I have a secret. Now, what I'm about to tell you won't sound like much of a secret. But I promise most people don't realize this secret applies to them. It comes in two parts:

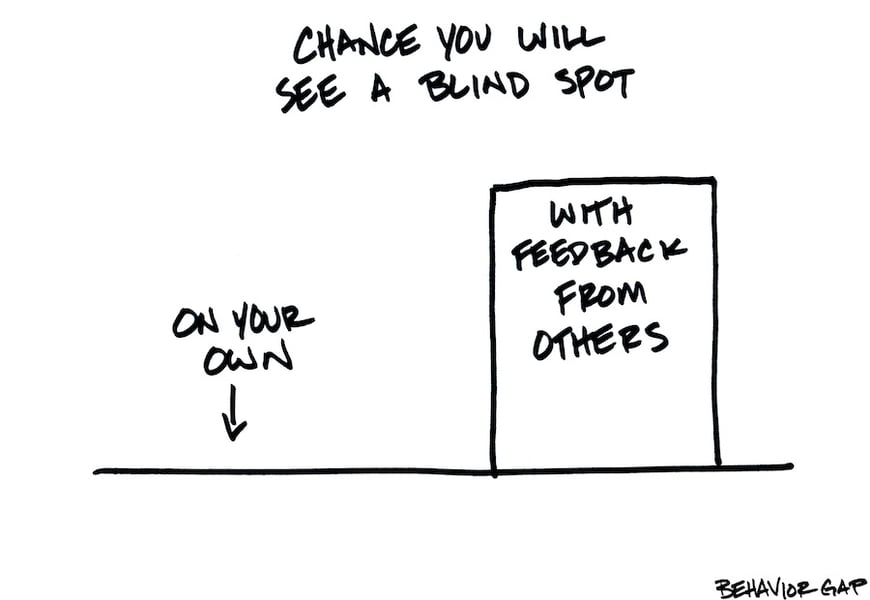

1. We all have blind spots.

2. We can't see them.

Obvious, right? But the tragic reality is that most of us struggle with our blind spots. After all, by definition, we can't see them, and if we can't see them, then they aren't a problem, even when they're staring us in the face.

All of this leads me to an important lesson. As advisers, we're in the perfect position to coach our clients through their financial blind spots. But how do we reach that point? How do we help our clients? It's a simple solution, and it starts with building a relationship based on trust and empathy.

(More from Carl Richards: Why looking for perfect investments is counterproductive)

We need to help our clients understand that blind spots exist, and that yes, they have them, too. At first, some people will hesitate. Maybe it's ego. Maybe it's fear. Whatever the reason, it can be hard to ask for feedback about something we can't see. We also have a tendency to think that feedback is about us and not our behavior.

However, if you've taken the time to build a trusted relationship, you can coach your clients past their fear and ego. In the beginning, though, be prepared to have at least a few people make excuses. It may even take a few tries for your advice to sink in and have an effect. Clients will appreciate candor when it follows trust and empathy, but they're not always prepared to apply what they hear. So be patient.

And don't ever forget that clients want to work with you because you've committed to telling them what they need to hear — even when it's uncomfortable. It's yet another example of why there will always be a need for human advisers.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money (Portfolio) last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.