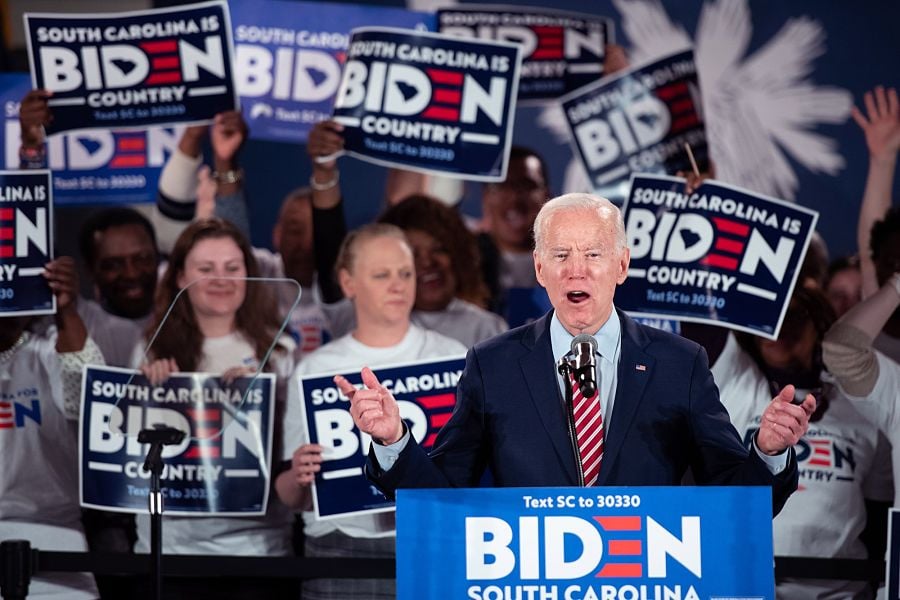

Wall Street has been warming to the idea that a Joe Biden presidency would be bullish for stocks.

However, there are strings attached: His victory needs to be accompanied by a “blue wave” that sweeps Democrats into the majority of both the Senate and House of Representatives.

Those strings now look a bit frayed, as investors watch the probability of Democratic control of the Senate dwindle to that of a coin toss according to some metrics. With it go the chances for a massive fiscal stimulus early next year that bulls were counting on to take stocks to new heights. The re-acceleration of COVID-19 cases in the U.S. and Europe underscores the renewed economic threat from the virus, with the S&P 500 plunging almost 6% in its worst week since March.

“There’s much more conviction around a Biden victory than a Democratic Senate -- that’s always been more of a jump ball,” said Alec Young, chief investment officer at Tactical Alpha. “It’s all kind of murky. It’s safe to say no one really knows what’s going to happen in the Senate.”

Democrats are now projected to hold 45 Senate seats and Republicans are forecast to hold 46, with nine considered to be toss-ups, according to RealClearPolitics. While the probability of a blue wave shifting control of the Senate to Democrats has held firm at 77% at election analysis site FiveThirtyEight, it has fallen from 70% in early October to as low as 55% on Oct. 24 in PredictIt’s market. Republicans regaining control of the House is considered a long shot by most metrics.

The result is an ever-shifting playbook of strategies surrounding the election, and less and less confidence in which one is correct.

At QMA, the quantitative investing arm of PGIM, fund manager Ed Campbell said his positioning has been influenced by expectations for a sweep and a subsequent reflation trade: Overweight equities -- emerging markets in particular -- and value over growth stocks. A Biden win that is not accompanied by a shift in control in the Senate would be among the worst of all possible scenarios for markets in the near term, according to Campbell.

“We can see what we’re seeing now -- Trump wants a deal, House Democrats want a deal, but Mitch McConnell and the Republican Senate are dragging their feet,” he said. “In that situation, it may require markets to revolt a bit before a Republican Senate would go along with a big fiscal stimulus package.”

For many fund managers, their final performance in 2020 may hinge in large part on any shifts caused by the outcome. Credit Suisse derivatives strategists are bracing for a sustained rotation from growth to value stocks and higher Treasury yields in the event of a blue sweep, they wrote in a note on Oct. 26. Technology stocks should be hedged since that group in particular would be vulnerable to Biden’s plans for higher corporate taxes and stronger regulation, they wrote.

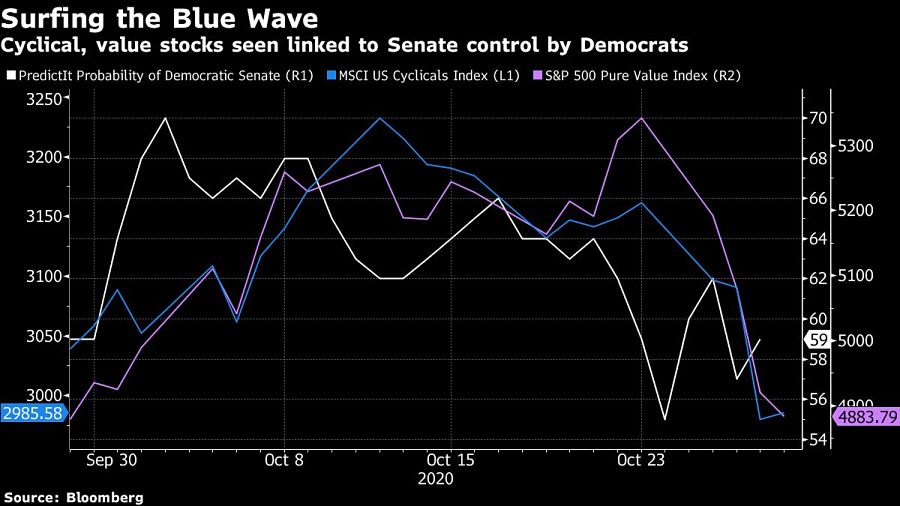

How big of an impact the rising and falling prospects of a Democratic sweep have had on markets so far is hard to determine. Many of the market moves associated with it -- the performance of cyclical and value stocks, the dollar and Treasuries -- can also be linked to perceptions of whether the economic threat of the virus is increasing or decreasing.

In other words, it’s hard to sort out how much, if any, of this week’s risk-off trading was a result of jitters that the election will result in a divided government compared with the more alarming indications that virus cases were accelerating in the U.S. and Europe, threatening ever-stricter lockdowns.

Still, enough of a “blue wave” scenario is believed to be priced in that many fund managers and strategists are bracing for turbulence in equities if Biden wins the presidency but his party does not gain enough seats in the Senate to quickly pass a large, sweeping stimulus plan.

Despite the potential for that type of volatility in the short term, many investors aren’t necessarily turned off by the possibility of a split Congress under a Biden administration in the longer term. The threat of the virus is likely to subside somewhat in 2021 as vaccines become available, allowing the economy to continue to heal without the support of government spending.

A divided Congress could keep in check the less market-friendly aspects of Biden’s platform, such as reversing some of Trump’s tax cuts and deregulation efforts. And regardless of who takes the Senate, a Biden administration is viewed as taking a less hostile and mercurial strategy to foreign trade relationships than the Trump approach that whipsawed markets.

The transition from disappointment over prospects for major stimulus to optimism about the positive elements of a divided government would be relatively quick, perhaps just a few weeks, according to Matt Peron, director of equity research at Janus Henderson Investors.

“The market would actually prefer a split government,” he said. “It gives a little more certainty, like it or not, just speaking from the market perspective. More certainty and less policy volatility. Some of the risks on the margin, trade in particular, would have a better tone from a market perspective.”

For some investors, trying to position for the exact election outcome is too dangerous. So they’re focusing on what they believe will be true regardless of the various potential scenarios.

Terri Spath, chief investment officer at Sierra Investment Management, likes equities in emerging markets such as South Korea, which she calls the “gold standard” for dodging U.S. economic and political risks. She also likes corporate junk bonds, since they still offer a yield that can cushion any downside while correlating with equity gains in a risk-on environment.

Municipal bonds are especially attractive to her. A blue sweep may provide an added tailwind to tax-free munis, given the likelihood of higher taxes and a stimulus package that delivers larger amounts of help to struggling state governments. But given the swollen U.S. deficit, she doesn’t see any likely election scenario that would result in taxes being cut further. That cements the appeal of munis.

“Not very exciting,” she said, “But sometimes I don’t think you should be afraid of the boring stuff.”

After a year like 2020, who could argue with that?

The 25-year industry veteran previously in charge of the Wall Street bank's advisor recruitment efforts is now fulfilling a similar role at a rival firm.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound