When advisers at wirehouses or independent broker-dealers look to launch their own firm, the main question on their minds is, “How will I recreate the products and services I’ve always offered my clients throughout my career, as an employee of my current firm?”

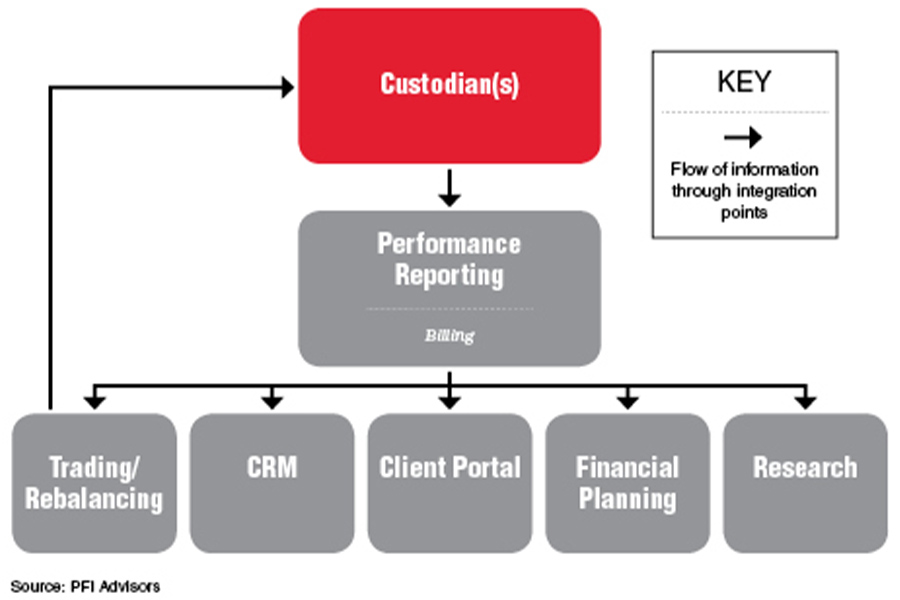

As they start to think through their technology stack, we advise them to choose a custodian first and a reporting provider second. The reporting provider will act as the “hub” through which all data flow across the rest of a registered investment adviser's back-office infrastructure.

For advisers moving to the RIA channel, reporting technology offers the first chance to provide clients with a holistic picture of their total net worth, including assets held outside of the adviser’s purview.

Custodial statements provide account owners with balances and transaction history. These statements are broken down by account number and act as an efficient way for clients to verify, through a third party, the assets they have invested under the RIA’s purview.

These statements do not, however, provide any performance numbers at the account, household, asset class or security level. The custodial statements provide no commentary on the direction of the markets or the specific investment strategy the client is invested in.

If the adviser wants to paint a picture of the client’s financial standing, he or she will need to utilize performance reporting software. With this technology, advisers can create customized and dynamic reports, usually through a drag-and-drop interface, to group accounts within the household in the most logical way for the client to understand.

Reporting provider technology also includes a client portal and a billing module, both essential components of an RIA’s business. Because this technology is so essential to an RIA’s infrastructure, here are four industry-leading reporting solutions for RIAs.

Advisers looking to move to the independent channel would be well-advised to learn more about these technology solutions, as they act as the engines that drive RIA business across the country (and globe).

Matt Sonnen is founder and CEO of PFI Advisors, an operations and technology consulting firm for RIAs, which recently published a report, “The Importance of Reporting Provider Technology for RIAs.” Follow him on Twitter @mattsonnen_pfi.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound