Baby boomers tend to grab the most attention from wealth managers — and with good reason. Boomers, the generation currently in their late 50s to mid-70s, hold 52% of the country's wealth and an estimated $14.5 trillion in investible assets.

Generation X and the silent generation, the groups on either side of the boomers, comprise the next two largest holders of wealth with 28% and 15%, respectively. Millennials, those born between 1981 and 1997, trail far behind with only 5% of the country's wealth.

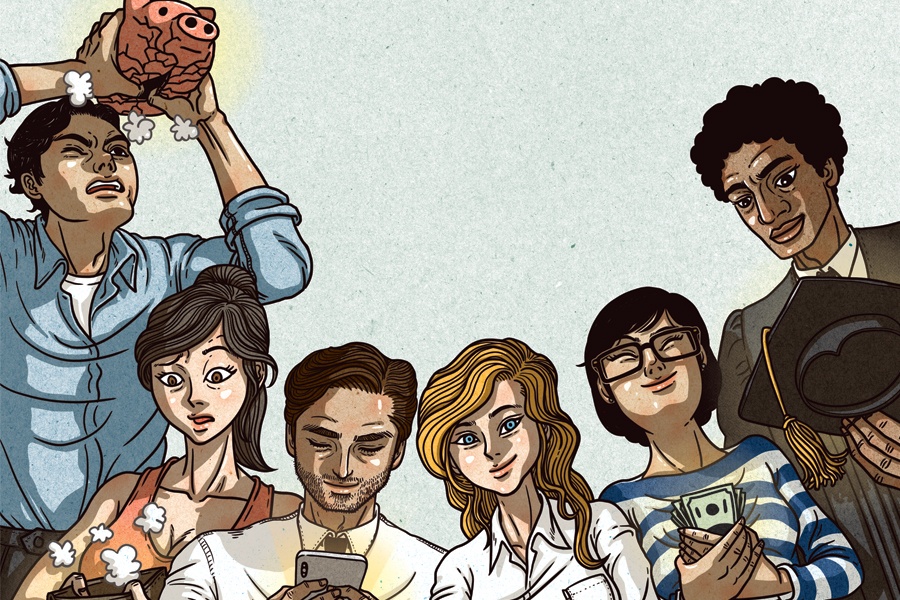

But millennials, the youngest of whom are in their mid-20s, are starting to come into their own and are worth a closer look by the financial services industry. Here are three reasons why:

Covid-19 was rough for everyone. The U.S. shed 9.37 million jobs in 2020 — the worst job loss since 1939 — as the country, and the world, came to a near standstill to contain the pandemic. The sectors hardest hit by the Covid shutdowns were hotels, restaurants and related industries, and those job losses disproportionately affected minorities, teenagers and less educated workers. Millennials were less impacted financially.

By the end of 2021, millennials more than doubled their wealth to over $9 trillion, outpacing the gains of any other generation in this period. More than one-third of millennials' total assets are in real estate, and they have benefited from soaring home values over the past few years. Where they lag is in retirement savings, but that will change over time.

This rise in millennial assets is expected to continue. Millennials will experience the fastest growth rate in net wealth through 2030, according to research from the Deloitte Center for Financial Services. This group will also become the new driver of consumption.

Sure, they collectively hold much less money than the other generations, but this is a group that will ascend to higher-paying jobs, buy their first, or even second, home and start to make investment decisions about retirement savings.

The great wealth transfer is underway. An estimated $30 trillion to $68 trillion will pass from the silent and boomer generations to their heirs over the next decade. While Generation X stands to inherit 57% of this windfall, millennials will gain anywhere from $10 trillion to $20 trillion.

That's a lot of zeros. A lot.

While it's nearly universally decried as quirky and financially irresponsible in the media, this generation's exposure to multiple financial and social media platforms have made its members more cautious and pessimistic than previous generations. Millennials started saving earlier than their counterparts and understand more about the markets than older generations. This is partly from a millennial mindset of not expecting employer-sponsored pension payouts or Social Security when they reach retirement age.

Baby boomers and Gen Xers, who are roughly 42 to 57, are likely to already be working with wealth managers and have well-established investment plans. On the other hand, millennials, especially those on the younger side of the generation, may need expert guidance on how to manage their coming inheritance, while creating college savings and retirement strategies.

This group is also being bombarded by investment choices, from crypto to NFTs. They are more likely to embrace digital platforms or a DIY philosophy — but regardless of their comfort with digital solutions, countless studies show that accounts with professional wealth management far outperform funds using DIY solutions. Millennials are in desperate need of sound, trusted and personal financial advice.

The time is right to take the millennial market more seriously — and not just as a favor to your older clients who have children that age. This group will be the future of your practice and should be marketed to and cultivated accordingly.

Right now, many millennials cite the amount of debt they carry and their low incomes as the reason they don't invest. But that will change as wealth is transferred and their careers take off.

Others that age are already becoming a growing force in investing. Almost a third of millennials with taxable accounts were under 21 when they started investing, a significantly higher percentage than their Gen X and baby boomer counterparts. And one in four millennials already has at least $100,000 in savings.

Attracting millennial clients may require some tweaks to your value proposition. You may want to offer more mobile and digital services, bring on tech-savvy staffers and create a better online and social media presence. But the results will be worth the upfront investment.

While boomers still hold the most wealth by far, millennials are a generation worth pursuing for the long term.

Brian Bunker is senior director and head of practice management consulting at Stratos Wealth Partners.

The 25-year industry veteran previously in charge of the Wall Street bank's advisor recruitment efforts is now fulfilling a similar role at a rival firm.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound