Though the most scrutinized Twitter feed in finance is on track to lose much of its power on Jan. 20, that still leaves about 10 weeks for President Donald Trump to roil markets.

After President-elect Joe Biden’s win is certified, Trump will enter the so-called lame duck phase of his presidency with a capacity for disruption that is formidable. Any number of executive decisions might leave investors on tenterhooks. Already, he’s ousted his defense chief and remade the leadership at the Pentagon.

Disputes with China spanning commerce, technology and human rights, the trade spat with Europe and the upcoming deadline on U.S. government funding in December all offer the potential for market-moving action. The current Congress remains in place through the end of the year. Earlier this week, Secretary of State Michael Pompeo said the Trump administration is “not finished yet” with getting tough on China.

“An aggrieved and outgoing President Trump may not be in a very cooperative mood, resulting in a shutdown standoff that could bruise an already ailing U.S. economy burdened with an ongoing pandemic,” wrote Gabrielle Debinski of GZERO Media, a subsidiary of the Eurasia Group political risk consultancy. “The upcoming lame-duck session could be more tumultuous than ever.”

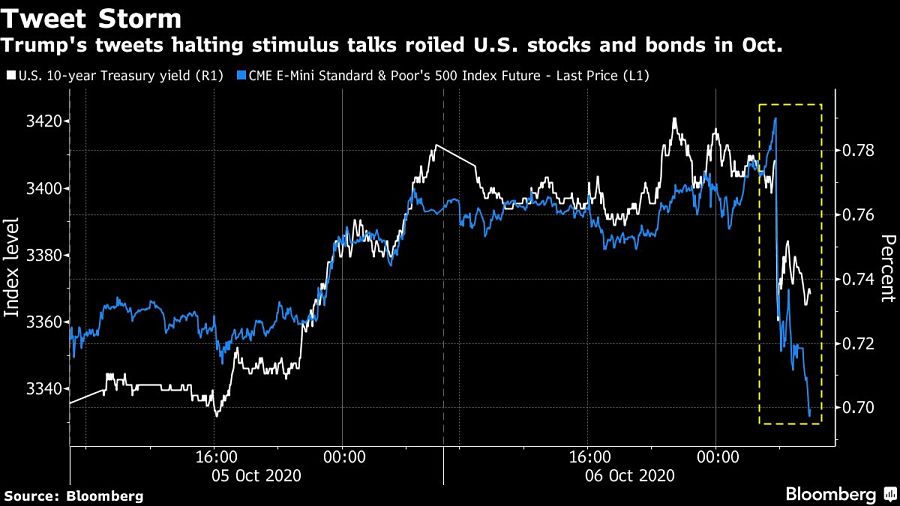

Investors only have to go back to October to see how a barrage of unilateral presidential action can shake markets. U.S. stocks slid and Treasuries surged after Trump tweeted that he had decided to halt stimulus talks.

Pricing in futures markets -- where January contracts on the Cboe Volatility Index are trading above both December and February levels -- suggests traders are braced for the possibility of a heightened period of turbulence.

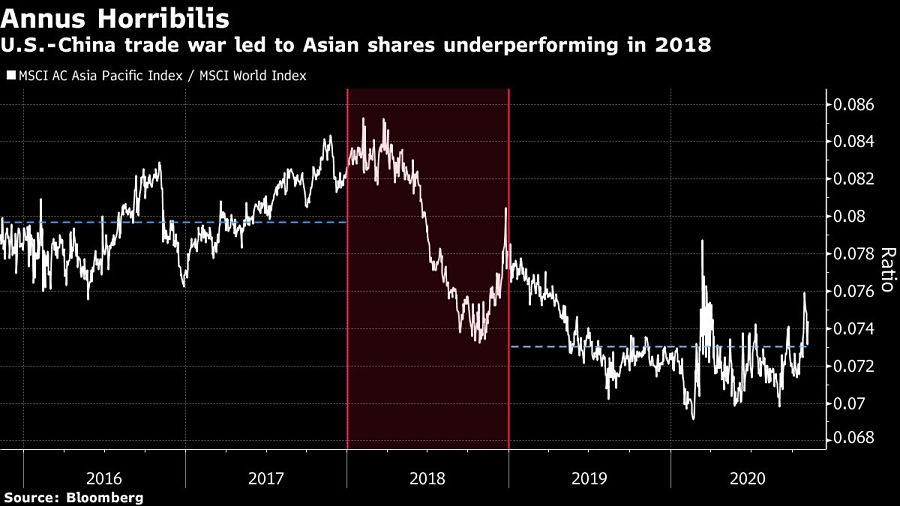

Trade with China is the most obviously vulnerable area for global markets, not least because Trump blames the country for the coronavirus outbreak in the U.S. that likely aided his electoral defeat. Asia investors spent much of 2018 anxiously awaiting pronouncements from the president on trade. Trump can bypass Congress and raise or lower tariffs on a variety of goods and services.

The forced de-listing of Chinese firms from U.S. stock exchanges is another potential market-moving step to target Beijing -- one that has been mulled by the administration for some time. This week, the U.S. imposed sanctions on four more officials accused of undermining Hong Kong’s autonomy.

Meanwhile, the European Union’s imposition of tariffs on $4 billion of U.S. goods that started Tuesday is an escalation of a dispute over illegal aid to aircraft manufacturers Boeing Co. and Airbus, and has the potential to spark a retaliation that would impact the region’s markets.

Domestic political maneuvers and presidential pardons are a traditional feature of lame-duck periods of departing American leaders, and one that on the face of it shouldn’t have much market impact.

But Mark Tinker, a former Axa SA strategist and founder of Market Thinking Ltd., raises the possibility that an attempt to settle scores with political insiders might lead to some disruption.

“One intriguing suggestion is that between now and inauguration, Trump, with little to lose, could simply de-classify large amounts of documents pertaining to the activities of what he has always referred to as ‘The Swamp,’” Tinker wrote in a note Tuesday. “Whether the markets are prepared for that remains to be seen.”

Trump is still tweeting that he will end up winning the Nov. 3 election. But some commentators expect the president will step down without causing havoc once his terms runs out.

“I’m assuming that when the time comes, Donald Trump will leave the White House peaceably,” Ed Yardeni, founder of Yardeni Research Inc., wrote in a note to clients Monday.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound