I'm about to ask you a really personal question. At certain moments, do you cringe when you hear a client on the phone? Oh, I don't mean that you dislike your clients or your work. But you've been paying attention to the headlines, and you know that clients who follow the news will be on the phone.

It doesn't matter that their goals haven't changed or that they have a well-designed plan. They saw or heard something on the news, and now they want to know if they should be doing something about it. Clearly, other people are doing something. Isn't it foolish to be doing nothing?

I get it. We all do it. In many ways, we've been trained to follow the news obsessively. Our phones seem to notify us anytime something happens, big or small. But when it comes to behaving as investors, this obsession will cause us grief.

That's why I want you to take the call every time. You need to help your clients through what I've referred to as a financial news detox.

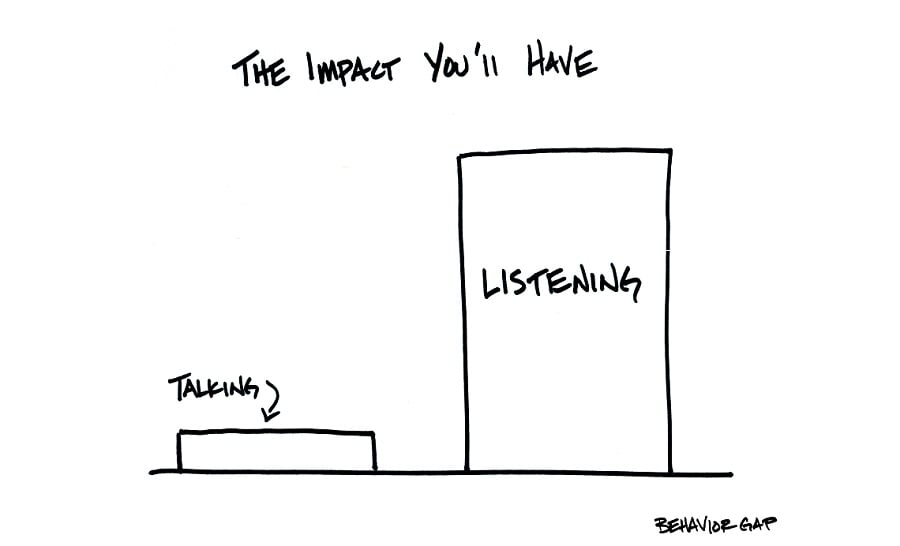

You need to help pull clients back from the edge of obsession over news that 1) they have zero control over and 2) will have little to no impact on their goals and plans. But until you listen to your clients, until you empathize with your clients, you can't begin to help them avoid falling into this trap.

I recommend a simple process for dealing with these calls. When you first answer, don't dive immediately into the discussion. Ask for a minute to grab the client's file. This small pause gives you a chance to focus and slow down the conversation.

Then, when you return to the call, acknowledge the concerns.

"Yes, that event or issue is a big deal, but let's revisit your values. Have the things you said were most important changed?"

I'm betting that the answer will be "no" 99.9% of the time.

From there, move on to goals. Ask them, for instance, "Do you still plan to retire in 10 years?"

"Yes, that hasn't changed."

"Great! Based on what I'm hearing from you, we still have the best plan in place to get you there, and you don't need to worry about what you heard in the news. It's not a factor."

I know it sounds easy, and you may wonder, "Why bother?" But please don't forget the reason clients call: They trust you. They need you to help them separate the important from the ridiculous so they can make the best money decisions possible.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, "The One-Page Financial Plan: A Simple Way to Be Smart About Your Money" (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.