Inflation expectations among U.S. consumers over the medium term rose to the highest level on record in the Federal Reserve Bank of New York’s surveys, according to the latest edition published Monday.

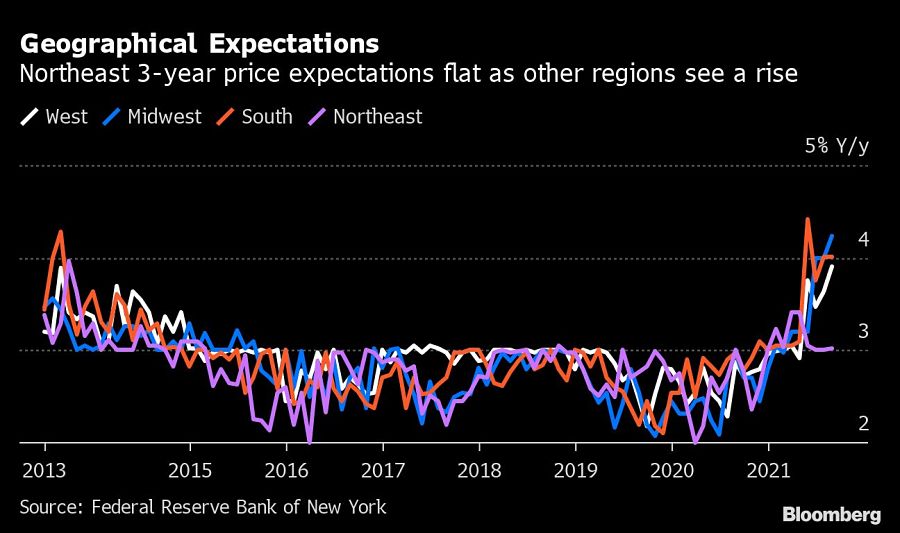

Consumers said they expect inflation at 4% over the next three years, up 0.3 percentage point from a month earlier.

The median expectation for the inflation rate in a year’s time also rose by 0.3 percentage point to 5.2% in August, the tenth consecutive monthly increase and a new high in the series, which goes back to 2013.

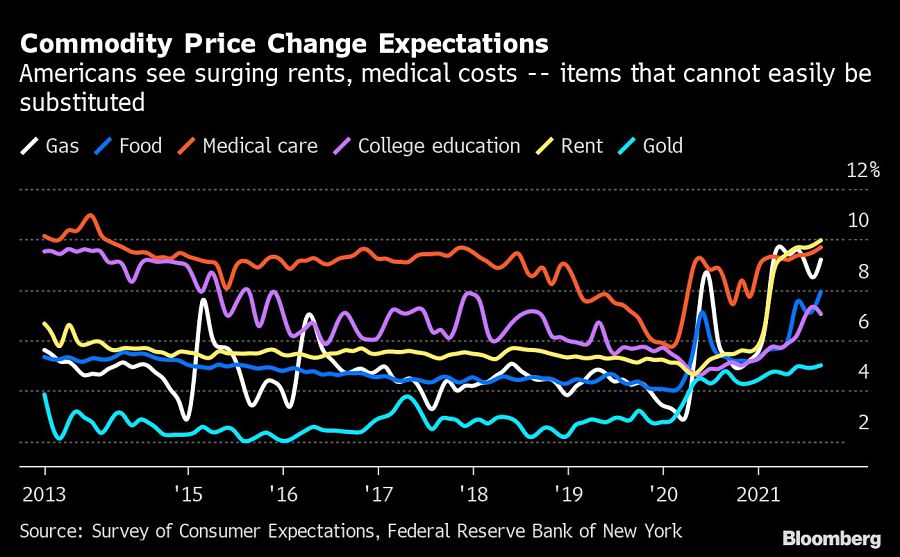

The Fed survey showed that Americans are expecting higher rates of price increases for items like rent and food that make up a big chunk of the consumer price basket and can’t easily be substituted.

Economists surveyed by Bloomberg expect slightly lower rates of inflation. The latest poll, published on Sept. 10, forecast an average increase in prices of 4.3% this year and 3% in 2022.

Meanwhile, expectations that wages will keep pace with the acceleration in prices are starting to cool. The median one-year-ahead expectation for earnings growth dropped 0.4 percentage point to 2.5%, with respondents over the age of 40 largely driving the decline.

Still, overall expectations for household incomes rose by 0.1 percentage point to 3%, a new series high.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound