Investment guru sees another recession within two to three years; 'not much that can be done'

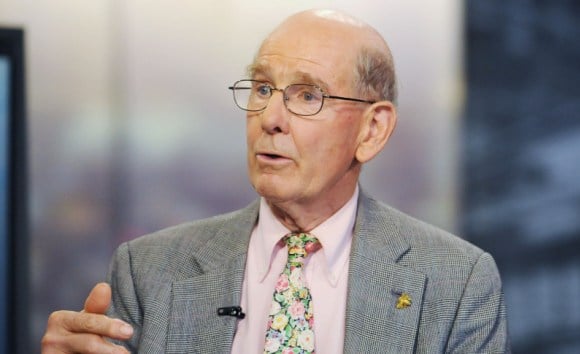

Gary Shilling, who predicted the U.S. housing collapse, says the stock market is overvalued and foresees a “significant” selloff within a year as the Federal Reserve fails to stimulate economic growth.

The Standard & Poor's 500 Index has climbed 18 percent since July 2 as investors anticipated the Fed's plan to buy $600 billion in Treasuries to boost growth. The benchmark gauge for U.S. equity trades for 15.1 times average annual profits, up from 13.7 in July, data compiled by Bloomberg show. Fed Chairman Ben Bernanke previewed his strategy of quantitative easing in an Aug. 27 speech in Jackson Hole, Wyoming.

“I don't think it's enough to make a great deal of difference,” Shilling, 73, president of the investment research firm A. Gary Shilling & Co. in Springfield, New Jersey, said in a telephone interview. “The earlier QE1 didn't and I don't think this will, either. The economy is weak and it doesn't take very much of a shock to push it into negative territory. I don't think that's enough to justify where stocks are now.”

Shilling, who predicts real gross domestic product growth of 2 percent “and maybe less in the next couple of years,” said the government is out of options for fixing the economy.

“There's not much that can be done,” said Shilling. “There isn't any magic bullet. There isn't anything in my view that's going to return us to the solid days of the 80s and 90s when consumers were spending freely. I don't think that's going to come back. The need to deleverage is just too great.”

The S&P 500 has fallen 2.1 percent this week for its first decline in more than a month, data compiled by Bloomberg show.

Shilling's past predictions had mixed results. The economist forecast the recession that began in December 2007 and warned investors a year earlier that residential real estate was in a bubble that would burst. The S&P 500 lost 57 percent between October 2007 and March 2009.

With the S&P 500 at a 12-year low that month, he said that higher unemployment would curb consumer spending, leading to “weaker stocks.” An investor following his advice would have missed the start of an 80 percent rally.

The U.S. economy, which grew at a 2 percent annual pace in the third quarter, may enter a recession in the next year or two, Shilling said. The U.S. gross domestic product will grow 2.7 percent this year and 2.4 percent in 2011 after 2009's contraction, according to a Bloomberg survey of economists.

The S&P 500 posted its biggest September-October rally since 1998 as economic data showed the threat of a recession is abating. The gauge extended the rally into November after the Labor Department reported a bigger-than-forecast decrease in jobless claims and as orders placed with factories and production rose to a five-month high.

Earnings have topped estimates at 76 percent of the 433 companies in the S&P 500 that have announced results since Oct. 7, according to data compiled by Bloomberg. Net income has grown 29 percent for the group as sales increased 9.2 percent.

While estimates for U.S. corporate profit fell last quarter, they still indicate that S&P 500 companies will report record earnings in 2011. The equity benchmark is valued at about 12 times projected income for 2011, according to data compiled by Bloomberg. That's the cheapest level since 1988, excluding the six months after New York-based Lehman Brothers Holdings Inc.'s filed for bankruptcy in September 2008, relative to reported profit from the past 12 months.

“Stock valuations remain attractive,” said James Dunigan, chief investment officer at PNC Wealth Management in Philadelphia, which oversees $105 billion. “The earnings prospects continue to be positive. We'll likely get back to an economy which is expanding in the early part of 2011. The story is pretty good.”

Shilling, who predicts that stocks will return 5 percent to 6 percent annually after inflation adjustments over the next decade, says that half of that will come from dividends and not from appreciation. The S&P 500's dividend yield, currently at 1.92 percent, may rise to at least 3 percent, Shilling said, without specifying a timeframe.

“You see a lot of companies being pressured to pay dividends,” he said. “Look at Microsoft. They borrowed money to pay dividends. It tells you that investors want dividends.”

In September, Microsoft Corp., the world's largest software maker, sold $4.75 billion of bonds at the lowest coupons on record. A day earlier, the company raised its quarterly dividend by 23 percent to 16 cents and received approval from its board to sell as much as $6 billion in additional debt.

Shilling reiterated his view in an Oct. 4 interview with Bloomberg Radio that looming deflation means U.S. Treasuries are still attractive. He says the yield on the U.S. 30-year bond will drop to 3 percent within the next “couple of years” from about 4.3 percent. Shilling also said he doesn't see a collapse of the U.S. dollar because of debt problems in Europe.

The euro slid to the lowest level in more than a month versus the dollar yesterday as concern that some European countries will have difficulty paying their debt and a drop in stocks curbed investors' appetite for risk.

“The dollar is probably going to strengthen,” Shilling said. “We're going to see increasing problems in Europe, led by Ireland. As a result, we're seeing a rally in the dollar.”