Morgan Stanley Wealth Management is shifting its focus to cater to Australia's affluent individuals, while collaborating with wealth manager Ord Minnett to handle clients with lower net worth. According to the Australian Financial Review, customers possessing less than A$1 million in assets (U.S. $683,000), will be given "the option" to transfer their accounts to 472 employee Ord Minnett. The U.S. firm claims this strategic move allows it prioritize high-net-worth accounts, not-for-profits, and family office funds.

The decision to reevaluate its client base arose from Morgan Stanley's exposure to inactive wealth management clients with less than A$1 million. The company has decided that the associated costs and time required to conduct Know Your Customer and Anti-Money Laundering checks on these accounts outweigh the returns, impeding the firm's ability to concentrate on more affluent clientele.

Morgan Stanley informed its team of 103 financial advisers in Australia about the review this week. The next step involves notifying eligible clients who can migrate their accounts to Ord Minnett.

A spokesperson for Morgan Stanley emphasized their commitment to providing a top-tier offering for high-net-worth, ultra-high-net-worth, and not-for-profit clients in Australia. The firm has initiated a formal review process, which is expected to conclude within several weeks.

Once the review is completed, impacted clients will be contacted and presented with alternative solutions, where appropriate, ensuring a smooth transition.

It's worth noting that the collaboration with Ord Minnett does not involve the sale of assets or branches to the stockbroker. Clients with assets below $1 million can also choose an alternate money manager instead of transferring to Ord Minnett.

Australia’s Hayne royal commission in 2018 exposed alleged misconduct within the wealth management and financial advisory sector, prompting significant changes in how wealth advisers operate. The subsequent increase in regulations for advising less-wealthy clients, combined with heightened tertiary requirements, has resulted in a decline in financial advisers. As a result, leading wealth management firms now prioritize winning over high-net-worth clients who engage in more transactions and generate higher fees for advisers.

Morgan Stanley's move comes amidst notable personnel changes within the organization. Ian Chambers retired as head of wealth management in November, and Rebecca Hill and Matthew Nicholls were appointed as co-heads. However, Mr. Nicholls departed in May, leaving Ms. Hill as the sole head of the business. Raha Nasseri assumed the role of chief operating officer of Morgan Stanley's wealth division in April, following her relocation from the bank's Hong Kong office, where she held the position of executive director.

In terms of rankings, Morgan Stanley's wealth management arm currently manages approximately $42 billion in client assets. Last year, 24 of its private client advisers were included in Barron's Top 100 Financial Advisers List.

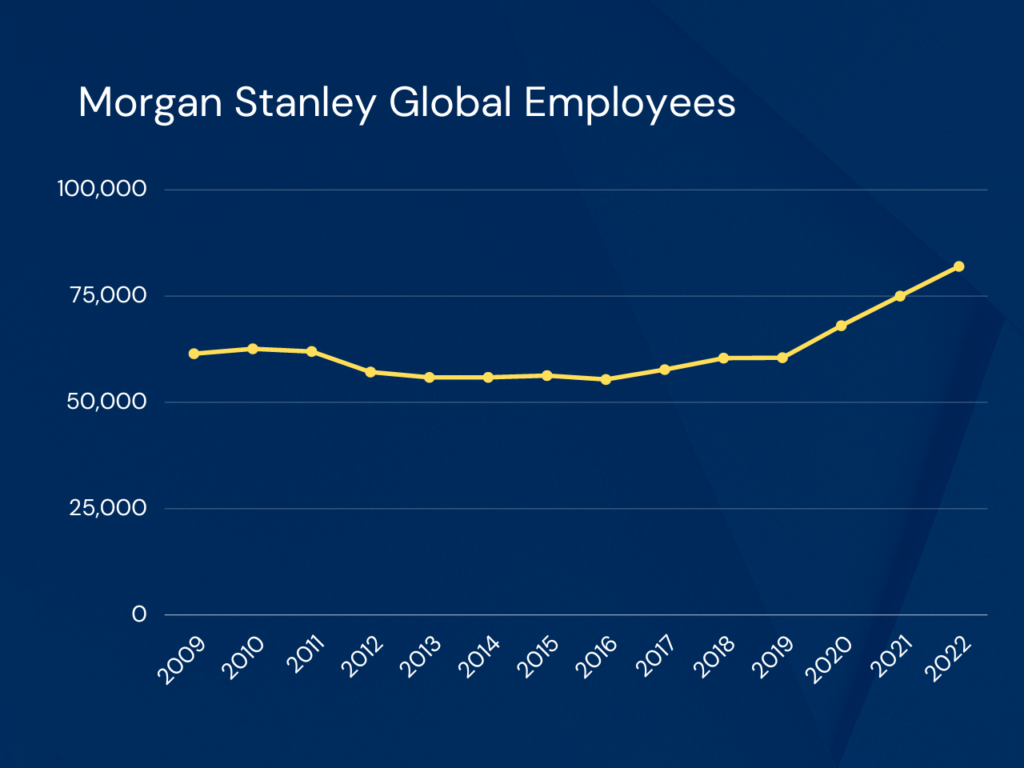

Under the leadership of CEO James Gorman, who announced his departure in May, the bank has prioritized wealth and asset management over investment banking during his 13-year tenure. Gorman, an Australian himself, previously served as co-president in charge of wealth before assuming the CEO role in 2010. Since then, he has overseen the acquisitions of wealth and asset management businesses ETrade and Eaton Vance.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound