Bank of America Corp., the biggest U.S. bank - and the financial stock hit harder than any other this year - said Warren Buffett's Berkshire Hathaway Inc. will invest $5 billion in the company. The news had shares of BofA up 20% in early morning trading.

Bank of America Corp. Ticker:(BAC), the biggest U.S. bank, said Warren Buffett's Berkshire Hathaway Inc. will invest $5 billion in the company.

Bank of America will sell 50,000 shares of cumulative perpetual preferred stock to Omaha, Nebraska-based Berkshire, the Charlotte, North Carolina-based bank said today in a statement. The preferred stock pays an annual dividend of 6 percent.

Bank of America has lost almost half its value on the New York Stock Exchange this year as investors speculated the lender will have to access the public markets to raise capital. Chief Executive Officer Brian T. Moynihan, 51, has said the company won't need to issue shares to comply with new international capital standards and to settle claims surrounding defective mortgages.

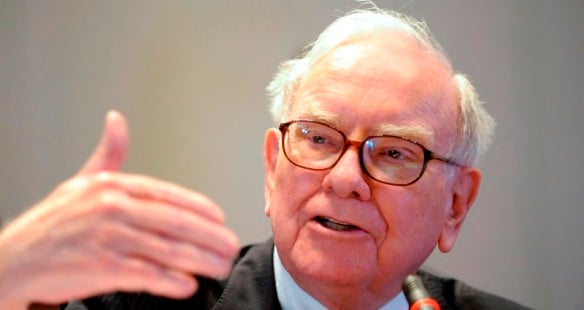

“Bank of America is a strong, well-led company, and I called Brian to tell him I wanted to invest in it,” said Berkshire Hathaway Chairman and Chief Executive Officer Warren Buffett. “I am impressed with the profit-generating abilities of this franchise, and that they are acting aggressively to put their challenges behind them. Bank of America is focused on their customers and on serving them well.”

Bank of America climbed 11 percent to $6.99 on the New York Stock Exchange yesterday, the biggest gain in the Standard & Poor's 500 Index, after Meredith Whitney, the bank analyst, said in a Bloomberg Radio interview that Bank of America Corp. has no urgent need to raise capital.

Moynihan agreed to sell the bank's Canadian card unit, with $8.6 billion in loan balances, and plans to leave the U.K. and Irish card markets, Bank of America said this month. The bank has been forced to write down credit-card and mortgage units acquired by Moynihan's predecessor, Kenneth D. Lewis. Bank of America has sold more than 20 assets or units since Moynihan took over last year.

Bloomberg