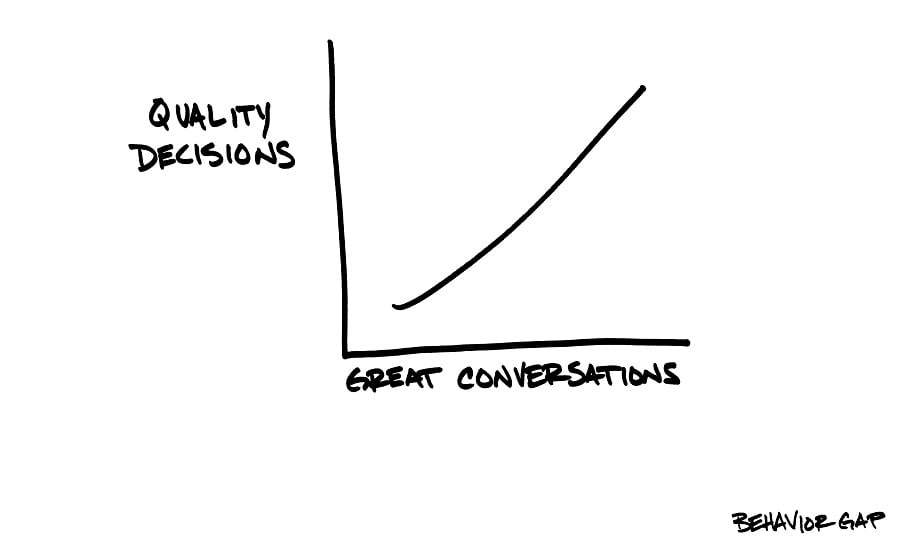

For financial advisers, learning to have great conversations with clients is the golf swing of our business. But it doesn't come easily to everyone, and few of us have any direct training.

With

Master Communicator, I plan to share the lessons I've learned over the years about how to communicate effectively. And it all started with something I'm sure you've experienced, too.

More than once, you've probably sat across from a client and tried to explain something super critical. But the only response you got was a blank stare. How do we break through and make these incredibly important connections?

As algorithms take over the technical side of our business, it's important to remember that they can't duplicate our ability to create one-on-one human connections. Plus, we know that great financial advice takes more than spreadsheets and calculators. It also requires understanding dreams and goals, fears and worries.

As long as we remain human, human advisers will continue to play a critical role, but we have to do our part. It starts with learning to ask great questions, listening to the answers with complete focus and showing empathy. These steps sound simple, but try doing them all at once, and you'll see it takes practice. There's a lot that goes into this process.

With this series, I hope to show you very specific ways to communicate more effectively and have more meaningful conversations with your clients. So please, let me know what you think. I'd love to hear how this process works for you and what you find helpful.

Carl Richards is a certified financial planner and the director of investor education for the BAM ALLIANCE. He's the author of the weekly "Sketch Guy" column at the New York Times, and a frequent keynote speaker at financial planning conferences and visual learning events around the world. In 2015, he published his second book, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money (Portfolio, 2015).You can learn more about Carl and his work at BehaviorGap.com.