Firm that bears no relationship to the Oracle of Omaha or Berkshire Hathaway filed offering with the SEC last month

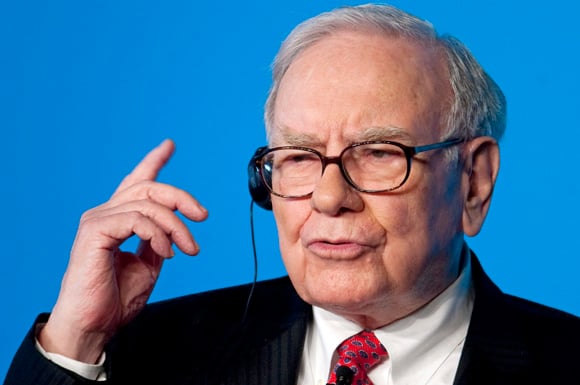

Warren Buffet is getting into the high-risk business of Regulation D private placements. That's Warren Buffet, with one T, not Warren E. Buffett, with two.

The latter is chairman and chief executive of Berkshire Hathaway Inc., the world's most famous investor, commonly known as the Oracle of Omaha. The Buffet that's short one 't' is the moniker of a new private placement connected to a stockbroker and investment adviser based in Boca Raton, Fla., named Peter Bruno.

Adding to the confusion, Mr. Bruno touts research for the two-T Warren Buffett Holdings Newsletter on a website, tradingletter.com. The newsletter “will track and monitor all the publicly announced holdings, as regulated by the regular SEC reporting requirements, of the Warren Buffett investment vehicle, Berkshire Hathaway,” according to the website.

Mr. Bruno also offers the Warren Buffett Managed Account, according to his website, peterbruno.com. The managed account will “track and monitor” the publicly announced holdings of Mr. Buffett's firm, Berkshire Hathaway, according to the website.

Such outlandish confusion with a famous name is a no-no, according to one intellectual-property attorney.

“It's outrageous. General trade market law prohibits using someone else's name or brand where that can cause confusion,” said Anthony F. LoCicero, a partner with Amster Rothstein & Ebenstein LLP.

“Warren Buffett is the most famous financial person in America, but I honestly don't know how many T's he has in his name,” Mr. Lo Cicero said. “It's a violation of Mr. Buffett's rights in many ways, and it will likely cause confusion and was likely intended to cause confusion.”

Few details were readily available about the Warren Buffet LLC offering, which was filed with the Securities and Exchange Commission last month.

Mr. Bruno is the chief executive of the equity offering, which lists itself as being in the “investing” industry and has revenue of more than $100 million.

When it comes to managing assets, Mr. Bruno falls far short of Mr. Buffett.

According to Mr. Bruno's website, he is chief executive of Wall Street Money Management Group Inc., a registered investment advisory firm. According to filings with the SEC, the firm has $17.1 million in assets under management and 122 client accounts.

At the end of September, Berkshire Hathaway reported assets of $385.5 billion.

After the collapse this decade of private placements sold by representatives affiliated with independent broker-dealers, the high-risk deals have been closely scrutinized by regulators. This week, the Financial Industry Regulatory Authority Inc. issued a statement listing sanctions against eight broker-dealers stemming from an alleged breakdown or lack of due diligence by the firms.

Mr. Bruno didn't respond to two voice mail messages left Friday seeking comment about the “Warren Buffet” offering.

Berkshire Hathaway spokesman Marc Hamburg also didn't return calls seeking comment.