Summertime, and the advising is easy.

Okay. Perhaps that’s an overstatement. Nothing is ever completely carefree when it comes to the wealth management business. There are always bumps in the road, and the sailing is never entirely smooth. Whether they come from individual clients, staff, or left field, problems inevitably arise to shake things up in the office.

Nevertheless, from a market perspective at least, the first half of 2024 undoubtedly proved to be a comfortable ride for financial advisors.

The S&P 500, powered by a handful of still “magnificent” big-cap tech stocks, rose over 16 percent through mid-June on the heels of last year’s more than 24 percent higher move. The Russell 2000 also stayed in the green, if only by a few percentage points. And volatility as measured by the VIX stayed at historic lows below 14 save a quick spike in April.

Meanwhile, those advisors still skeptical of the bull run took pleasure (or cover) in the fact that their clients sitting out the rally pocketed over 4.25 percent in risk-free government bonds. And even their gold-bug customers were able to chill out as the yellow metal gained more than 12 percent through mid-June.

So as the wealth management community looks forward to some well-deserved rest and relaxation during the upcoming dog days of summer, InvestmentNews asked some advisors to recount their biggest hits of the first half, as well as whether they plan to keep riding those horses through the rest of the year.

Oh, we asked for their misses too, because nobody at the track trusts a guy that shows you only his winning tickets!

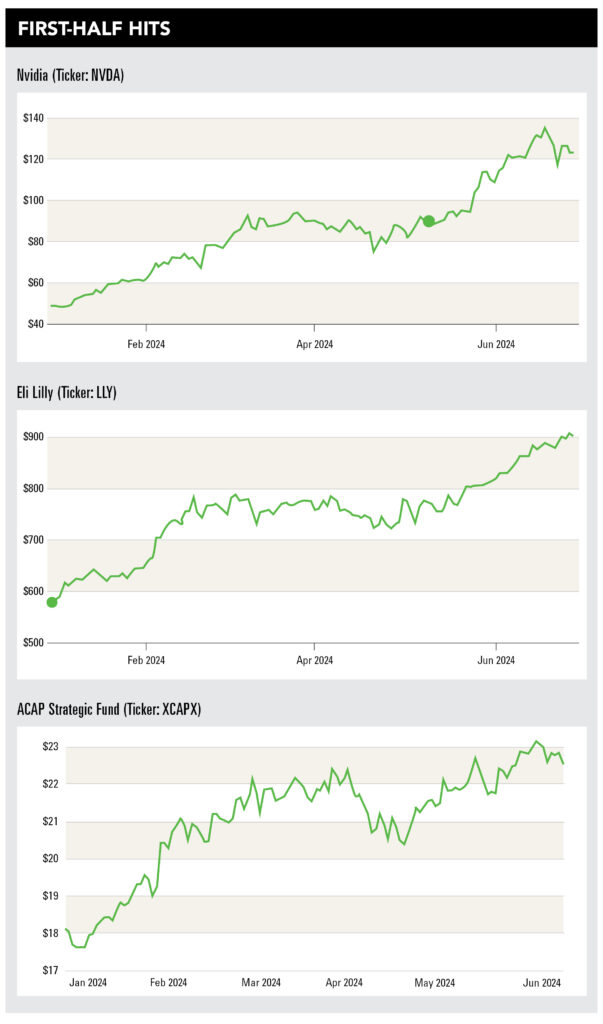

Eric Diton, president and managing director of The Wealth Alliance, said his best investment of the first half of 2024 was the ACAP Strategic Fund (TICKER: XCAPX), up over 27 percent through mid-June. This is a long-short interval fund that invests in high-quality global growth companies that fit its thematic trends.

“The fund had its worst drawdown ever during the 2021 to 2022 period, and we believed its holdings were oversold and presented compelling value,” said Diton. “Given its large exposure to technology and our belief in the future of AI, we intend to stick with this investment.”

Elsewhere, Malcolm Polley, chief market strategist for Stratos Investment Management, pointed to Eli Lilly (Ticker: LLY), up almost 50 percent through the first half, as his biggest winner. He bought the drugmaker because demand for its drug, sold as Mounjaro in the diabetes market and as Zepbound in the obesity market, is currently outstripping supply.

“We believe that the market for drugs in the diabetes/obesity space could reach over $100 billion by 2030,” said Polley.

Polley added that he is sticking with the name because the company has a strong research and drug platform outside the diabetes/obesity market, and the FDA unanimously recommended the company’s Alzheimer’s drug, donanemab, for approval, which may pave the way for FDA approval later this year. And despite the huge run-up in the company’s stock, Polley still does not see it as overly expensive.

“The company’s PE is reasonable given our expected growth rate, and our proprietary quantitative screening rates the company fairly highly,” said Polley.

Chris Brown, private wealth advisor and managing director at Kingswood US, says his biggest moneymaker so far in 2024 has been chipmaker Nvidia (Ticker: NVDA), up over 160 percent. That said, there have been some other performers he’s been happy with too, including CrowdStrike (Ticker: CRWD) and Taiwan Semi (Ticker: TSM).

“I've been buying semi-conductors for a while but heavier in the past six to eight months. AI is helping drive some of that interest,” said Brown. “I’m definitely sticking with NVDA and TSM.”

Along similar lines, John Khoury, wealth manager at Savvy Advisors, rode the semiconductor sector to victory through June 2024, notably names such as Nvidia, Broadcom (Ticker: AVGO), and Applied Materials (Ticker: AMAT).

“In the case of Nvidia, I feel it is positioned for continued momentum into 2025 with increasing demand for AI and data centers and acceleration in gaming and automotive,” said Khoury. “That being said, I believe it’s important to continually monitor and rebalance portfolios for concentration risk, which could occur in any stock or sector/industry as stocks appreciate over time.”

Francisco Rodriguez, portfolio manager at Brinker Capital Investments, points with pride to his overweight position in securitized products, particularly high-grade CLOs, as one of his best decisions so far in 2024.

“Our analysis leading into 2024 indicated expectations for sustained higher interest rates and continued volatility in rates. Spreads across many traditional sub-asset classes, including corporates, high yield, and preferred stocks, were historically compressed. Given their attractive spread levels, tranche structure, and floating rate nature, we found CLOs to be particularly compelling,” said Rodriguez, who is not giving up on CLOs in the second half.

On the flip side, while The Wealth Alliance’s Eric Diton rode big-cap tech stocks higher in the first half, he says his bond allocations were his worst investments over the same period. While they remained relatively flat, he expected the Federal Reserve to be more aggressive in dropping interest rates this year, pushing bond prices higher.

“Given the inverse relationship between interest rates and bond returns, we expected more dynamic, positive returns from the bond market year to date. We are sticking with this exposure, since we expect the economy to slow, inflation to continue to abate, and the Fed to cut rates by year-end,” said Diton.

Chris Brown called Enphase Energy (Ticker: ENPH) his most disappointing holding in the first half, saying, “It just hasn’t done what I expected.”

“The solar subsector is trending downward in general, but it’s cyclical and will be back,” said Brown. “I have not exited the trade and don’t plan to exit any time soon.”

Stratos Investment Management’s Polley, meanwhile, says his biggest whiff for the first half of 2024 was Boeing (Ticker: BA), which lost almost a quarter of its value through mid-June.

“We believed that the company’s cash flow would recover fairly quickly in 2024. However, just a few days into the year, missing bolts led to a mid-air door blowout for an Alaska Air Boeing 737 Max 9 airplane,” said Polley.

Polley still likes the fact that Boeing is basically in a duopoly for non-military aircraft and believes that it will get over the quality issues that have hurt it so far this year. As a result, he’s sticking with the name despite its lackluster performance to date.

“Fundamentally, we believe that Boeing is a high-quality company that has strong cash-flow generation capabilities. This can be seen in its long-term debt, which has come down $14 billion since 2020, despite operational challenges,” said Polley.

Brinker’s Rodriguez calls his biggest miss so far this year his “overweight exposure to the size factor within equities.” Recognizing that smaller capitalization companies often rely more on floating rate debt, he says he was caught “leaning into small and mid-cap equities that exhibit strong fundamental business characteristics and less reliance on debt.”

“This allocation aligns with our conviction, especially given current valuation levels relative to large/mega-cap equities. We believe valuations and starting points matter when it comes to long-term wealth creation, which underpins our investment philosophy,” said Rodriguez.

Finally, Savvy Advisors’ Khoury said he wasn’t so savvy when it came to his healthcare allocation in the first half of 2024. He said it was dragged down by UnitedHealth Group (Ticker: UNH), one of the sector’s biggest names, which faced headwinds due to a cyberattack that occurred in February, which resulted in a network shutdown and lost revenue.

Still, Khoury expects the company to return to fiscal health soon given its “financial strength, earnings growth potential, and industry-leading scale.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound