Markets tend to embrace narratives. Compelling tales typically have an impact on investor sentiment, as well as on factors used in technical analysis of short-term markets such as momentum and price action. In 2024, investors’ attention is tethered to stories centered around the ubiquitous chatter about artificial intelligence, the robust stock performance of semiconductor manufacturer Nvidia, and the future path of benchmark interest rates in anticipation of changes in monetary policy from the Federal Reserve.

Other frequently used narratives coalesce around geopolitical risks such as regional conflicts, wars, and elections. However, are investors conflating what the market is pricing in with perceptions on what the market should price in as it relates to geopolitical risks? Oftentimes greater attention is focused on conflicts or geopolitical tensions rather than political risks, such as elections.

A case in point: Middle Eastern markets, such as those in the Gulf Cooperative Council (GCC),[1] are often perceived by developed world investors as being fraught with risk and instability because of long-standing regionalized conflicts. However, recent market price action following political events suggests that political outcomes have a greater influence on the markets than geopolitical conflicts.

Investors should pay attention to elections in 2024 as nearly half of the world's population — 64 countries and the European Union — will head to the polls.[2] These elections have already shaken investors and affected markets in the first half of 2024. We need only to look back over the past year to see where the market appears to impart greater angst.

In early June 2024, markets saw considerable volatility after President Emmanuel Macron of France unexpectedly declared a snap election after the far-right National Rally party, led by Jean-Marie Le Pen, garnered significant voter support in the polls. While investors had largely anticipated the National Rally party to tally significant votes, the result of subsequent snap election went to the left.

The outcome shook markets. This volatility was partially brought on by investors’ reservations over the sustainability of France's debt. The primary concern was the effects of divergent fiscal policies between the two political parties, such as the possibility of undoing Macron's pension reforms, as it could cost the government an additional 9 billion euros.[3]

By mid-June 2024, France’s stock market was down 6.23%, with the premium for French credit default swaps (CDS) — an insurance contract for the unlikely event an issuer goes bankrupt — rising 69.32%. Markets in Germany moved in sympathy as the stock market fell 2.99% and CDS contracts rose 42.89%. More significantly, the yields on 2-year and 10-year German bonds dropped by 10.48% and 9.89% as investors sought safety during the risk-off environment.

Figure 1 indicates that in contrast to occurrences involving geopolitical conflicts, markets seem to be more volatile after political developments that could have an impact on a government's financial standing. The table captures changes in respective financial assets after a given event date. The data implies that investors are more troubled by the sustainability of government debt than by war, at least initially.

Another period of significant market volatility occurred when former British Prime Minister Liz Truss unveiled a mini-budget on September 23, 2022. The proposed budget included tax cuts in the order of 45 billion British pounds,[4] raising the UK government's estimated costs to roughly 161 billion British pounds over the next five years.[5] The abrupt reaction in the markets necessitated intervention by the Bank of England, which pledged to buy up to 65 billion British pounds worth of government bonds in order to stop the market's collapse.[6] Figure 1 shows that seven working days following the fiasco of this event, the value of the pound declined by 8.90% against the US dollar, CDS increased by 31.62%, and the 2-year and 10-year bonds issued by the UK increased by 6.79% and 6.92%, respectively.

We don’t want to dismiss the gravity and human tragedy of conflict, such as the Israel-Hamas conflict, as it does exact a material impact. However, to assume it imparts a threatening outcome throughout other regions such as the GCC can mislead investors. Israeli markets were severely affected by Hamas's surprise strike, as seen by the country's CDS rising 182.17%, the stock market plummeting 7.55%, and the yields on government 2-year and 10-year bonds dropping by 9.34% and 3.16%, respectively.

However, Middle Eastern countries such as Saudi Arabia did not see any appreciable instability. Saudi Arabia stayed relatively stable despite the country's CDS increasing by 21.11%. Many investors are often surprised by this, as they assume that volatility will emanate across all the countries in the region. This implies investors are more concerned with the national debt's sustainability than with war.

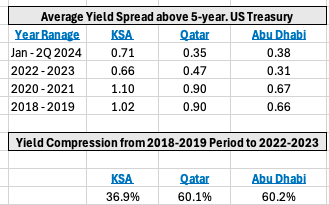

We can observe historical yield spreads of selected GCC government bonds relative to the US Five-year Treasury to understand investor sentiment regarding risk premiums in the region. Figure 2 shows how yield spreads of selected GCC government bonds have compressed over the years, reflecting a reduced risk premium. Saudi Arabia’s (KSA) government bonds have compressed nearly 37% from the start of 2018 through year-end 2023. Qatar and Abu Dhabi experienced a material yield compression of more than 60% relative to the US Five-year Treasury over the same period.

There are a multitude of factors that can help explain the decline in the GCC’s risk premium over the years. These include strong credit ratings, low deficits, strong capital buffers, and extensive hydrocarbon reserves among member states. This also often surprises investors. In fact, the GCC fixed income markets are among the highest risk-adjusted returns.[7]

Conversely, it appears developed world economies are behaving more like emerging market economies during political election cycles. A common thread shared among presidential contenders is continued fiscal spending with anticipated rising deficits and debt. There appears to be little political appetite for fiscal prudence and austerity to reduce government debt and deficits as we approach alarming metrics during a period when the economy is not in a recession.

The Congressional Budget Office offers many sobering statistics that the US may be near a tipping point as interest on $34 trillion of debt exceeds $1 trillion. Another surprising milestone is that for the first time, the US is spending more on debt interest than on its military budget.[8],[9]

Ultimately, as the US election draws near, investors may want to exercise added caution when selecting where to place their funds.

Patrick T. Drum, Senior Investment Analyst and Saturna Sustainable Bond and Amana Participation Funds Portfolio Manager joined Saturna Capital in October 2014. He is a former adjunct professor of finance for the Sustainable MBA Program at the Bainbridge Graduate Institute (BGI) currently known as Presidio Graduate School. Mr. Drum holds a BA in economics from Western Washington University and an MBA from Seattle University Albers School of Business. He is a Chartered Financial Analyst (CFA) charterholder and a Certified Financial Planner™.

[1] The Gulf Cooperation Council (GCC) is a political and economic alliance of six countries in the Arabian Peninsula. Its members are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. The GCC was established in 1981 to promote security and stability for its members.

[2] Ewe, Koh. The Ultimate Election Year: All the Elections Around the World. Time Magazine. December 28, 2023. https://time. com/6550920/world-elections-2024/

[3] Hummel, Tassilo. Investors concerned by French elections, Paris stock market head says. Reuters. June 25, 2024. https://www.reuters. com/world/europe/french-snap-elections-spark-investor-worriesparis- stock-market-head-says-2024-06-25/

[4] Partington, Richard. The mini-budget that broke Britain – and Liz Truss. The Guardian. October 20, 2022. https://www.theguardian. com/business/2022/oct/20/the-mini-budget-that-broke-britain-andliz- truss

[5] Aldrick, Philip. "Liz Truss’s Historic Gamble With the UK Economy Is Already Unraveling." Bloomberg. September 23, 2022. https:// www.bloomberg.com/news/articles/2022-09-23/liz-truss-s-historicgamble- with-the-uk-economy-is-already-unraveling

[6] Partington, Richard. "The mini-budget that broke Britain – and Liz Truss." The Guardian. October 20, 2022. https://www.theguardian. com/business/2022/oct/20/the-mini-budget-that-broke-britain-andliz- truss

[7] Please refer to GCC USD Sukuk Primer for more information.

[8] https://www.cfr.org/blog/first-time-us-spending-more-debt-interest-defense

[9] https://www.visualcapitalist.com/u-s-debt-interest-payments-reach-1-trillion/

Pro-bitcoin professionals, however, says the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Donald Trump's second turn at the White House is expected to bring a fresh bout of turbulence, supercharging retail demand.

“After learning about a bad actor who is barred, the securities industry should have a responsibility to put clients on notice,” one lawyer said.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound