While financial professionals who look to traditional bonds as a steady source of current income for their clients have been forced to contend with meager yields for some time, the inflation pressures that emerged in the aftermath of the Covid-19 recession represent a new complication — and a novel one for many, given four decades of relative moderation.

Despite persistently lower yields relative to historical averages and elevated risks that characterize core fixed-income assets and unsecured below-investment-grade debt, we believe there are alternative solutions to be had. For example, assets like broadly syndicated loans and direct-lending investments (aka private credit or private debt) feature near-zero duration thanks to their floating-rate coupons, as well as relatively high income potential given limited liquidity and non-investment-grade status. Structures like interval funds can provide individual investors access to income strategies comprised of these less liquid and illiquid assets, with periodic redemption opportunities that have the potential to mitigate the illiquidity of the underlying holdings.

Coming out of the economic dislocations of Covid-19, high inflation prints thought to be transitory by many — including the Federal Reserve — have proved quite persistent. Inflation packs a one-two punch against traditional fixed-rate bonds, eroding the purchasing power of static coupon payments and often signaling higher interest rates, both of which weigh on market prices.

Treasury rates began to creep up in late 2021 and moved sharply higher in 2022 as it became evident the Fed was poised to hike its benchmark rate for the first time since 2018. The Fed ultimately raised rates in March in what may prove to be a lengthy tightening cycle.

Given their longer duration and lower yields, investment-grade issues have had a particularly rough time in this environment of early-1980s-style inflation and multiyear-high interest rates; the Bloomberg US Aggregate Index lost 10.3% in the first half of 2022.

In contrast, floating-rate fixed income assets have been a relative port in the storm, though concerns about the impact of tighter financial conditions on economic growth have weighed on total returns more recently. After a flattish first quarter, the S&P/LSTA Leveraged Loan Index is down 2.4% for the first five months of the year. The Cliffwater Direct Lending Index, which tracks the quarterly performance of middle-market loans, gained 1.8% in first quarter 2022.

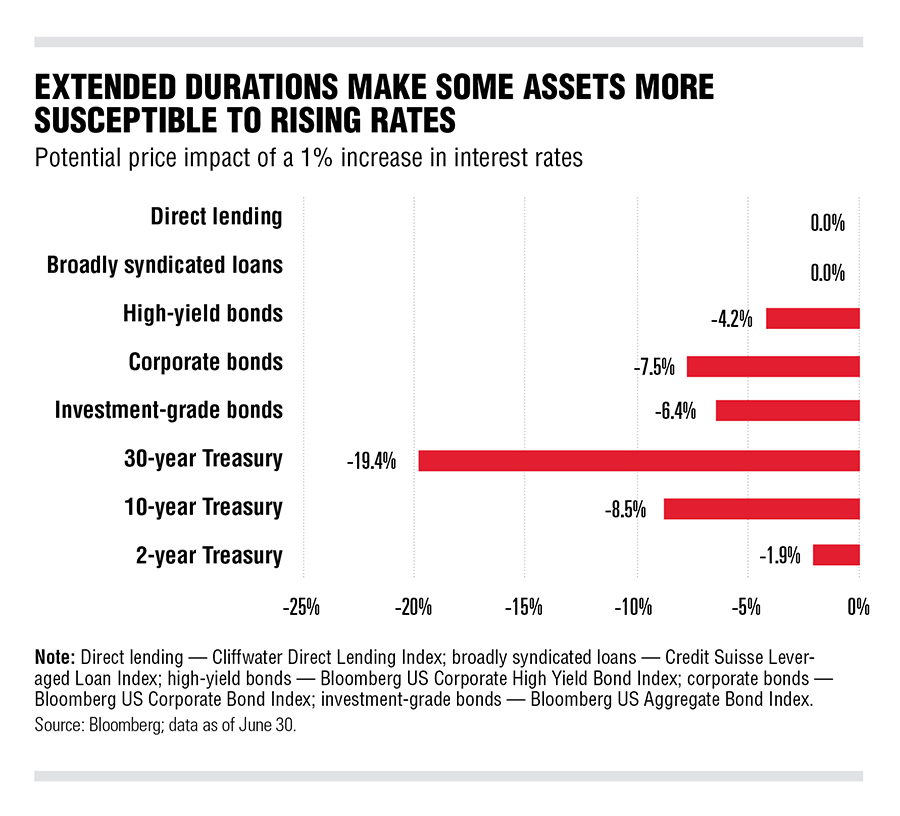

Key to the outperformance of syndicated loans and private debt has been their floating-rate coupons and senior secured status. With coupons that reset on a periodic basis to maintain a fixed spread over a reference rate, both assets have very limited duration — and thus limited sensitivity to changes in interest rates, as shown in the chart below. Further, both are predominated by loans that are secured by the borrower’s assets and cash flows, and are senior in its capital structure. This advantaged position historically has resulted in lower default rates and higher recovery rates compared to bonds, which are unsecured and subordinated. These structural features may be all the more important in light of the economic uncertainty facing investors today.

Finally, syndicated loans and private credit typically offer higher yields than investment-grade bonds as compensation for the reduced liquidity of bank loans and near-zero liquidity of private credit. It's our view that 100% of an investor’s fixed-income exposure doesn't need to be 100% liquid given the potential benefits that can be had in exchange for taking on some illiquidity risk. Recognizing this, investment managers have been hard at work developing alternative investment solutions appropriate for individual investors and their financial professionals.

Syndicated loans have been widely available in the retail space through mutual funds and exchange-traded funds, but access to private credit strategies historically has been limited to institutional investors through high-minimum private funds or separately managed accounts. More recently, however, investment managers have turned to the interval fund structure to provide individual investors with differentiated investment solutions that leverage the spectrum of unique risk-return profiles in the alternative credit markets.

Like an open-end mutual fund, an interval fund is a pooled investment vehicle that's available for purchase continuously at net asset value. Unlike mutual funds, however, interval funds don't provide shareholders with daily liquidity; instead, redemption windows open periodically at predetermined intervals (monthly, quarterly, semiannually or annually). This structure makes the interval fund wrapper particularly well-suited for strategies that invest in less-liquid assets like private credit in exchange for the higher coupons they often provide. For assets that do have some secondary market liquidity, like syndicated loans, it also frees the investment manager from the forced selling that may hamper performance in the daily redemptive space.

Though the Securities and Exchange Commission authorized interval funds in 1992, issuance didn’t really take off until recently. The structure, which isn't limited to alternative credit, brought in about $19 billion in 2021 after raising assets at an annual rate closer to $9.5 billion from 2018 to 2020. Current interval fund assets under management stand at around $60 billion, and it wouldn't be surprising to see this figure climb, given forecasts that retail holdings of private credit products could grow nearly 13% by 2025.

In an environment characterized by persistently high inflation, rising interest rates, tightening financial conditions and an uncertain macroeconomic trajectory, the interest-rate sensitivity and slim yield cushions of core bond assets represent an unfavorably asymmetric risk-return profile for financial professionals seeking current income. There are alternatives, however.

Loans — both broadly syndicated and directly originated — typically offer higher yields than investment-grade debt as well as a floating-rate, senior secured structure that provides some cushion against the impact of rising rates and economic uncertainty. Though investors must bear additional liquidity risk in exchange, we think this is a trade-off that may deserve consideration. Given the role that fixed-income investments typically play in portfolios, 100% liquidity isn’t a necessity, in our view, particularly in light of potential benefits that can be found in less-liquid corners of the credit markets.

Jack Snyder Jr. is national sales manager for the wirehouse and RIA channel and head of retail alternative sales for First Eagle Investments.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound