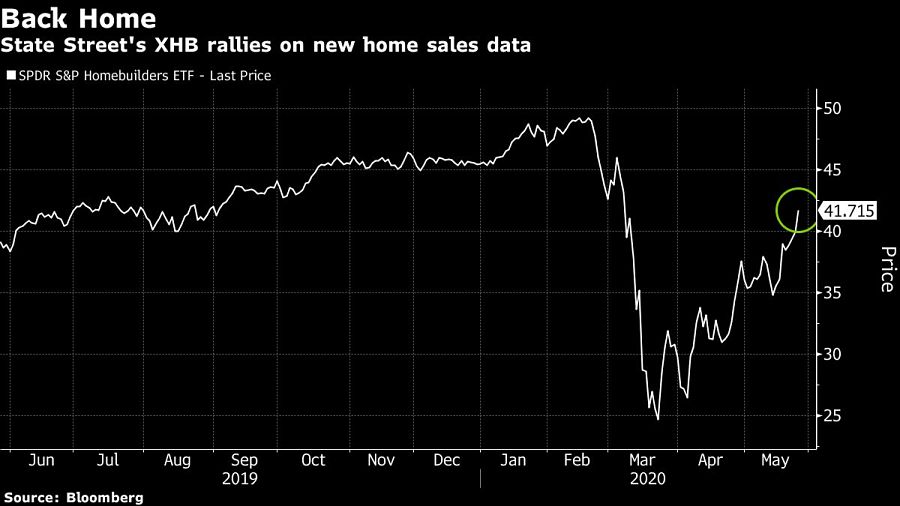

The largest homebuilder ETF surged to pre-crisis levels Tuesday on data showing a surprise increase in sales of new houses last month.

State Street’s SPDR S&P Homebuilders exchange-traded fund (XHB) rallied as much as 4.6% to the highest level since March 6. Purchases of single-family houses in the U.S. unexpectedly climbed in April after sales dropped the most since 2013 in March, when much of the U.S. economy shut down to stem the spread of coronavirus.

Since tumbling to a more than seven-year low on March 23, XHB has soared 68%, compared with a 34% increase in the S&P 500. While the latest homebuilder data suggest the housing market is starting to stabilize, the industry rebound will depend on how quickly the rest of the economy bounces back. High levels of unemployment could serve as a headwind to the recovery.

“The housing market could be one of the brighter spots,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management. “We’ve probably seen the worst of the data in the month of April, but it may take some time for the economy to recover from here.”

Government data also showed that the median sale price of homes in April fell 8.6% from a year earlier, to $309,900. And the S&P CoreLogic Case-Shiller National Home Price index rose 4.35% year-over-year in March after climbing 4.16% in prior month.

“Home prices are still relatively stable and are not showing any sign of a housing bubble bust like that which occurred in the Great Recession over a decade ago,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound