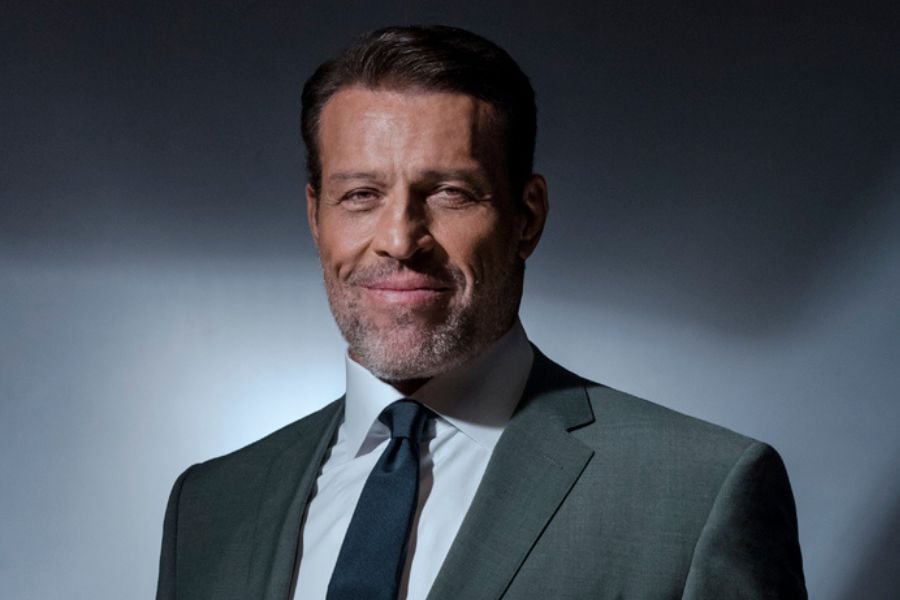

Shove over Indiana Jones, Tony Robbins is on a hunt for a holy grail, too.

The only difference between the two is that Robbins’ quest wends through the pillars of private equity instead of the treacherous jungle and desert terrains Jones tends to traverse. That, and the fact that Robbins seeks eternal wealth (or at least generational wealth) on his expedition, while Jones pursues immortality (or at least another blockbuster sequel) on his adventures.

For his latest book, The Holy Grail of Investing, the financial author and business coach sat down with more than a dozen giants from the world of private equity to find out how they overcame the perils of Wall Street to amass their billions. Not that Robbins doesn’t appreciate the public markets and the ability to profit from good old stocks and bonds, mind you. But to unearth the holy grail of true wealth, he believes investors need to search those private places where at one time only accredited investors were allowed to tread.

“These are firms that are valued at $20 billion to $100 billion and they've consistently returned 20 percent, some of them 30 percent, compounded for decades,” said Robbins. “I wanted to bring that to the general population because there are some new rules that are being passed that will make these opportunities available to the general population, and they've never been available before.”

Robbins says the idea for the book stemmed from a conversation he had with famed hedge fund manager Ray Dalio, who told him the key to increasing his upside was establishing a solid core of uncorrelated, highly diversified investments.

“It's hard to do that looking just at the general open markets. So you’ve got to go to some of the private investments to do that, and so that's why this book gives you lots of options,” Robbins said.

The collapse of both stocks and bonds in 2022 also served as an impetus for Robbins to pick up a pen. That was the year in which retail investors suffered greatly as the S&P 500 sank more 18% while the supposedly safe Barclay's U.S. Aggregate Bond Index fell over 13 percent. Private equity players, meanwhile, weathered the storm and simultaneously inspired Robbins.

“Some of these great private equity plays, the very best in the world, they produce returns that are ridiculous. But even an average private equity investment has returned 14.2 percent for 35 years, compared to an S&P return of 9.2 percent,” said Robbins. “So these things are compounding 50 percent faster every single year.”

And the good news now, he says, is that those private market opportunities, whether they be in real estate, credit or sports teams, are no longer purely the domain of Wall Street’s elite. New legislation from Congress has opened up private markets to more and more retail investors. And Robbins’ stated mission is to open the eyes of individual investors to the possibility of making the same outsized returns as those pocketed by the private equity practitioners in his book.

“I've said for years, ‘Why do we give the greatest investment returns only to the richest people?’ That's ridiculous,” Robbins said. “You don't need $1 million net worth. You don't need to have $200,000 a year and you'll still be able to do this. That's why I wrote the book, because now literally it's going to be available everywhere. And the size of the market is gigantic.”

And as for simply buying publicly traded shares of private equity powerhouses like Blackstone or KKR instead of trying to emulate their investing styles, Robbins says that’s not a bad idea, but it’s also not the way to capture that elusive “holy grail.”

“You absolutely can buy the stocks of private equity players, but you'll see that there's greater returns in the private equity environment than there are in the public markets,” he said. “And in the public markets, even with those stocks, you still go with the ups and downs.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound