Prudent investors typically spend decades building wealth for retirement. With the help of their financial advisor, they create and update a financial plan and develop a portfolio of investments to accumulate the wealth they will use to fund their post-working years. One day, they finally reach retirement. What happens then? How do they approach the years of decumulation?

A new study by InvestmentNews Research on the value of professional financial advice, conducted on behalf of Protective, reveals that investors could use as much help from their advisors during retirement as they do during the years leading up to it. Contrary to what many clients may believe, going on “autopilot” in retirement can be detrimental to their overall financial health and wellbeing. Clients need the information, guidance and support, as well as access to a wide range of solutions, that advisors can provide — not just before retirement, but also in retirement.

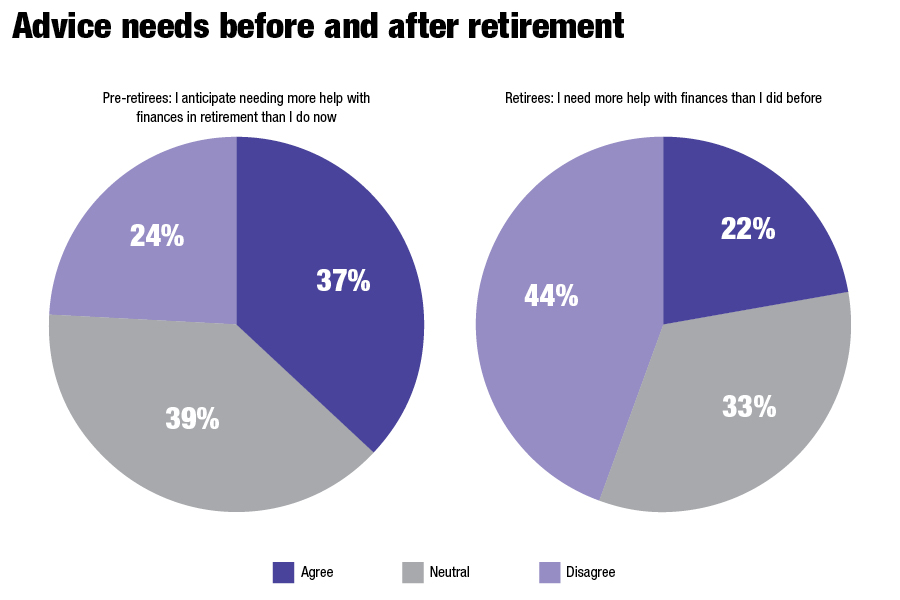

Responses to surveys conducted for the study revealed the client disconnect. Among pre-retirees, more than a third of respondents (37%) agreed they expect to need more help from their advisor during retirement. Among retirees, however, just 22% agreed they need more help with their finances than they did before they retired.

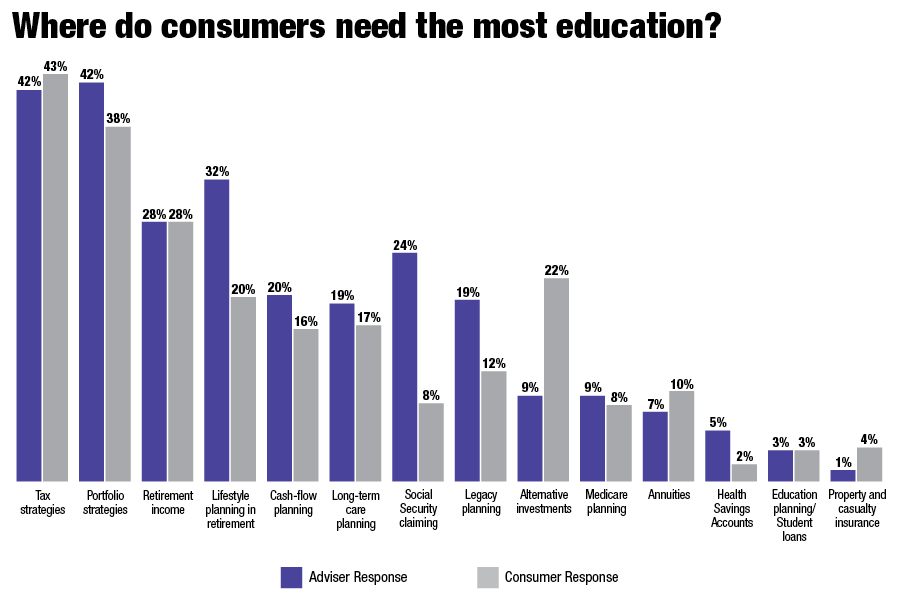

Since clients may not fully understand the complexity of the decumulation phase of their investment journey, advisors should probably not take retirees' views on their need for financial advice at face value. In fact, other survey results showed that consumers are eager for financial education in key areas that can become more important in retirement years — tax strategies (cited by 43% of respondents), portfolio strategies (38%) and retirement income (28%). Professional financial advice in these areas in retirement can help minimize taxes, which often are higher than many retirees anticipate, as well as optimize portfolios to increase retirement income opportunities that many retirees may not realize are possible. Advisors can also help ensure that clients do not outlive their retirement assets regardless of what future markets may hold.

The survey found that advisors are well aware of the many other factors that constitute financial success during decumulation: lifestyle planning, cashflow planning, long-term care planning and Social Security claiming strategies. These were all areas where advisors said their clients needed more education, but that were less recognized by consumers as areas where they could use more information. In fact, three times as many advisors as clients believe a greater understanding of Social Security is important, recognizing that those benefits will constitute a significant share of retirement income even among their client base, which tends to be more affluent than Americans in general.

Since advisors have a better handle on income and expense challenges in retirement than clients, educating clients about those challenges is critical. Even more important, however, is being able to offer solutions. Fortunately, there are many solutions available to advisors and their clients.

In addressing the challenge of retirement income, for example, advisors can educate clients about products that offer lifetime income guarantees — and may provide greater income than other investments. A variable annuity with an optional guaranteed minimum withdrawal benefit is one of those solutions. Advisors also can explain to their clients that allocating a portion of their investments to a guaranteed income solution can free other portions of the portfolio to be allocated to a wider array of investments that can help achieve long-term growth goals.

Clearly, financial challenges and the need for the valuable advice that financial advisors provide do not end with a client’s working years. In fact, retirement represents a new beginning. During this new phase of life — which has the potential for great satisfaction — the value of professional financial advice is as important as ever.

Lauren Drapeau is National Sales Director of Annuity Advisory Solutions at Protective and a registered representative of Investment Distributors, Inc., a Registered Broker/Dealer, member FINRA and wholly owned subsidiary of Protective Life Corporation.

Protective® is a registered trademark of Protective Life Insurance Company. The Protective trademarks logos and service marks are property of Protective Life Insurance Company and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective refers to Protective Life Insurance Company (PLICO) and its affiliates, including Protective Life and Annuity Insurance Company (PLAIC). PLICO, founded in 1907, is located in Nashville, TN, and is licensed in all states excluding New York. PLAIC is located in Birmingham, AL, and is licensed in New York. Product availability and features may vary by state. Each company is solely responsible for the financial obligations accruing under the products it issues. Product guarantees are backed by the financial strength and claims paying ability of the issuing company. Securities offered by Investment Distributors, Inc. (IDI) the principal underwriter for registered products issued by PLICO and PLAIC, its affiliates. IDI is located in Birmingham, Alabama. Insurance and Annuities are: Not a Deposit | Not Insured by any Federal Government Agency | Have no Bank or Credit Union Guarantee | Not FDIC/NCUA Insured | May Lose Value

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound