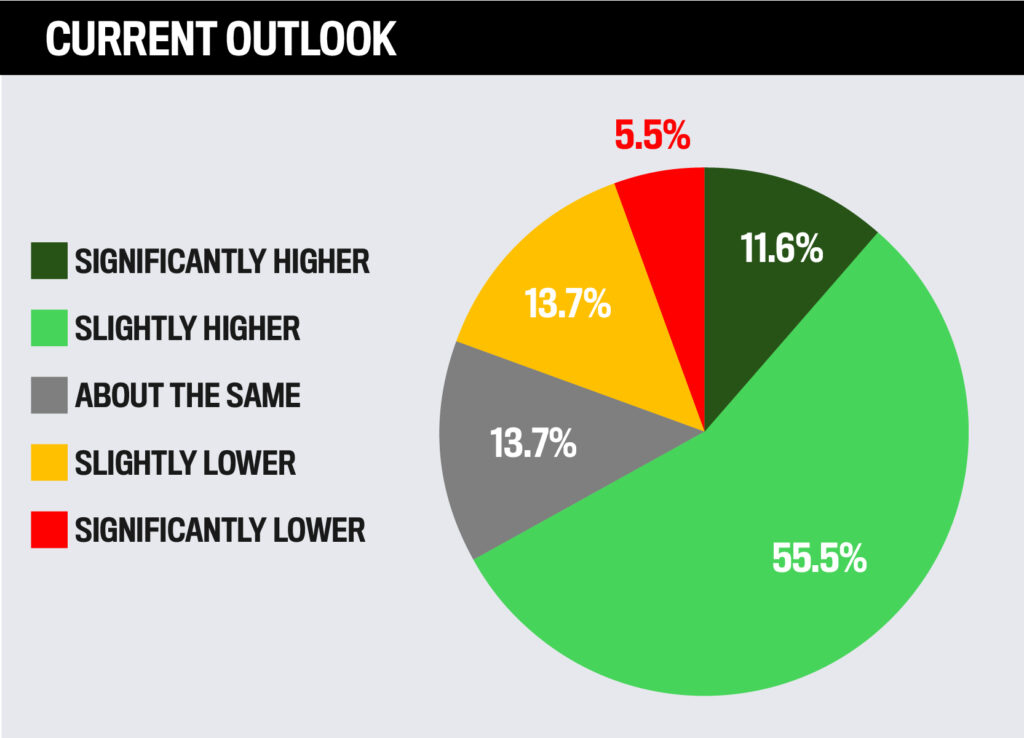

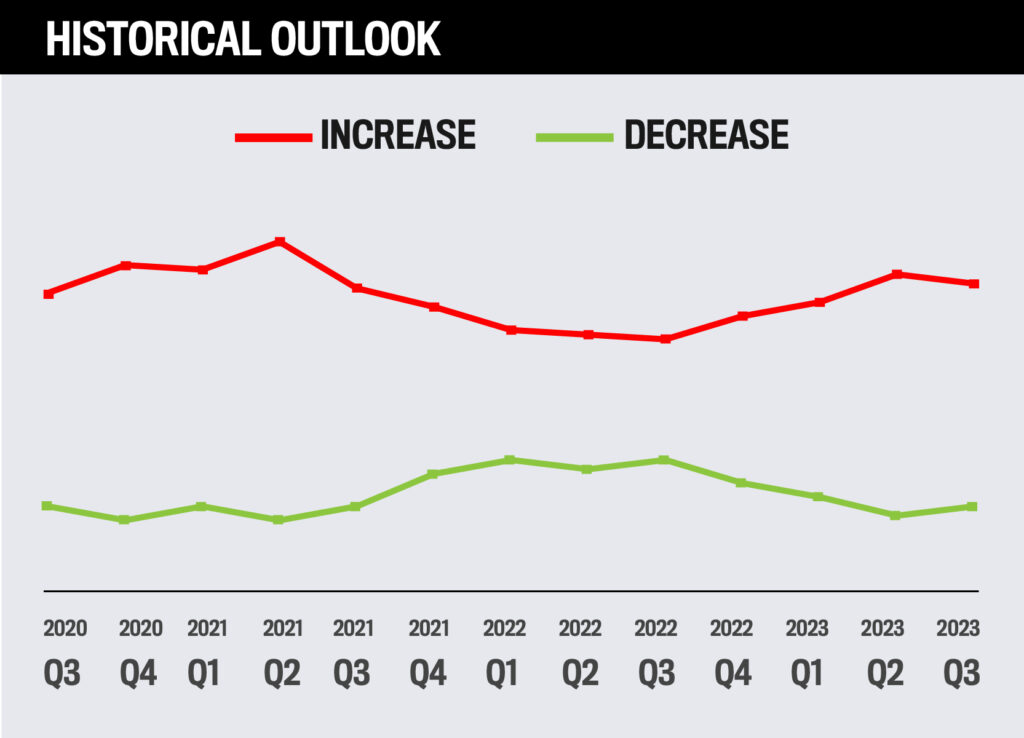

Between October and December 2023, 67% of advisors expected markets to rise over the coming year while 19% expected them to fall. This represents a slight decline in sentiment over the previous quarter but an improvement over the previous year. This overall outlook is similar to where it was in the fourth quarter of 2021.

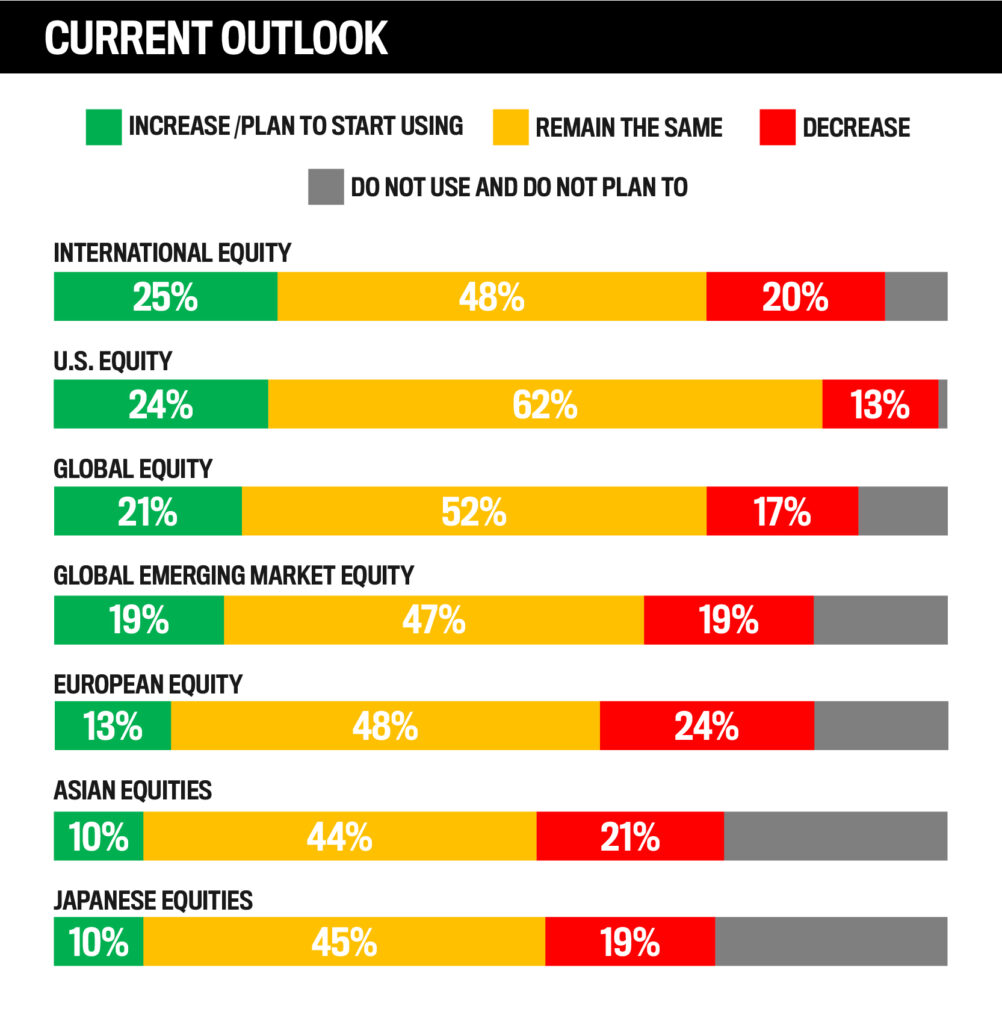

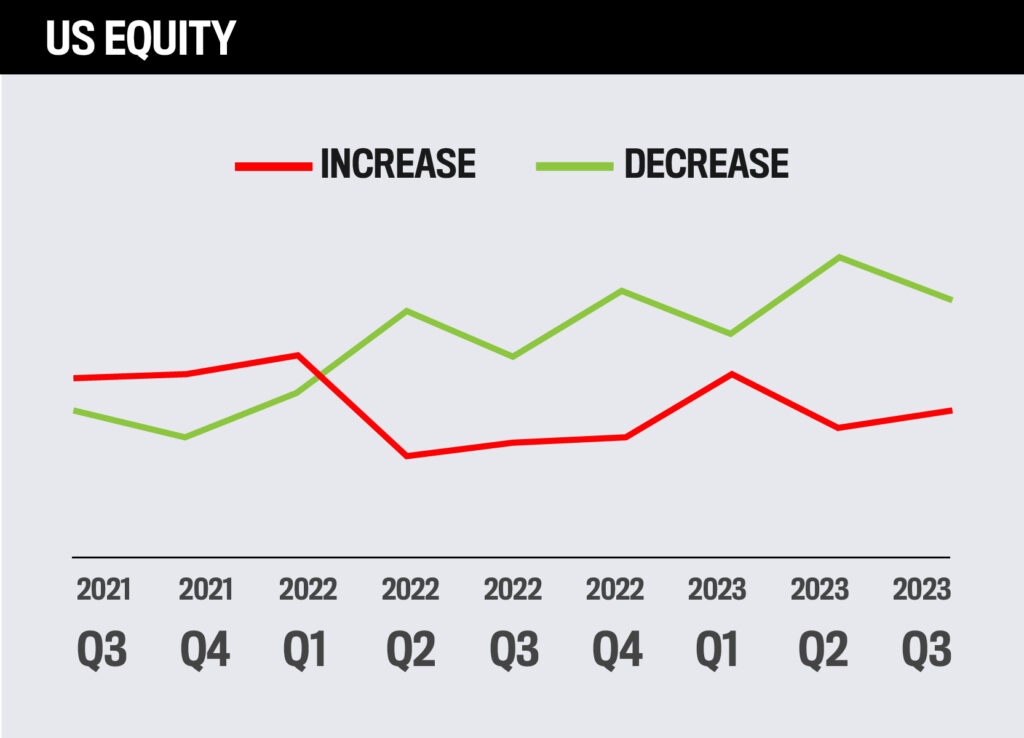

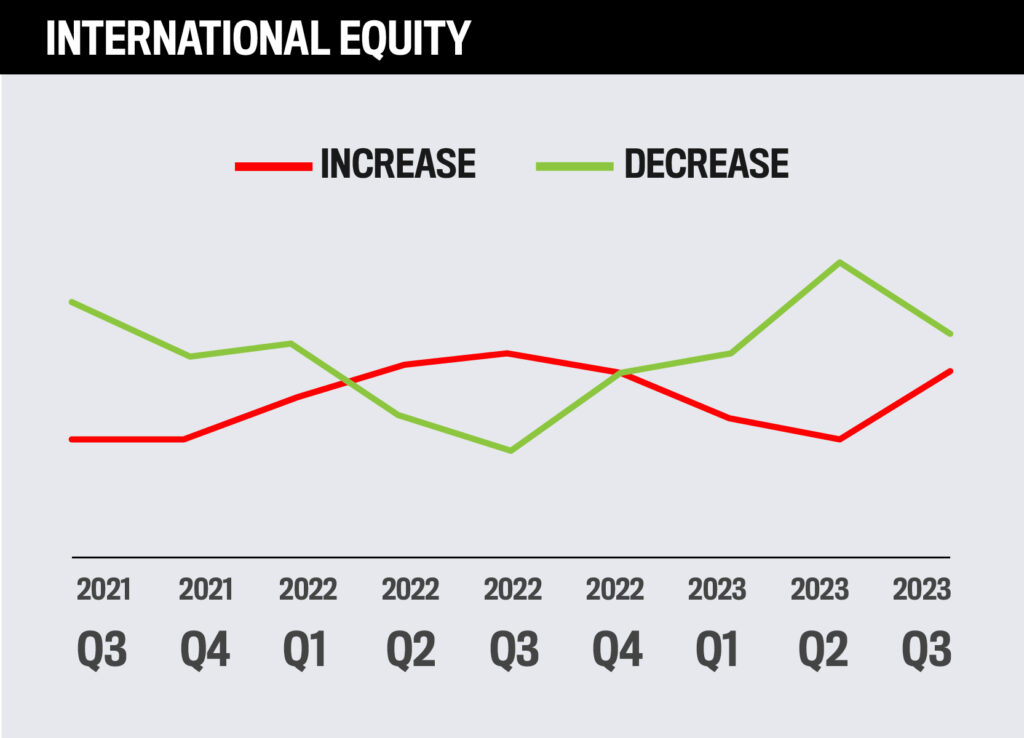

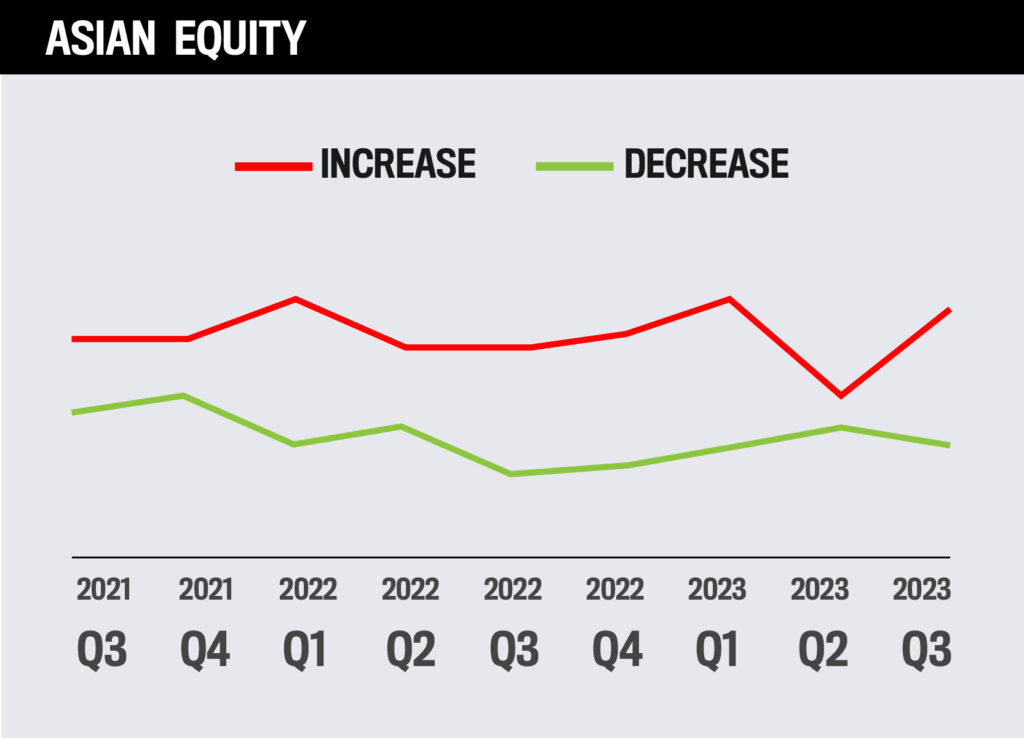

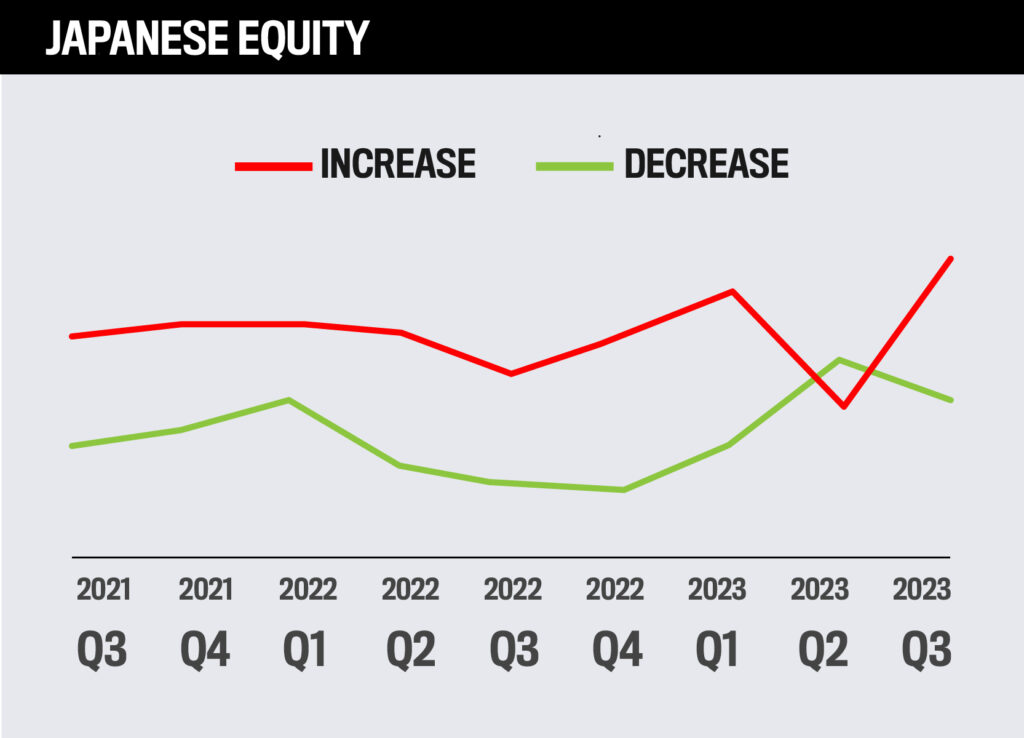

Within equity markets, international equity is expected to see the most investment among financial professionals over the next year, while Japanese equity is expected to see the least.

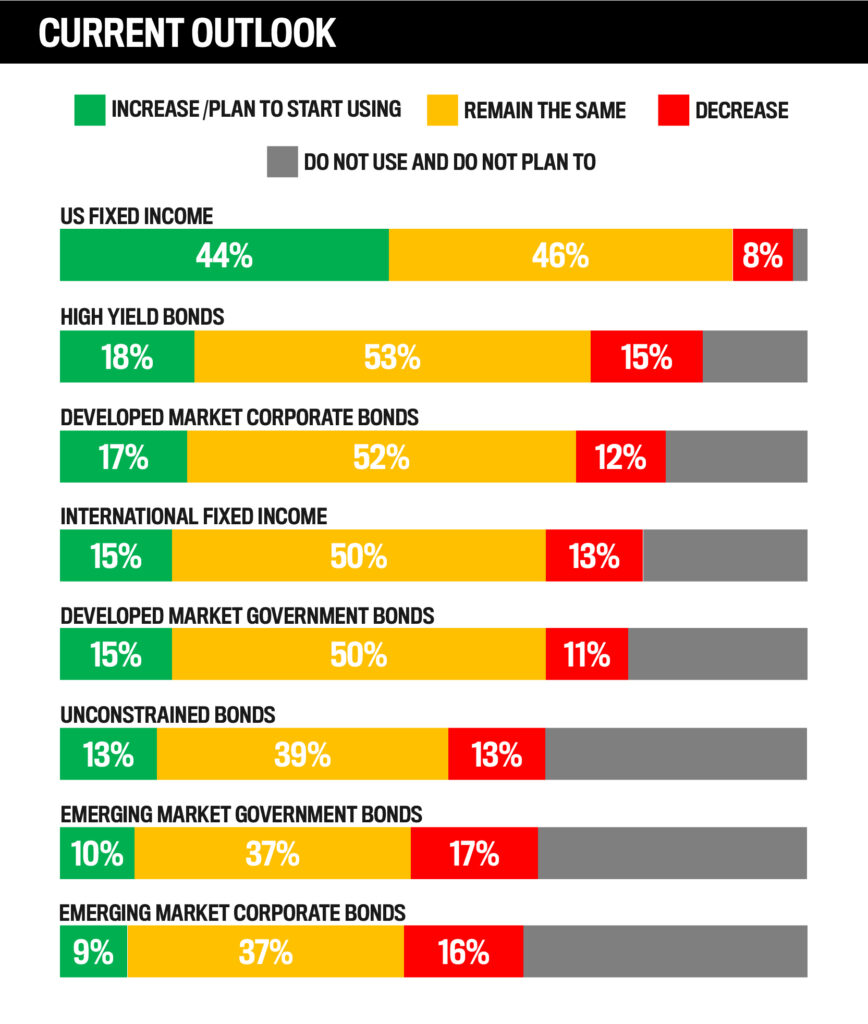

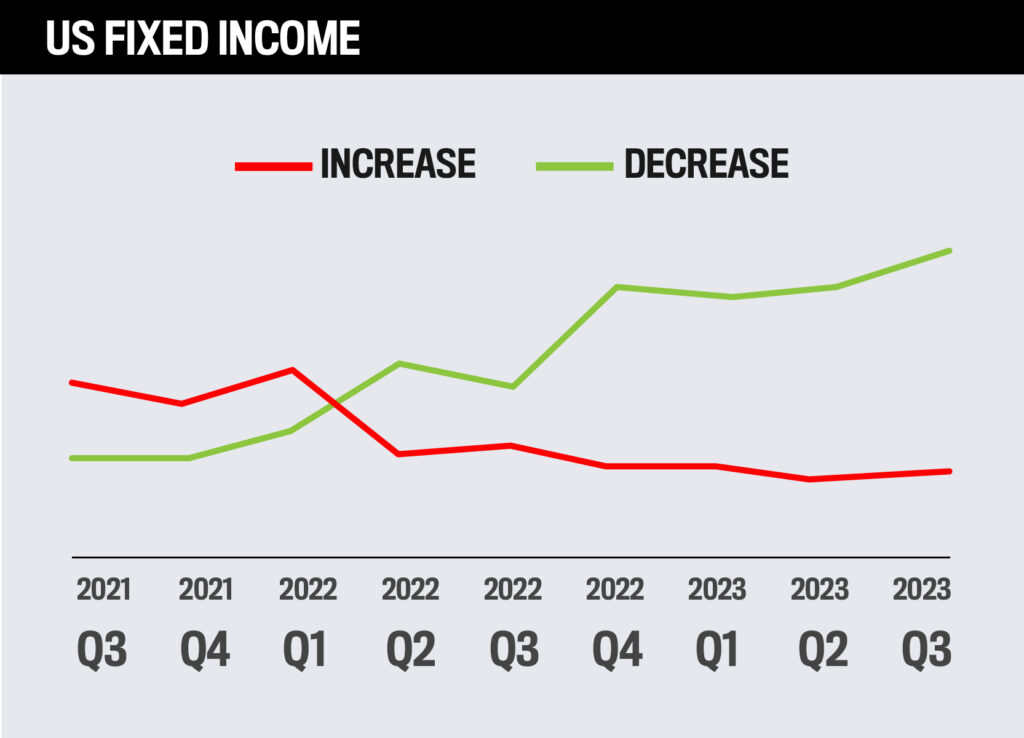

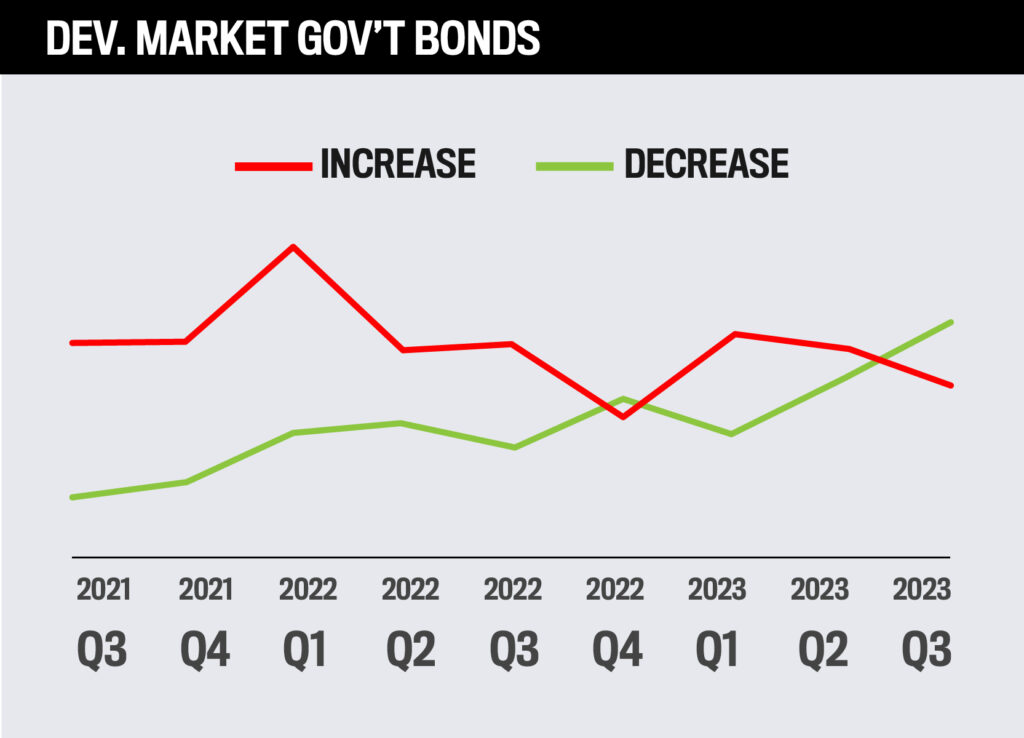

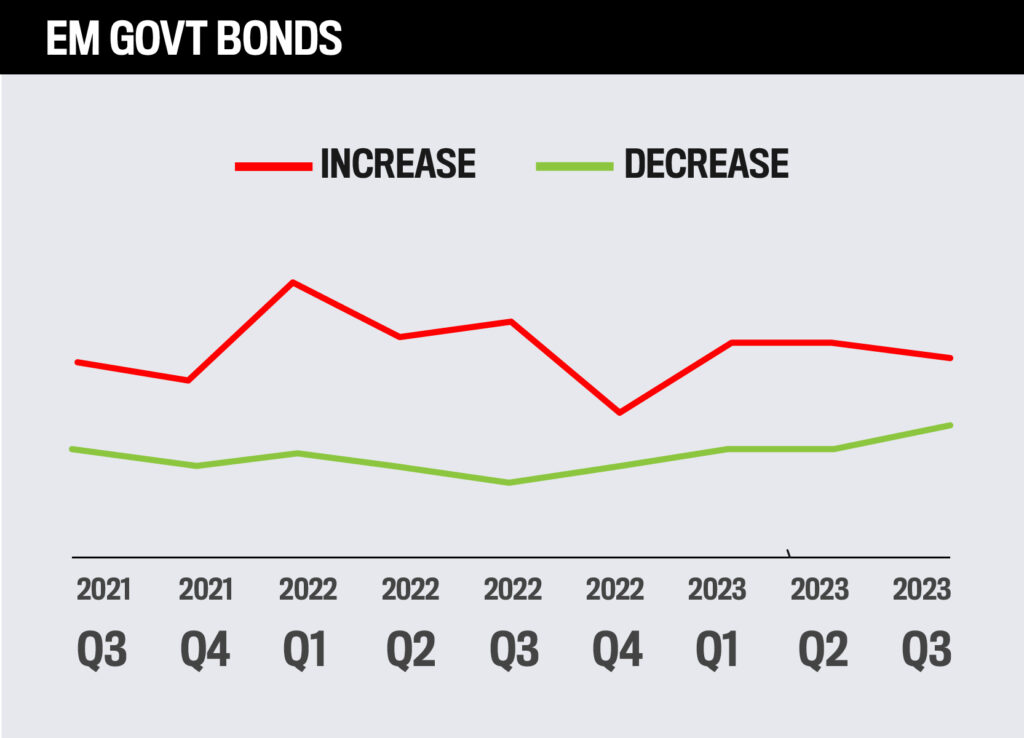

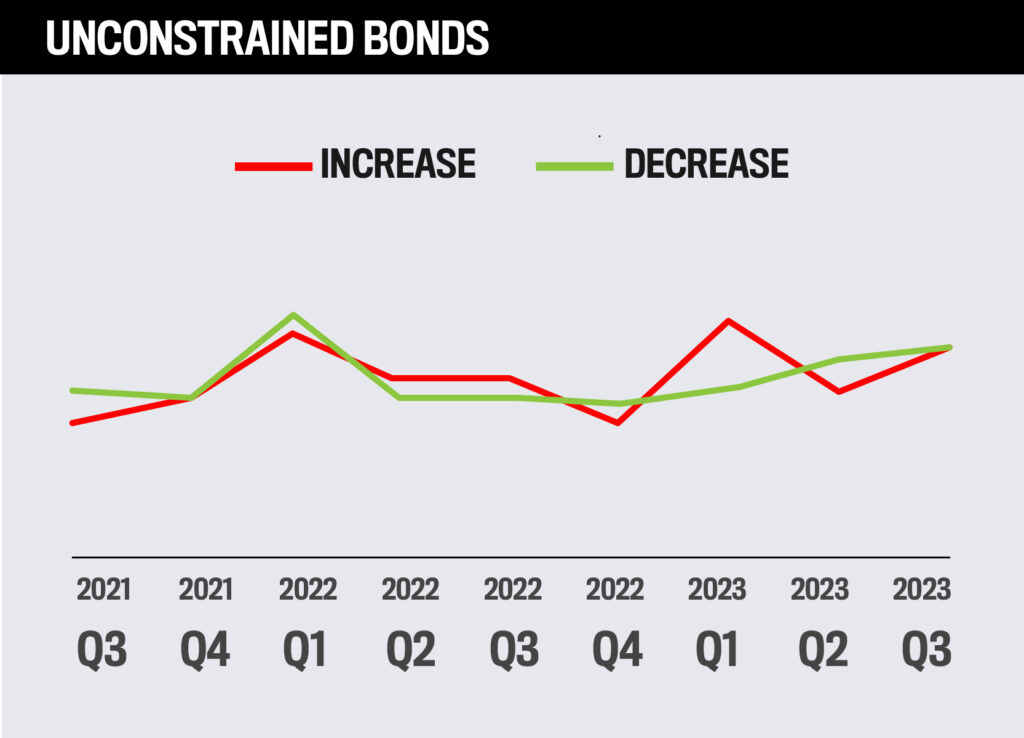

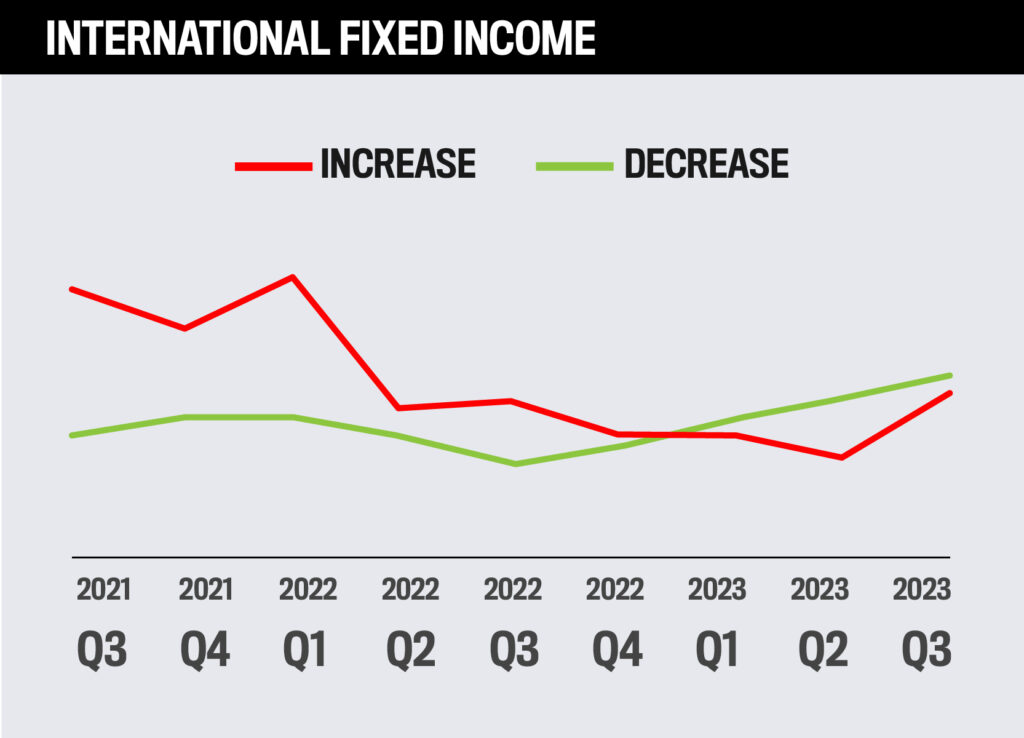

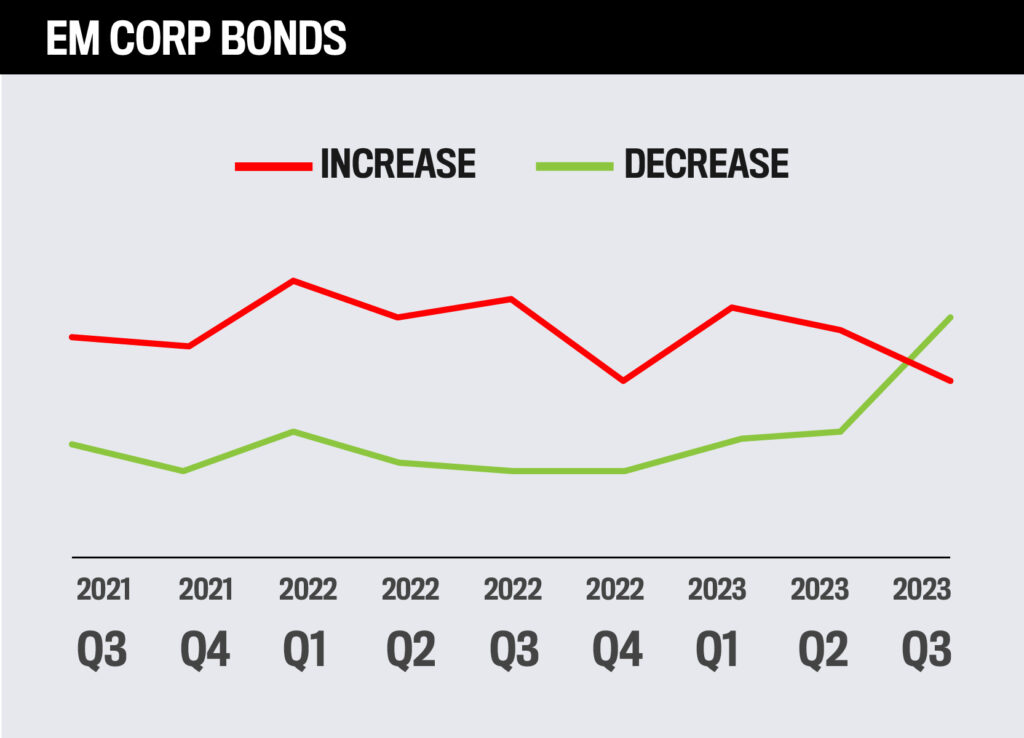

Within fixed income markets, U.S. fixed income is expected to see the most investment among financial professionals over the next year, while emerging market corporate bonds are expected to see the least.

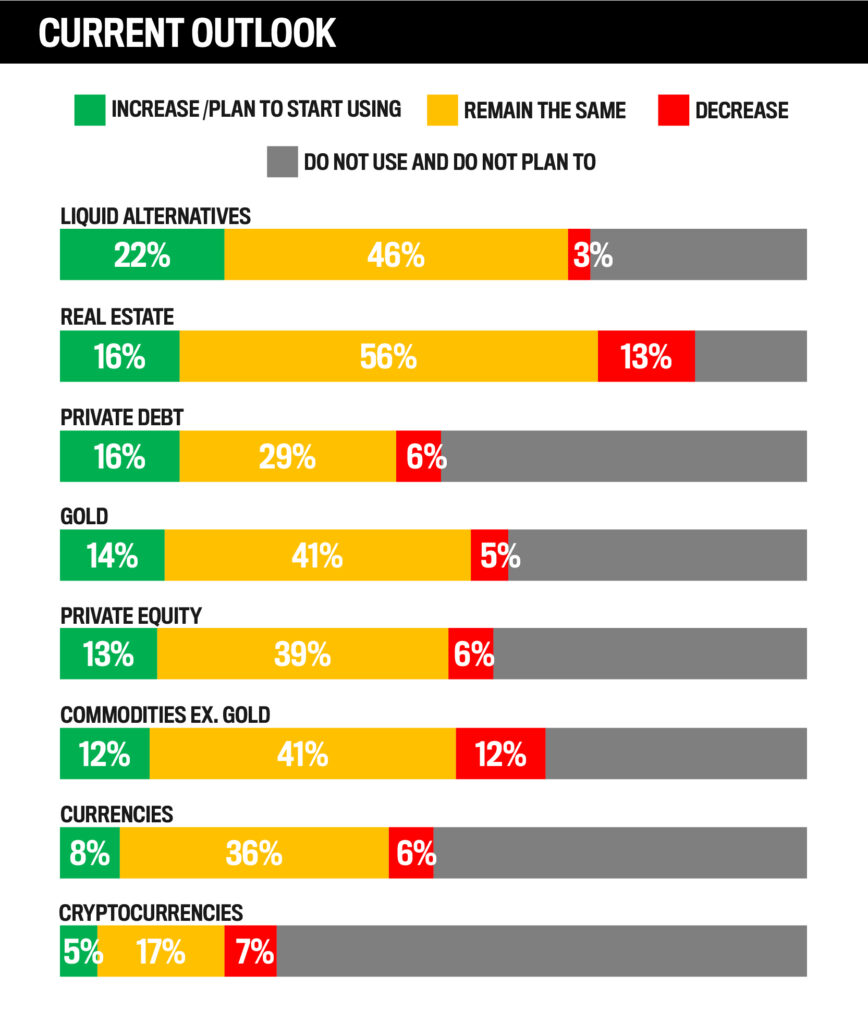

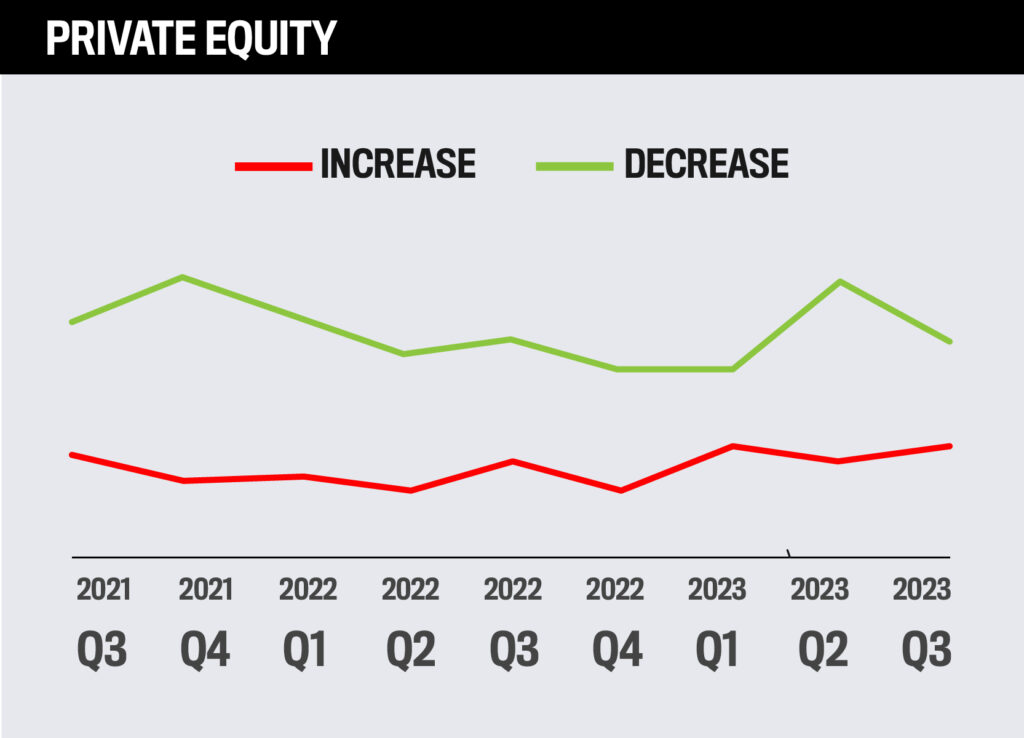

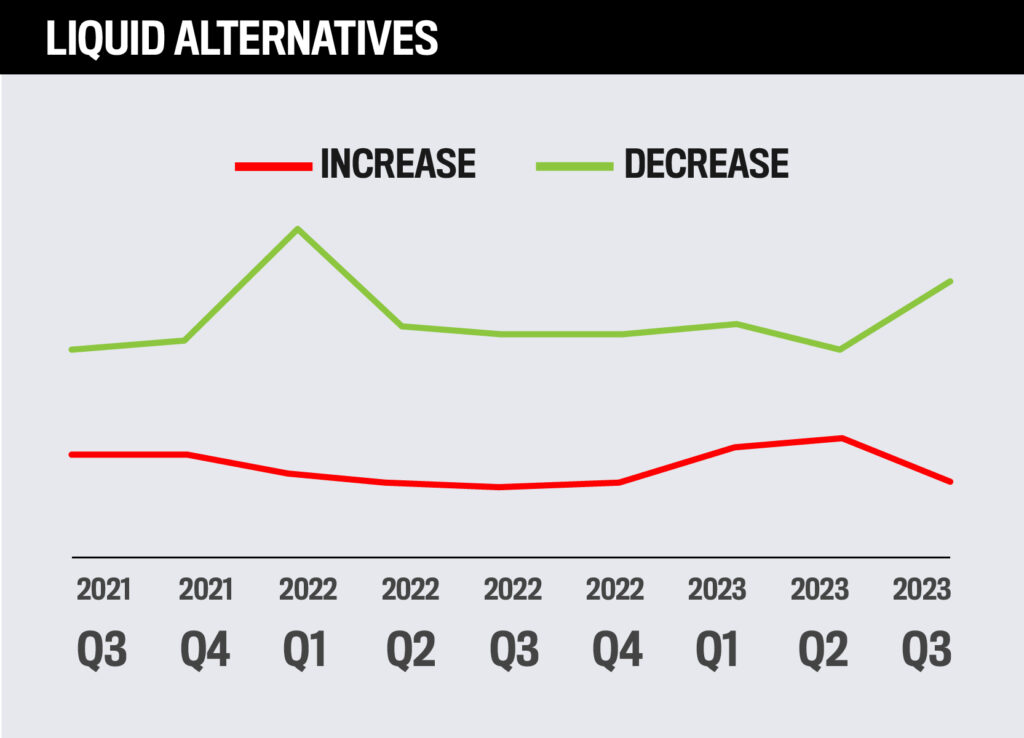

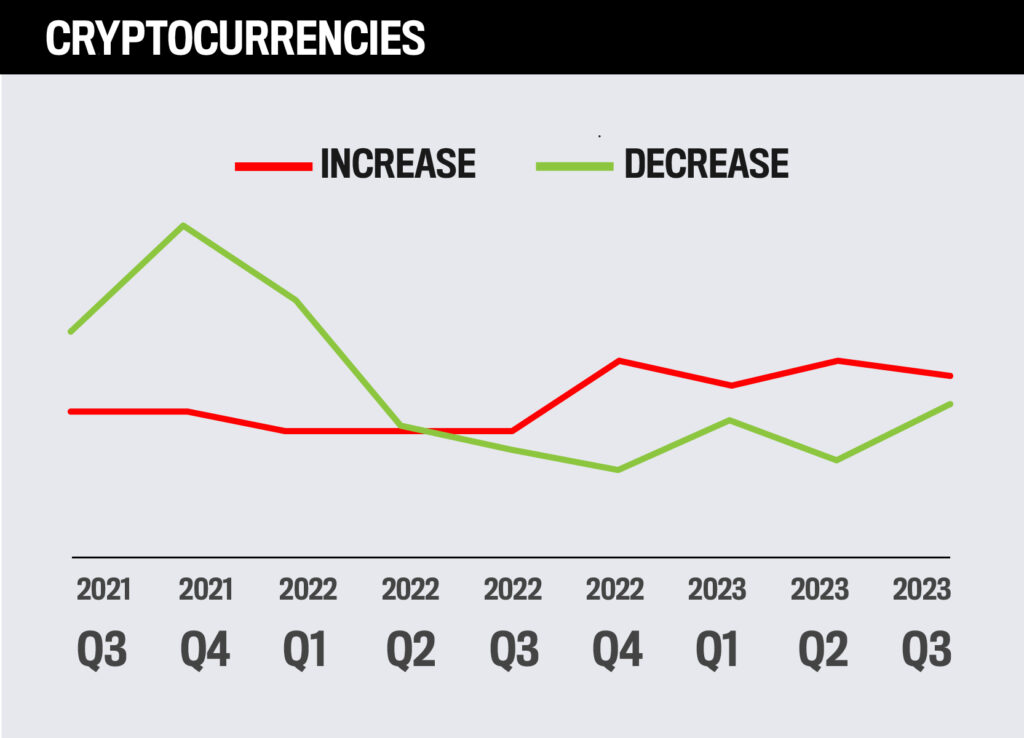

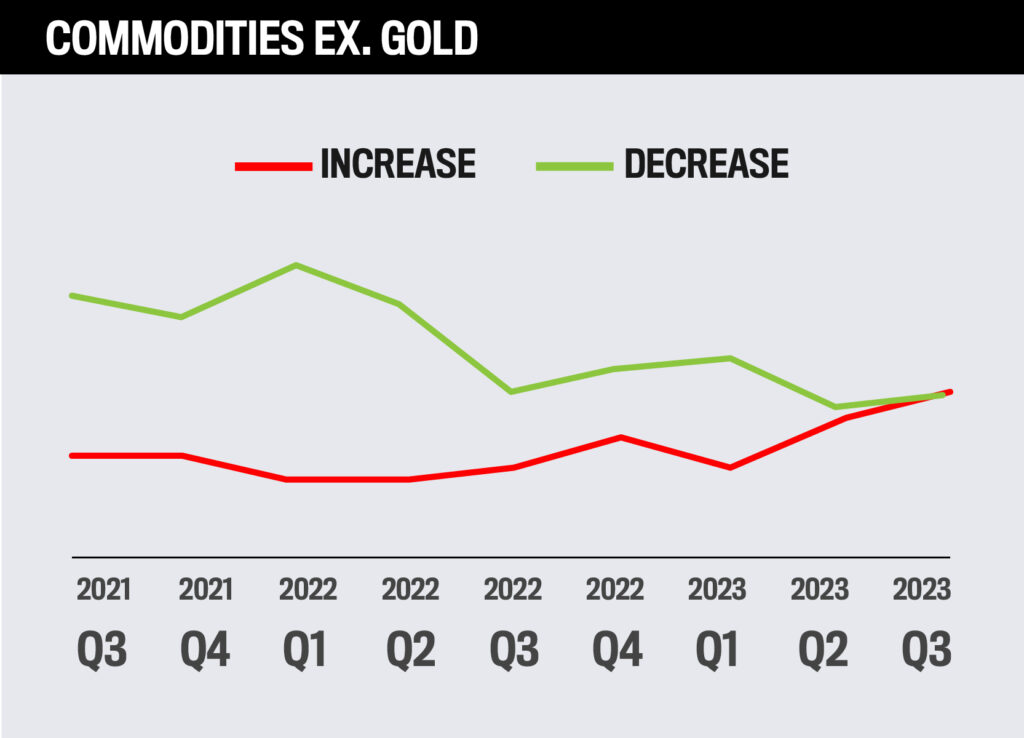

Within the alternatives category, liquid alternatives are expected to see the most investment among financial professionals over the next year, while cryptocurrencies are expected to see the least.

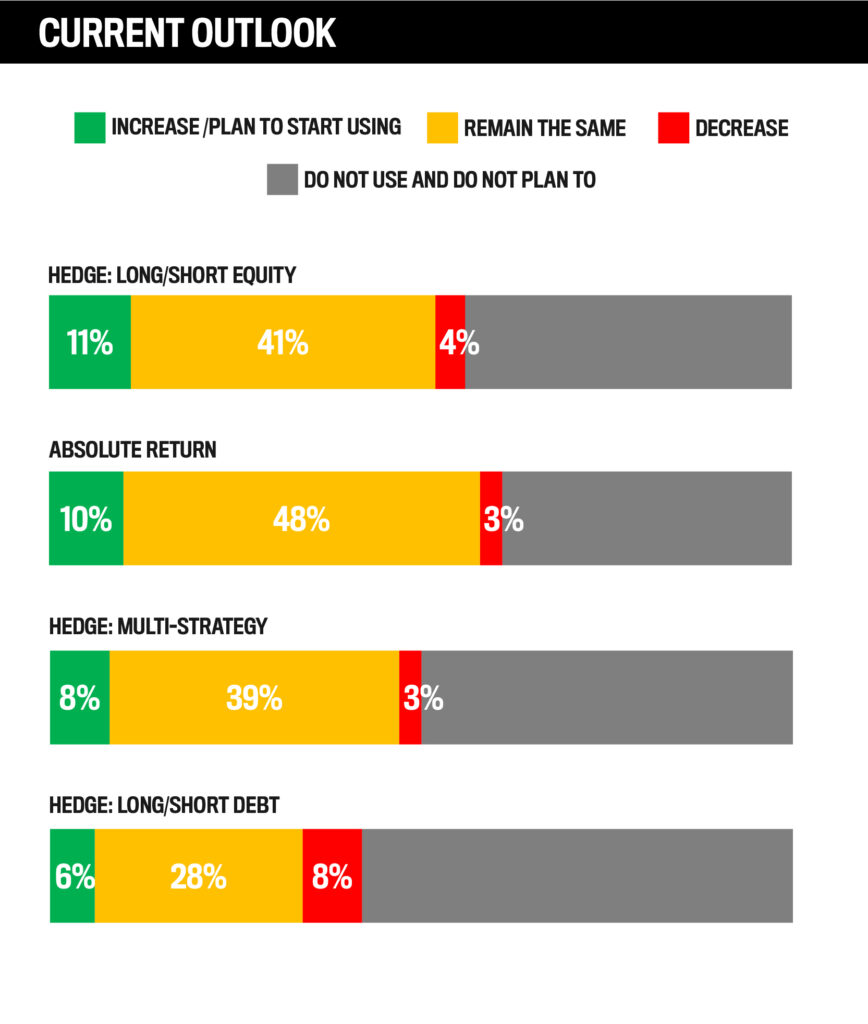

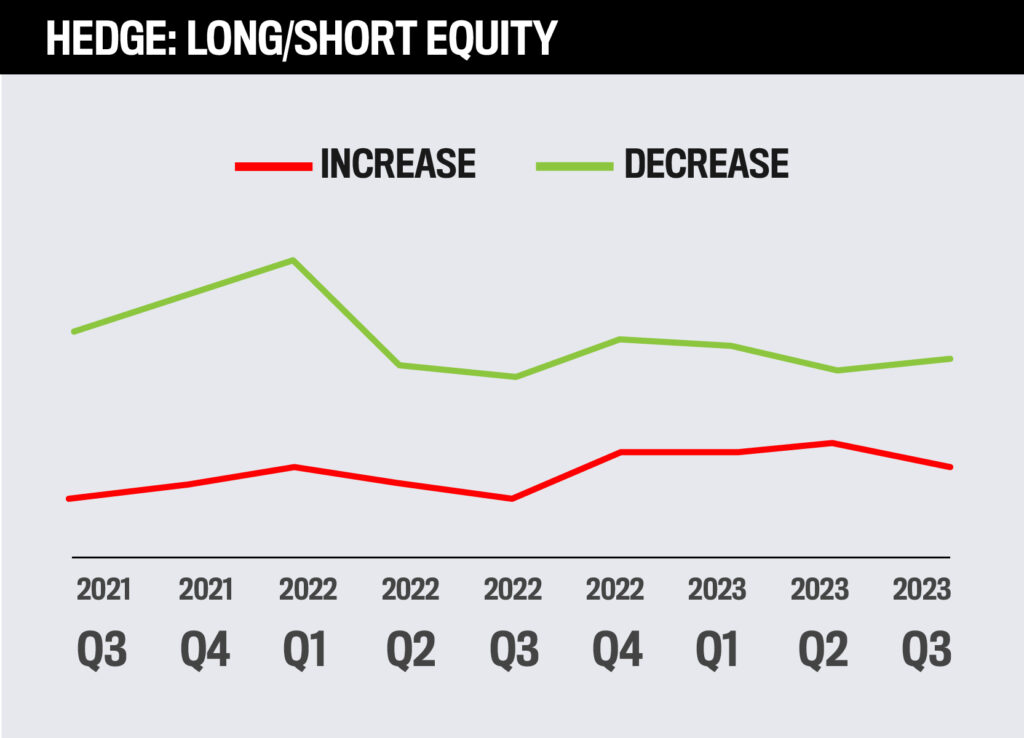

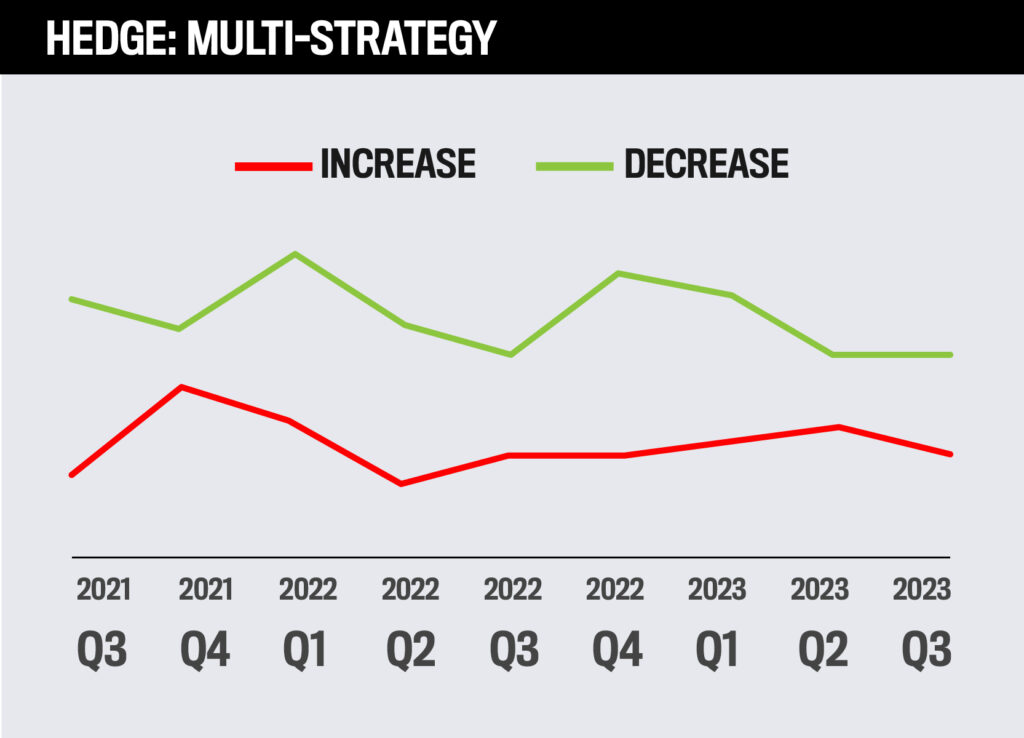

The most popular advanced strategy is currently long/short equity hedging, while the least popular is long/short debt hedging.

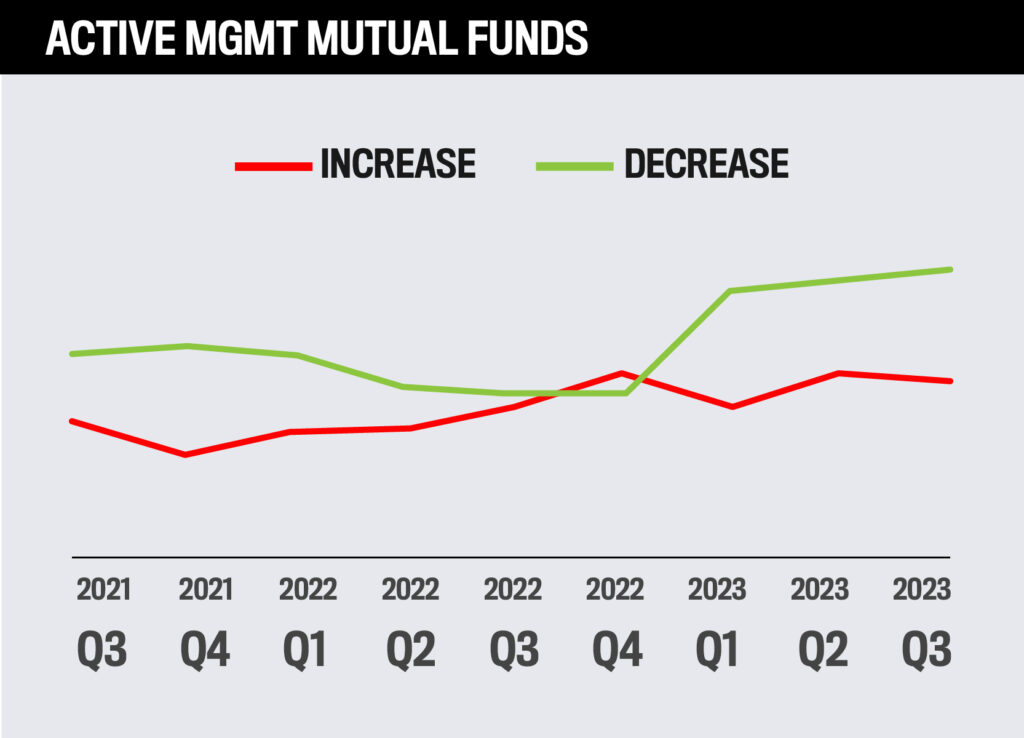

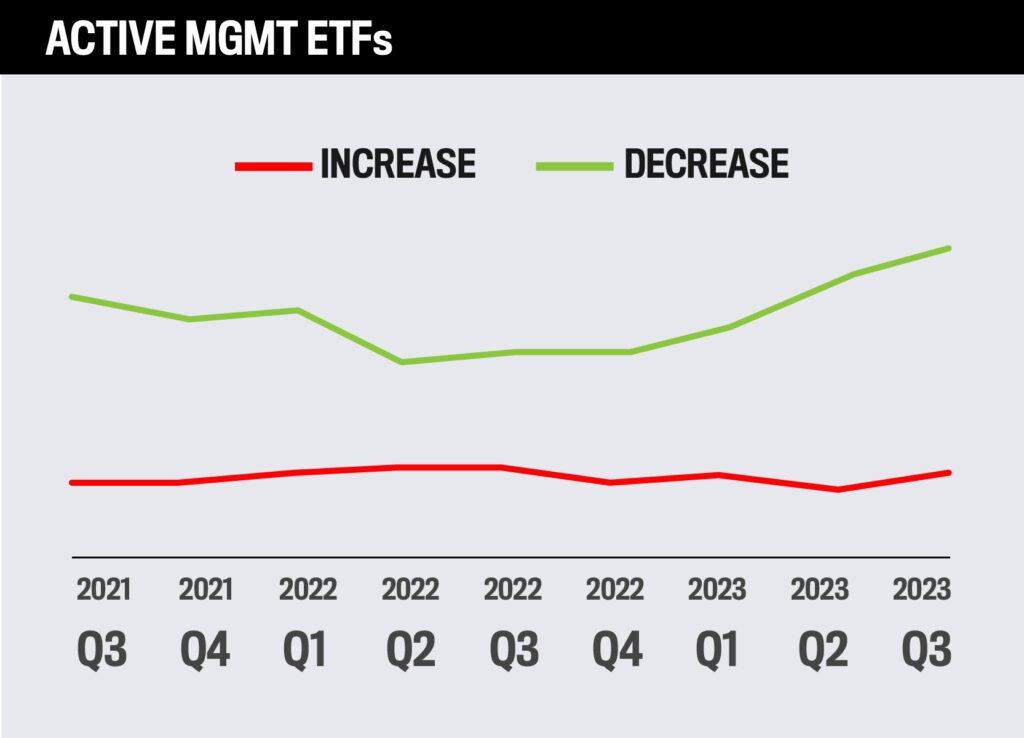

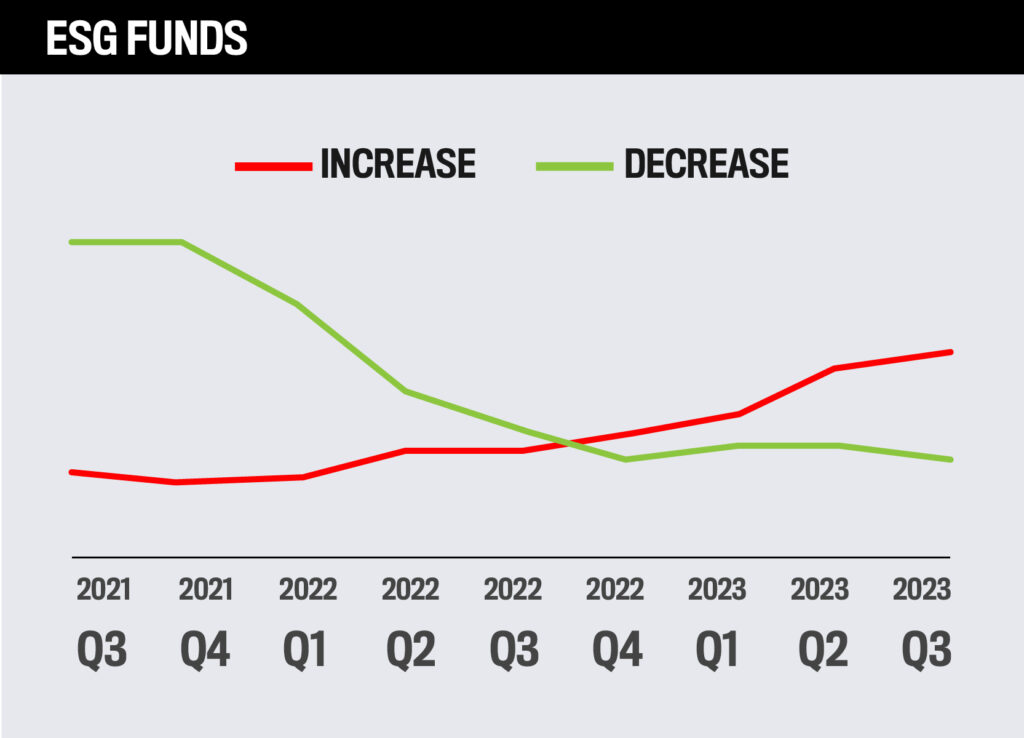

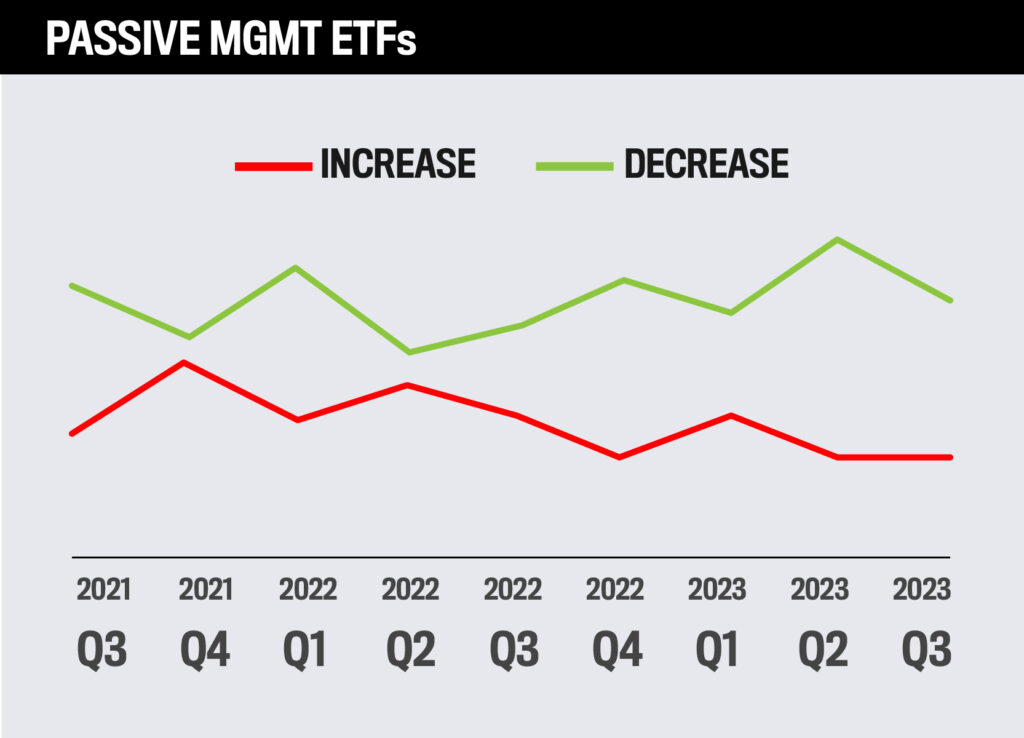

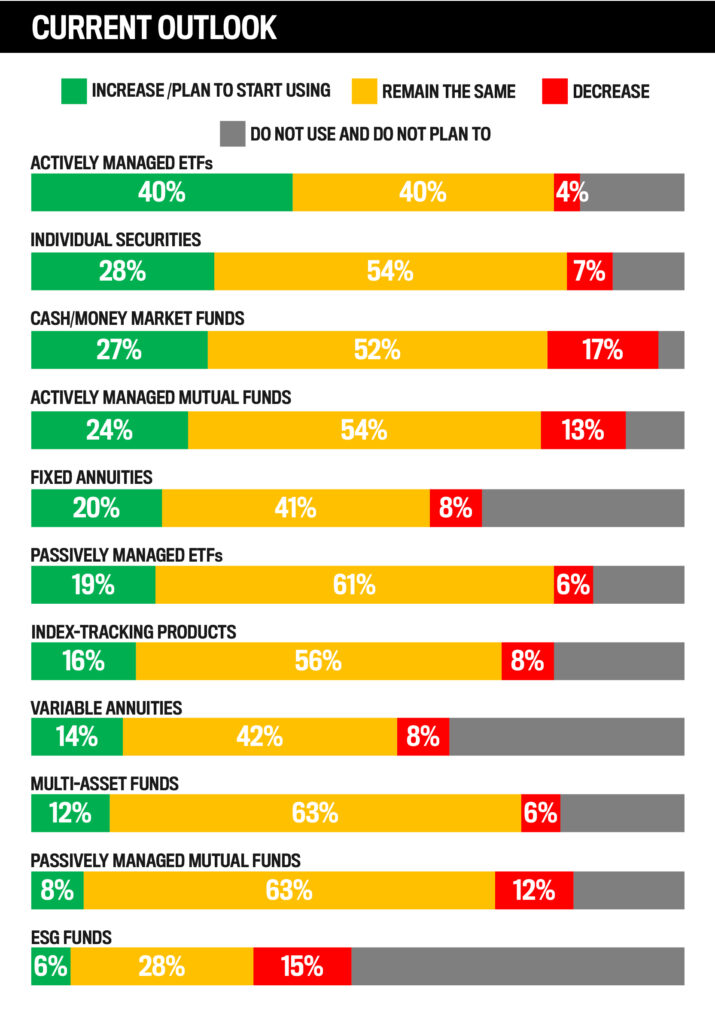

Actively managed ETFs are currently expected to see the most increase in usage among advisors over the next year, while ESG funds are expected to be used less.