Without proper planning, taxes may consume a painful share of your clients’ investment returns.

This is because different types of accounts and assets are taxed in different ways, and taxes can have a big impact on realized returns. Fortunately, by focusing on tax-efficient investment strategies, you can help your clients keep more of their money.

According to professor of wealth management and Wealth Management Certified Professional® (WMCP®) Program director at The American College of Financial Services Michael Finke, PhD, CFP®, “An easy way to understand how assets are affected by taxation is to focus on the net after-tax return we’d receive by holding investments over time. After all, the only returns we can spend are the ones we receive after paying taxes.”

When evaluating how taxes impact net returns, there are two categories of interest: taxable assets, which include annually taxable and basis assets; and tax-sheltered assets, which include tax-exempt and tax-deferred assets.

Below, we will explore their relative post-tax performance. Our key assumptions will be:

Among taxable assets, basis assets are more tax-efficient than annually taxable assets.

Annually taxable assets include instruments that generate regular income, such as certificates of deposit (CDs), money markets, and corporate bonds. This income is taxed on receipt at the investor’s ordinary income tax rate.

If an investor invested $6,000 ($10,000 of gross income after paying 40% in taxes) in an annually taxable asset, she would earn 4% ($240) annually and would pay income tax on those earnings at 40% ($96), yielding a net return of 2.4%. After 20 years, she would realize $9,642 on her notional $10,000 investment (see Figure 1).

Basis assets, such as stocks and mutual funds held in taxable accounts, enjoy advantages over annually taxable investments. The gains on these assets compound tax-free until they are realized and are taxed at capital gains rates, which are typically lower than income tax rates.

If our investor invests $6,000 of after-tax income in an ETF, after 20 years her holdings would be worth $13,147, yielding a capital gain of $7,147 on sale. This gain would be taxed at the CGT rate of 20% ($1,430), netting $11,717 (see Figure 1).

Tax-sheltered assets enjoy an advantage over taxable assets. However, the relative advantage of tax-exempt versus tax-deferred assets depends on various factors.

Tax-exempt assets, such as Roth IRAs, allow investments to grow tax-free. Contributions to a Roth IRA are made with after-tax dollars, and withdrawals in retirement are tax-free.

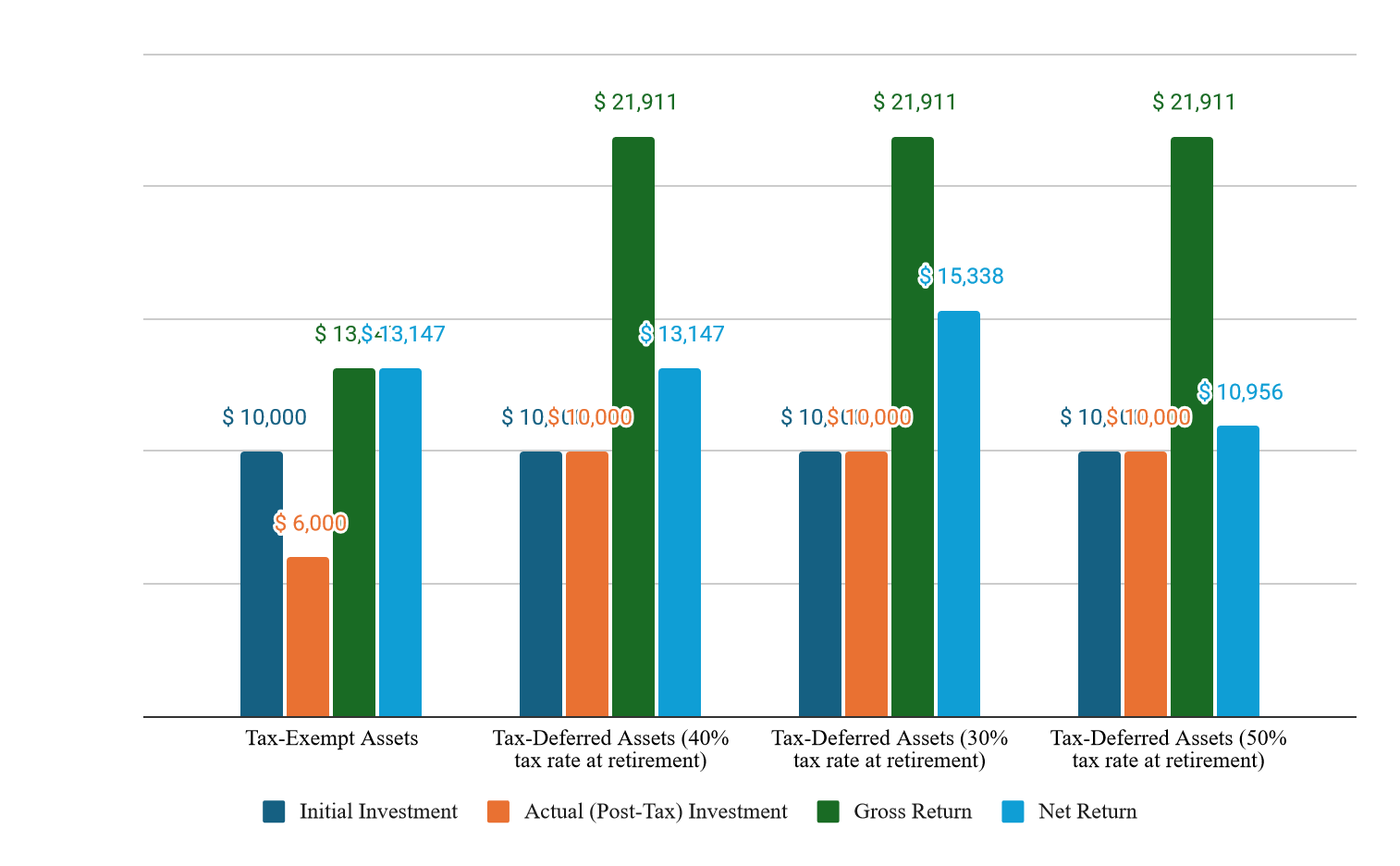

If our investor invested her $6,000 of after-tax income in a Roth IRA at 4%, her investment would grow to $13,147 over 20 years and could be withdrawn tax-free – a much greater net return compared to taxable assets (see Figure 1).

Tax-deferred accounts, such as 401(k)s and traditional IRAs, allow investments to grow without being taxed. Contributions are made with pre-tax dollars and taxes are due when withdrawals are made, typically at the retiree’s marginal tax rate.

Here, our investor would invest $10,000 of pre-tax income. At 4%, this would grow to $21,911 over 20 years. However, upon withdrawal at a 40% tax rate, this would net to $13,147 (see Figure 1).

As you can see, there’s no difference between tax-exempt and tax-deferred accounts when the tax rate remains the same over time. This is referred to as the traditional/Roth equivalency: when tax rates are equal, tax-exempt and tax-deferred accounts provide the same sheltering advantage over taxable assets.

Importantly, however, if the investor’s tax rate were to fall to 30% on retirement, the net amount would be $15,388, illustrating the potent benefits of deferring taxes when expecting a lower tax rate in retirement. The reverse is true when expecting a higher tax rate in retirement (see Figure 2).

Choosing the right tax-advantaged vehicle, therefore, is dependent on a client’s tax rates today and at retirement.

The simplified examples above illustrate the general impact taxes can have on net returns and the benefits of different investment vehicles. In practice, however, the impact of taxation can be complex and tax-efficient strategies can be multifaceted.

Asset location strategies, for example, involve placing tax-inefficient investments such as actively managed funds in tax-advantaged accounts and keeping tax-efficient investments such as index funds in taxable accounts to optimize overall portfolio returns. Similarly, tax-loss harvesting and other tools can support further portfolio optimization. However, these strategies require a deep understanding of the tax implications of various investment vehicles and changing tax laws.

Finke agrees that tax-efficient investing can be complex.

“Selecting the right tax-efficient strategy requires a great deal of knowledge and expertise. That’s why The College has developed the Tax Planning Certified Professional™ (TPCP™) Program in partnership with Jeffrey Levine, CFP®, CPA/PFS, ChFC®, RICP®, CWS, AIF, BFA™ and other leading tax planning experts.

“Our goal is to help financial advisors deliver expert tax-efficient investment advice no matter what their client’s unique circumstances,” Finke said. “By building their expertise in tax-efficient investing, financial advisors can deliver real value for their clients and, in doing so, set themselves apart from the competition.”

This column was provided to InvestmentNews exclusively by The American College of Financial Services.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Donald Trump's second turn at the White House is expected to bring a fresh bout of turbulence, supercharging retail demand.

“After learning about a bad actor who is barred, the securities industry should have a responsibility to put clients on notice,” one lawyer said.

Wealth managers weigh in on the chipmaker's influence over the greater market in the wake of its earnings report.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound