The wealth management industry runs on talent. Intense competition to recruit and retain experienced financial advisers is the norm, especially when these advisers can carry their books of business from firm to firm. Being a best place to work isn’t just good for employees. It’s good for business.

That perspective is evident among the firms comprising InvestmentNews’ third annual class of the Best Places to Work for Financial Advisers. In an industry that saw more than 15,000 advisers change firms during 2019, these 75 Best Places collectively reported turnover of only 6%.

What makes employees want to stay at these firms?

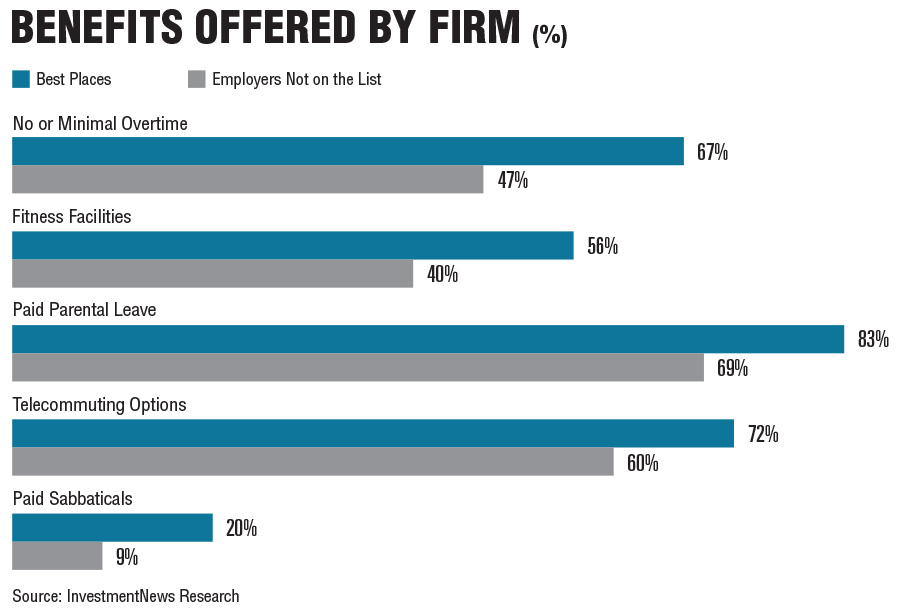

As part of the Best Places selection process, eligible firms answered a questionnaire on which benefits, amenities and other HR policies they have in place. The policies that show the largest gaps in enactment between Best Places and firms not on the list – the biggest differentiators of the top employers – are displayed in the chart below.

Notably, the Best Places and the firms that failed to make the list differ little when it comes to core benefits packages. More than 90% of both groups offer health care coverage to employees and their dependents, retirement plans, incentive bonuses and support with continuing education. These are the table stakes in competitive recruiting.

Instead, the policies that differentiate the Best Places mainly address work-life balance and flexibility to take time away from work for family or personal fulfillment. Firms with the following policies in place were more likely than their peers to be named a Best Place to Work.

No or minimal overtime: 20 percentage points higher

Perhaps the best way to provide a healthy work-life balance in the office is to encourage employees to leave it on time. Two-thirds of firms on our Best Places list have policies that either minimize or eliminate overtime work, compared with less than half of other firms. Reducing overtime means not only encouraging employees to shut down for the day, but also ensuring there’s enough capacity at the firm to handle client needs without overloading staff. At the Best Places, 93% of surveyed employees said staffing levels at their firm are adequate to provide quality service, while only 78% of employees at other firms agreed. Keeping an eye on capacity can help advisory firms, which don’t tend to operate with a lot of excess. Our 2019 Compensation & Staffing study found that 76% of firms were nearing their capacity, and 16% were already over and in need of another adviser.

Onsite fitness facilities: 16 percentage points higher

More than half (56%) of the Best Places to Work offer onsite facilities to promote exercise and fitness. Wellness has been a human resources watchword for decades, and though the concept has steadily expanded into emotional and financial well-being, companies across industries have continued to invest in employees’ physical fitness. According to the Society for Human Resource Management, 29% of U.S. companies offered onsite fitness programs in 2019, up from 25% a year prior. On this front, even advisory firms that did not make the Best Places list outperformed the national average: 40% reported offering onsite fitness facilities.

Paid parental leave: 14 percentage points higher

The Best Places also stand out for their wide use of paid parental leave, which 83% of these firms provide. Paid parental and family leave has come under heightened focus in recent years as several states have passed laws to provide or require it. Yet in most of the country, new parents are at the mercy of their employers’ policies, and the paucity of benefits has been shown to disproportionately hurt women and their career ambitions. Paid parental leave may in fact go hand-in-hand with more gender balance in an advisory’s ranks. In an industry that continues to struggle with diversity, the combined workforce at the best places is 46% female.

Telecommuting: 12 percentage points higher

Telecommuting is offered to employees at 72% of the Best Places to Work, compared with 60% of firms not on the list. On this benefit, the Best Places are roughly in line with U.S. employers overall; SHRM found that 69% of companies allowed at least some telecommuting in 2019. Although some advisory firms may be resistant to cutting back office hours in a high-touch industry, technology is making it easier for advisers to keep up with client meetings remotely. According to our 2020 Adviser Technology study, 70% of firms now use video-conferencing software to communicate with some clients. Telecommuting can be a selling point to employees at all stages of their lives and careers. Some firms, for example, have used telecommuting arrangements to retain retirement-age advisers who want to remain engaged but reduce their hours in the office.

Paid sabbaticals: 11 percentage points higher

Although only one-fifth of Best Places offer paid sabbaticals, this ultimate work-life balance perk has generated buzz among advisory firms as a tool to retain top talent and differentiate the culture of their organization. A typical arrangement at an advisory firm may consist of a month of paid time off after five years of company service. Whether employees use the time to spend a summer with their family or travel the world, the provision helps encourage staff to stick with the firm for the long term. Even at 20%, the Best Places to Work for advisers provide this benefit at a far higher rate than other U.S. companies, and it will surely remain part of the discussion around employee retention for years to come.

See the 75 firms that made InvestmentNews' 2020 Best Places to Work for Financial Advisers.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound