In recent weeks, investors and industry professionals have engaged in spirited debate regarding the state of the current market and whether we’re in bull territory.

Even as these debates press on and investors revel in rallies, a gentle reminder is in order. Investing in the stock market is a dynamic and complex undertaking. It is natural for investors to seek strategies that minimize risks and maximize returns. However, a common misconception among some investors is that they can achieve superior results by trying to time the market, hopping in and out at precisely the right moments. This approach inevitably leads to missed opportunities. Experience and data overwhelmingly show us that the sidelines are no place for long-term returns.

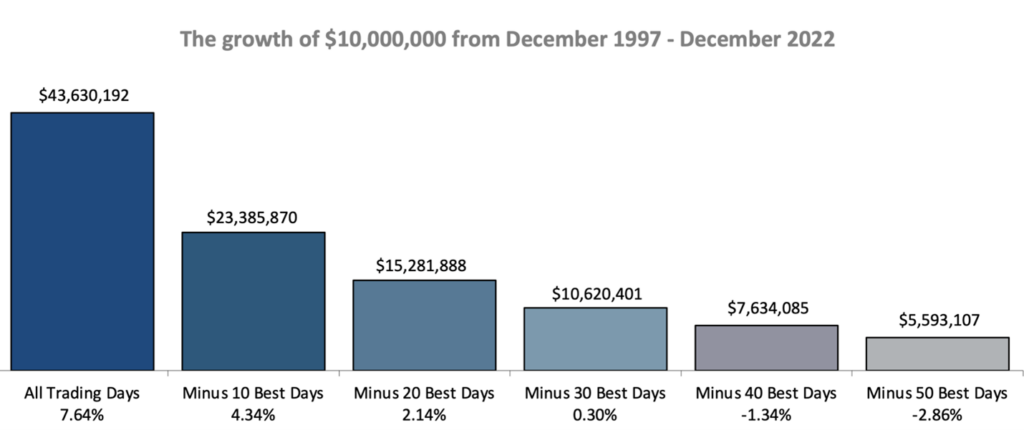

Between December 1997 and December 2022, the S&P produced an annualized return of 7.64%. However, investors who missed just the 10 best days during this period would have received an annualized return of 4.34%, significantly lower than the overall market return. This data provides a clear picture of the importance of staying invested through even the most dramatic fluctuations.

The impact becomes even more pronounced as we delve deeper. Investors who missed the 30 best days would have received an annualized return of just 0.30%, and those who missed the 50 best days would have received a negative annualized return of 2.86%. The market rewards informed decision-making and steadfast patience as bull runs like that of our current landscape can erase losses.

Staying invested applies not only to equity markets, but markets across the financial landscape. Private equity, real estate and even bond markets all operate within the same overarching framework.

In volatile times, capital markets tend to be less accommodating to companies seeking capital, allowing savvy money managers in private equity and real estate to negotiate favorable terms.

In bond markets, as in equity markets, rallies can rise quickly as policy changes are announced and take shape. We advise investors to carefully manage exposures — for example, underweighting bonds in a low yield environment or periods of sustained inflation — but do not lose faith in long-term market resiliency.

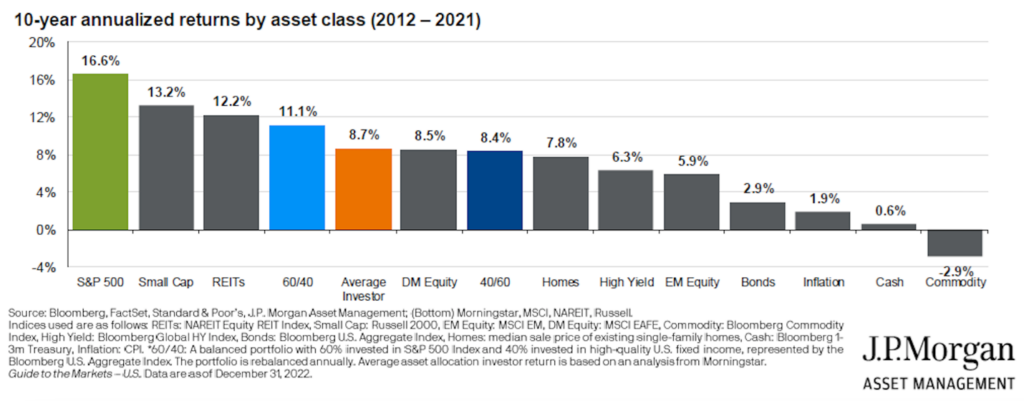

One of the most common misconceptions in our industry is the notion that investors can maximize returns by trying to time in and out of the markets. As indicated below, the returns for an “average investor” who engages in trying to time the markets are significantly below the market returns, permanently impacting their net worth.

The reality of investing in the stock market is to accept volatility and sometimes unusual levels of volatility. Volatility stems from speculators who tend to overreact in the short term and try to capitalize on momentum — both up and down. However, over time, these periods of volatility consistently dissipate as investors revert to fundamentals. As long as the world economy grows, it lends itself to sufficient economic activities for companies around the world to grow revenues and earnings to make equity investments profitable.

[Read more: How to invest in stocks – and become successful]

Skeptics may argue that the worst days in the market overshadow the best. Instances like Black Monday, for example, are extremely rare and unlikely to repeat themselves as financial regulators have historically responded swiftly to such crises. Electronic trading in the high-frequency trading world has led to several mini “flash crashes,” but trading is paused and rationality soon returns as intelligent investors realize that the trading frenzy typically stems from some kind of human error.

Even amid the most significant downturns, a blend of patience and strategy prevails over temporarily removing oneself from the market. Seven of the S&P 500’s 10 best days in the past 20 years occurred in the midst of the global financial crisis of 2008, largely as a result of new policy measures to address the credit crisis.

Suffice it to say, when risk levels are more obvious but not reflected adequately in the markets, we have advised that investors de-risk portfolios by reducing exposure to risk assets while maintaining some exposure. It’s impossible to predict when things will reverse. But while bear market bounce backs and the market’s best days are not predictable, they are not random, as administrative policies and monetary policies have historically driven these events.

Staying invested, even during uncertain times, can yield favorable long-term results. By understanding historical context and the benefits of a disciplined investment strategy, we can approach the market with confidence and patience. The best days often follow the most unexpected turns of events, and by thinking twice before stepping out of the market, we can unlock its full potential.

Arun Bharath is chief investment officer at Bel Air Investment Advisors.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound