Annuity sales have rocketed to record levels this year, fueled by demand for products that give contract owners stock exposure but provide limits that keep them from getting burned too severely by market drops.

Those products, registered index-linked annuities, have gone from being a blip on independent broker-dealers’ radar to one of the hottest-selling products, according to a sales report Tuesday by Limra.

“In 2017, we had four carriers that were offering RILAs. And today we have 17 — and there are more coming,” said Todd Giesing, assistant vice president at Limra Annuity Research, adding that he expects as many as 21 carriers in the space by the end of the year.

The products are different from traditional variable annuities in that they include buffers against both losses and upside. While VAs are also often sold with guaranteed income components, some RILAs are adding those features as well, Giesing said.

Whether RILAs with guaranteed living benefits are additive to the market or will end up cannibalizing sales of VAs with similar insurance features is a big question, he noted.

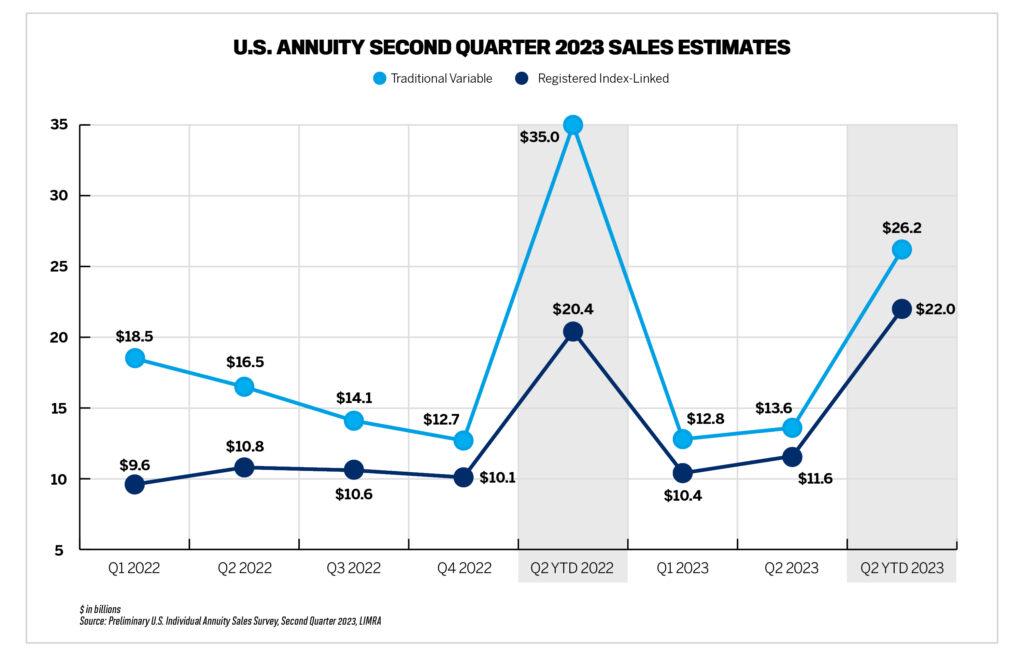

So far this year, total annuity sales hit $182.9 billion, a 28% bump from the the first half of 2022, according to Limra.

There were $26.2 billion in sales of traditional VAs, down 25% from the figures in the first half of 2022. Meanwhile, sales of RILAs reached $22 billion, up by 8%.

Fixed annuities have also been selling at higher volumes, with total sales of $134.5 billion for the first half of the year, up 54% from the $87.3 billion seen during the same time last year. While more than half of this year’s sales went to fixed-rate deferred annuities (up 64%), fixed-indexed annuities raked in $48.5 billion (up 35%), according to Limra.

“The annuities market has really exploded over the past year,” Giesing said. “What we’re seeing here is a changing dynamic in the second quarter.”

With equity markets up substantially this year and interest rates stagnant but nonetheless favorable for annuity products, customers have gravitated toward products that give market exposure. At the same time, the negative returns and bond valuations in 2022 are recent enough to make people cautious about losses — and that, so far this year, has favored RILAs, fixed-rate deferred annuities and fixed-indexed annuities.

“Last year, we ran into the factor of investors having no place to hide,” Giesing said.

Historically, traditional VA sales have rebounded quickly in bull markets — although the last prolonged bear market was so long ago that it’s hard to predict how sales of the products will respond this year, he said.

However, a bigger question is where most of the $113 billion currently in fixed-rate deferred contracts with less than five-year terms will go, Giesing noted. Currently, RILAs, fixed-indexed annuities and products with income features stand to benefit when the money trickles through, he said.

Mark Cortazzo, senior vice president and financial advisor at RIA Wealth Enhancement Group, said that RILAs and VAs are different tools for principal and income protection. In some cases, clients are better off putting their assets in balanced portfolios, but annuities are a good alternative for money that would otherwise be sitting in cash — or potentially even money market funds or bonds, he said.

“You do have people who are sitting with a tremendous amount of money in cash” who feel as if they missed an opportunity to get into, or back into the market, Cortazzo said.

“What we are looking at is what the money is going to be worth five to 10 years from now,” he said.

If someone is interested in an annuity for principal protection but doesn’t think the market is going to go down very significantly, they might consider a balanced portfolio, Cortazzo noted. But clients who are very close to retirement and have a primary goal of insuring their income might be better suited to annuities, he said.

“One’s not better than the other. They’re just different ways of addressing risk,” he said. “Why are you considering the protection? What are your alternatives? And is this one of the more effective ways to solve for the problem you’re trying to address?”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound