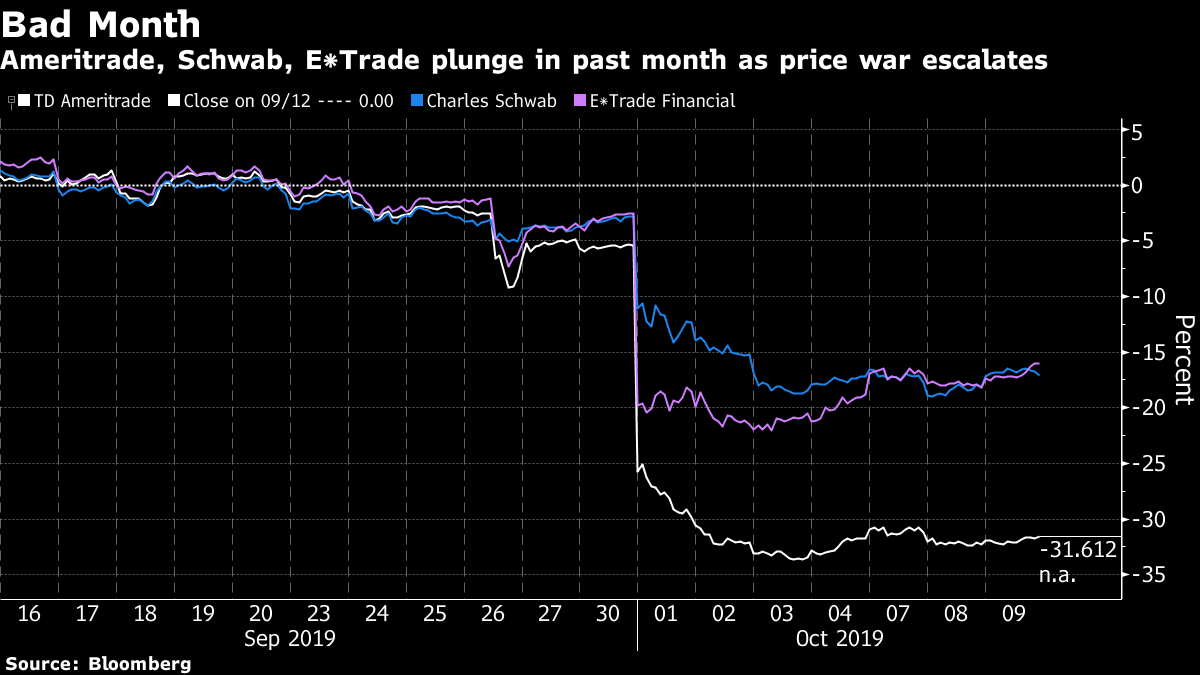

Shares of TD Ameritrade Holding Corp. rose as much as 2.8% in Thursday morning trading, while Charles Schwab Corp. gained 2.3% and ETrade Financial Corp. climbed 3.4%. TD Ameritrade has plunged 29% in the past month, while Schwab and ETrade have both tumbled 13%, as brokers gave up on commissions.

"Product pricing is now in-line across e-brokers and Fidelity and removes a near-term overhang," Morgan Stanley analyst Michael Cyprys wrote in a note. He flagged Fidelity leaving its contract fee on options at 65 cents per contract, and said, "fears around margin lending going to zero are well overdone."

Mr. Cyprys added that Fidelity highlighting its money fund sweep option, which pays a higher yield on customer cash balances than bank sweep offerings at Schwab, TD Ameritrade and ETrade isn't new. "They've been touting this for a while now, and concerns around this are already reflected in the price for Schwab," he said.

[

More: Zero commission fight could pressure wirehouse earnings]

Fidelity said Thursday it will offer zero commissions for online buying and selling of U.S. stocks, exchange-traded funds and options, and also provide higher yields for cash balances and better trade execution. The move came after four major industry players rolled out commission-free stock and ETF trading:

Interactive Brokers Group Inc. announced commission-free stock and ETF trading in late September

Schwab and TD Ameritrade then slashed trading fees to zero on Oct. 1

ETrade joined its rivals and cut commissions to zero the next day

Fidelity's price cut may have other impacts as well, according to Bloomberg Intelligence analyst David Ritter:

[

Recommended video: Financial planning wasn't even a thing 50 years ago]

"Fidelity's move to free online trades may spur Schwab to cease accepting payments for order flow (1% of net revenue), likely improving prices received by clients and enhancing its appeal. We think the company is also likely to default to higher interest-bearing options for customers' cash balances."

Last week, Mr. Cyprys said that he saw a higher probability Fidelity would reduce prices after E*Trade, TD Ameritrade and Schwab slashed commissions to zero.

Investing in profitability, performance and people:

Register for our Top Advisory Firm Summit.

Last week, Mr. Cyprys said that he saw a higher probability Fidelity would reduce prices after E*Trade, TD Ameritrade and Schwab slashed commissions to zero.

Investing in profitability, performance and people: Register for our Top Advisory Firm Summit.

Last week, Mr. Cyprys said that he saw a higher probability Fidelity would reduce prices after E*Trade, TD Ameritrade and Schwab slashed commissions to zero.

Investing in profitability, performance and people: Register for our Top Advisory Firm Summit.