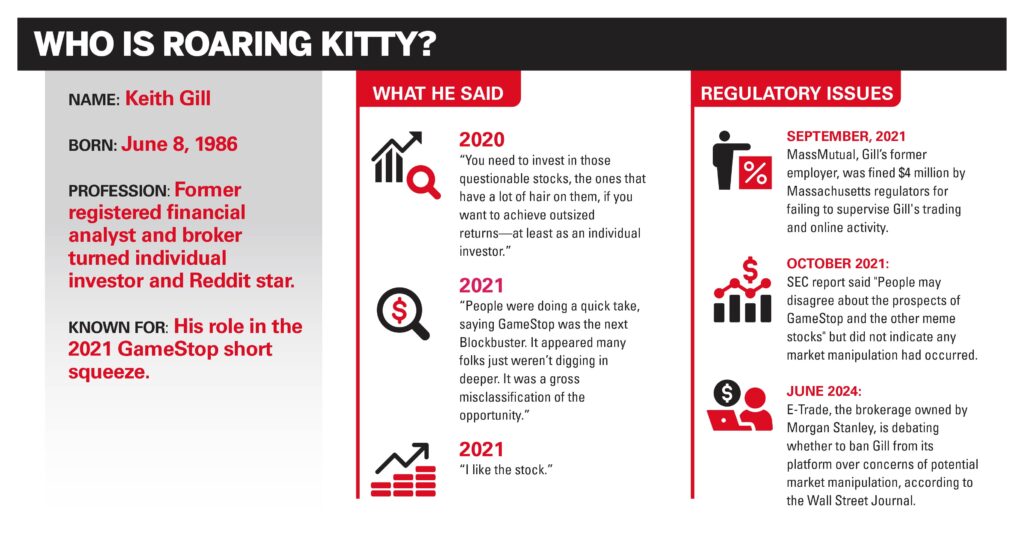

Keith Gill, aka Roaring Kitty, is reportedly under scrutiny from regulators and at risk of losing access to Etrade, following publicity earlier this week of his holding of more than $116 million in GameStop stock.

The concerns center on potential market manipulation, especially in light of the stock’s volatility since the June 2 announcement that has been attributed to Gill, according to the Wall Street Journal. In addition to Massachusetts’s securities division looking into Gill’s activities, the Securities and Exchange Commission may also be looking at options trading issues around the stock more broadly, the outlet reported.

Shortly after Gill’s post, GameStop stock doubled in price, briefly going over $40 per share before returning to about $27 as of Tuesday afternoon. That volatility hints at some of the risk for novice retail investors who may recently have become interested – or reinterested – in the stock.

“It’s an interesting sideshow, and certainly GME, since it resurged, has been one of the most active stocks on our platform,” said Steve Sosnick, chief strategist at Interactive Brokers.

This time is different from the 2021 meme-stock craze, he said.

“The original meme-stock craze did get people into investing… It was coming out of Covid. Interest rates were zero. You had stimulus checks. Many people were working from home and therefore subject to less supervision than they might otherwise been if they were in the office.

"You had an amazing bull market. Bull markets draw in new investors,” he said. “You needed something to get excited about, and the meme stock craze got people excited… There was a huge us-versus-them mentality to the whole thing.”

Now, there is a lack of short sellers like Melvin Capital to be portrayed as villains hoping to profit off of the demise of nostalgia-conjuring businesses, he said.

“This has a very different character to me. I don’t know who ‘them’ is. If it’s us versus them, you need a ‘them.’”

That seems to make the current interest in GameStop more cynical he said, with some traders just hoping to buy the stock and sell it to someone else for more, without much belief in the value of the company.

No bad press

All of the attention that GameStop’s resurgence has generated is good for the financial services business, said Tom Sosnoff, CEO of financial network tastylive and cofounder of thinkorswim.

“It brings engagement and it brings some transition into finance,” he said. “On all levels of finance, it’s good and it’s incredibly healthy.”

While he doesn’t personally trade GameStop, he sees the appeal, with a 2X upside and 1X downside, he said.

“For the average retail investors, it’s an inexpensive stock with some crazy high volatility,” he said. “That interests a lot of investors who want to take speculative risk… [and] really exposes the amount of speculative demand there is in the markets for expensive stocks.”

The story around Roaring Kitty has captivated investors as “he actually made a lot of money on it,” and “they find the story fascinating because it’s not a Bill Ackman, Carl Icon, Warren Buffett or Elon Musk.”

However, people may want to exercise some caution in reading too much into the recent social media posts purported to be from Gill, Sosnick said.

“It’s not clear to me that this is actually him,” he said, adding that it is unclear how Gill would have the money to not only acquire 5 million shares of stock but also to exercise his call options at a strike price $20 and take delivery of a reported 12 million shares.

“In the case of GameStop, with the exception of the true believers, nobody thinks this company is fundamentally going to be worth what it is. Hopefully, you can play musical chairs and get out before the music stops.”

Learning curve

Li Liang, a recent PhD graduate from George Washington University who will start an assistant professorship at Eastern Connecticut State University in August, researched financial literacy and its correlation with meme stock investing.

Liang compared results of an investing literacy quiz with whether participants said they had invested in meme stocks in 2021. She found that those who answered more questions incorrectly were more likely to have bought meme stocks, whereas people who answered “I don’t know” to questions were less likely to have bought such stocks.

The data hint at overconfidence in investing ability, which was more common among men and younger people, may contribute to buying GameStop or other meme stocks, she said.

“They actually traded meme stocks, maybe because they overestimated their financial knowledge, or maybe they just don’t have the ability to understand what is going on and become a momentum trader,” she said. “I do see this craziness happening again,” with the resurgence of GameStop and activity of Roaring Kitty.

“They like to take risks. They are gambling,” she said. “I would encourage people, especially retail investors, to learn more about finance before they become involved in such risky trading when it comes to meme stocks.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound