For some, the battle for market share between wirehouses and RIAs rages. For others, it’s done and dusted. “The war is over and they lost; that game is over,” says Jim Gold, chief executive at Steward Partners, an employee-owned, hybrid RIA.

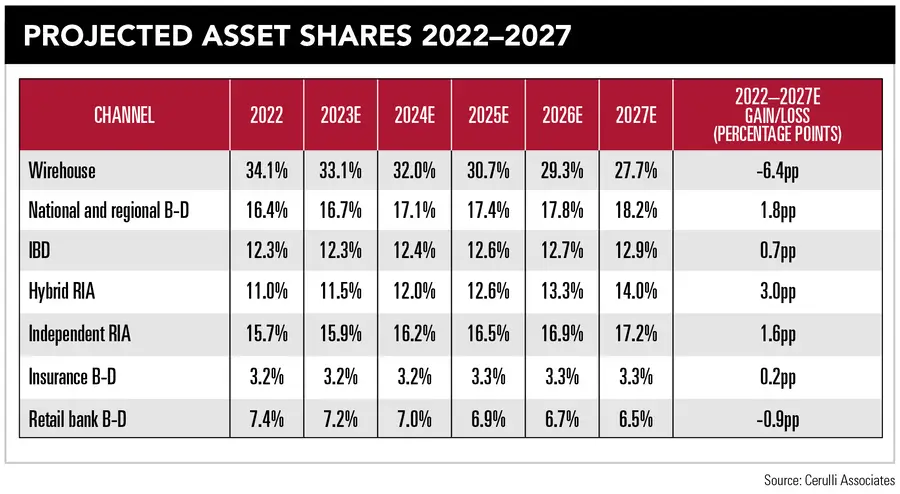

A study by Cerulli Edge in early January suggests he might be right. It projected that the wirehouses’ share of assets under management will decrease from 34.1 percent in 2022 to an estimated 27.7 percent in 2027, a drop of 6.4 percentage points. In contrast, over the same period, the AUM share of independent RIAs and hybrid RIAs is predicted to go from a combined 26.7 percent to 31.2 percent.

“We’re passing each other on the elevator,” Gold says. “For every percent they go down, it literally goes to us because we’re taking it.”

He expects the wirehouses’ share of the pie to eventually level out in the teens and believes they remain the ideal home for some advisors, thanks to their depth of resources. But he says they’re not investing in the next generation, who can also find the autonomy, flexibility, and reduced bureaucracy they crave at an independent firm.

Gold instead sees more intense competition on another battle line – within the RIA space. Private equity money has flooded in, allowing some firms to hoover up rivals and smaller players.

It’s dog eat dog, and while Gold is easy company – a colleague described his leadership as “fun, fair, but firm” – he says he’s relentless when it comes to the evolution of Steward. Central to that has been giving his network of about 250 advisors what they want, not what he thinks they want. Providing options is key, and Steward offers a range of affiliation models, including W-2, 1099, and RIA-only (IAR). In 2023, it went multicustodial, adding Pershing to its established partnership with Raymond James.

It’s an approach that has helped Steward become one of the top corporate RIAs in the country, with more than $32 billion in AUM. Last year, armed with a credit facility of $150 million to use only on growth, Gold put it to good use, capping the firm’s M&A activity with the late-year acquisition of Freedom Street Partners, which alone added $3.2 billion in assets and 38 advisors.

Overall, 2023 was a record growth year for Steward, with $43 million in additional revenue growth through recruiting and M&A, and more than $7 billion in assets brought onto the platform. Its legacy advisors – those who have been with the company for two years or more – brought in another billion dollars.

“We have a ton of recruits coming in, and we’re teed up to have another record year,” Gold says. “We could see $10 billion net new assets this year, and I think you could see $50 to $70 million in revenue attracted as well.”

Gold has come a long way since he cold-called New Yorkers as a Smith Barney trainee before taking on various roles at the firm, including branch management. The company believed its leaders should be people who have done the job of the people they are leading. He learned a lot and believes there is a lineage of Smith Barney culture that has carried through to Steward.

Morgan Stanley acquired Smith Barney in 2009 (Citigroup was also part of the deal but soon sold its shares to Morgan Stanley), and by then, Gold was hearing more and more about independent firms like Hightower and Dynasty. He saw what he calls “the destruction of the wirehouse culture from the inside,” and, in 2013, as a co-founder, he launched Steward with the aim of building a true partnership. To that end, everyone who works for Steward is an equity owner. “It’s our firm,” Gold stresses. “It created a real alignment.”

In a nod to what he sees as the positive side of working for a wirehouse, Steward wanted a high service level and coined the phrase “Independence with infrastructure.” The mission was to give advisors the best of both worlds – the resources and platform of a Big Four firm and the superior payout and autonomy synonymous with independence – and get rid of the downsides of both.

After taking in capital for the first time in 2019 and 2021, Gold foresees a series of further liquidity events that will provide more ammunition for growth as well as allow advisors to benefit from profit-sharing. Steward has also extended its credit facility to continue its M&A momentum in 2024.

While regulation, compliance, and cybersecurity requirements are beating up many smaller RIAs, the cost of financing is also pushing down the valuation of these firms at the same time the valuation of firms like Steward increase. Gold believes this price divergence leaves Steward well positioned.

“I’m not a doomsday guy,” he says, “but you can see a flat to down market this year. There was all this euphoria about rates coming down, but it looks like they’re not going to come down as quickly [as expected]. If you go into a period where markets are flattish to maybe down a hair, capital is still constrained by that, and firms like Steward are just primed to win even more.”

Equity ownership is a major differentiator for Steward, but Gold also cites the firm’s ambitious goals as a reason it has attracted top talent. He also points to the calibre of outside investors it has in Cynosure and The Pritzker Organization, while board members include Charlie Johnson, who was president and CEO of Smith Barney, and Janet Robinson, the former president and CEO of The New York Times.

From just 10 employees little more than 10 years ago, Steward’s rise has been eye-catching, but Gold believes the best is yet to come.

“It’s been an amazing journey, and we feel like we’re just getting started.”

Name: Jim Gold

Firm: Steward Partners Global Advisory

Position: CEO

Partners: 500

Advisors: 250

Offices: 59

AUM: $32 billion

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound