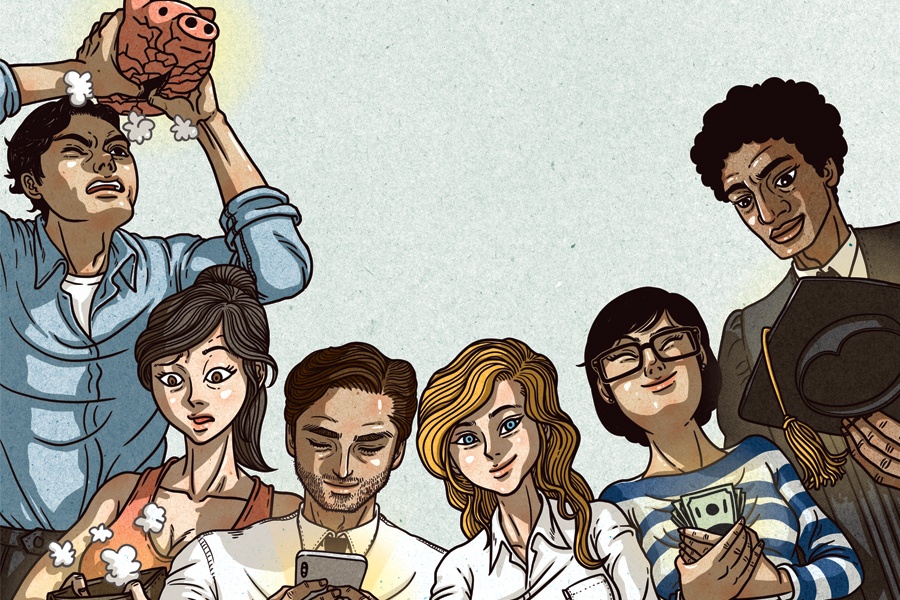

We are currently in the midst of the greatest generational transfer of wealth in history.

The Great Wealth Transfer is, without a doubt, one of the most pressing concerns and paradigm-changing priorities for firms and financial advisors around the world. And rightfully so.

The fact of the matter is that most financial advisors are not nearly as prepared as they need to be, and many heirs to the wealth will be looking to make moves on their own terms. According to Cerulli Associates, more than 70% of heirs are likely to fire or change financial advisors after inheriting their parents’ wealth. A number this high isn’t something to gloss over, sweep under the rug or “eventually” put a plan in place for.

This transfer of wealth has massive implications for how firms and wealth advisors operate their businesses and service clients if they want to retain assets and relationships. Below are three effective ways advisors (and firms altogether) can actively engage with the next generation and improve their chances of winning them over.

First and foremost, firms (and advisors) need to take a step back to ensure their business aligns with the values and goals of this next generation. This naturally involves reevaluating business processes, communication channels and engagement models, among many other areas, to ensure every bit of interaction resonates with the younger generation of clients and investors.

One often very overlooked area is human resource allocation. Does your firm have the right advisors and support staff to effectively engage with the next generation?

I recently spoke with an advisor who admitted that he and his firm felt were unequipped to adequately engage with the next generation. As a result, the firm hired two young, up-and-coming advisors who had much more in common with younger clients and prospects.

An intergenerational continuity plan is a comprehensive financial plan outlining how a family's wealth will be managed and transferred to heirs and future generations.

When put in place, an intergenerational continuity plan provides a detailed road map for managing and transferring wealth that aligns with the family's goals and objectives. It’s very common (and good practice altogether) that an intergenerational continuity plan includes strategies for managing and protecting assets, minimizing taxes and ensuring that wealth and assets are distributed in a fair and equitable manner.

At the end of the day, establishing an intergenerational continuity plan provides assurances for the family by ensuring that the family's values and legacy are preserved and passed down through the generations.

Family meetings are a tried-and-true approach that can help advisors create an intergenerational continuity plan while making sure the plan is continually worked on and followed through with. Family meetings encourage all necessary family members to participate in discussing the critical areas that go into such a plan: goals and values, transfer strategies, legacy and estate discussions, family assets and wealth, and more.

Last but not least, having the right tools and technologies in place is a game changer for a firm, its advisors and especially the next generation.

Younger investors are digital-first in almost every area of their lives, and how advisors plan on interacting with, communicating with and delivering value to them absolutely must match this.

When considering best-of-breed technologies to assist with wealth transfer conversations and engaging the next generation, there are a few key things to keep in mind. Consider technologies that make it easy for the family to access and manage critical information, data, and documents. Also look for platforms that offer mobile experiences and ensure that your workflow and the experience you deliver to clients is seamlessly integrated and connected. Every bit of interaction counts.

As your firm looks to better equip your staff and advisors with ways to effectively engage with the next generation, it's important to note that there is still no guarantee that your firm will retain every dollar of inherited wealth. However, you will increase your chances of participating in the conversation around the wealth transfer and build relationships with the next generation.

Kristian Borghesan is vice president at FutureVault, a provider of secure document management exchange and digital vault solutions built for financial services and wealth management firms.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound