The Financial Industry Regulatory Authority Inc. started an inquiry in November into whether broker and financial advisor James Iannazzo broke industry rules when he allegedly "structured cash transactions in his personal bank and brokerage accounts to avoid federal reporting requirements," according to his BrokerCheck report. Iannazzo was fired by Merrill Lynch a year ago after an uproar at a Connecticut smoothie shop that went viral online.

Iannazzo, who is now registered with Aegis Capital Corp., did not return a call Monday morning to comment. His BrokerCheck report states that an investigation is pending in the matter and that Finra has made a "preliminary decision" to recommend some type of disciplinary action against him.

Merrill Lynch fired Iannazzo last January after the incident. Iannazzo had ordered a drink at a Robeks location in Fairfield, Connecticut, that appeared to trigger an allergic reaction in his son, who had to be taken in an ambulance to the hospital.

Iannazzo’s attorneys later said that emergency medical responders recommended that he return to the shop to ascertain what was put in the smoothie, but that Iannazzo lost his temper when an employee told him they “didn’t know.”

Attorneys representing Gianna Marie Miranda, an 18-year-old employee at the smoothie shop, sued for $300,000 in damages after Iannazzo threw the drink at Miranda and called her a “f—ing immigrant loser.” In August, Iannazzo agreed to pay $7,500.

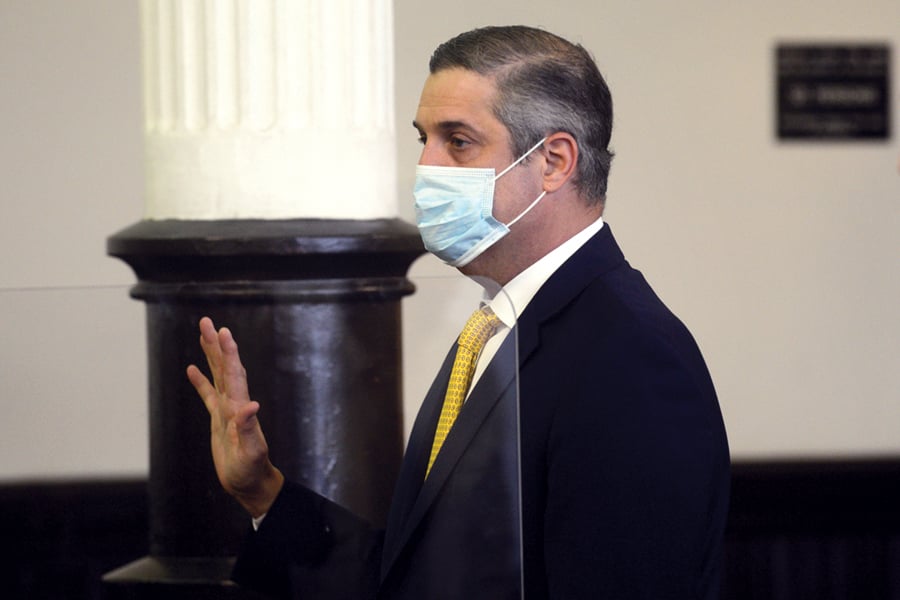

The interaction was caught on video and shared widely on social media. Iannazzo at the time turned himself in to police, was arrested and charged with a felony for intimidation based on bigotry or bias in the second degree, as well as two misdemeanors.

In April, Iannazzo was assigned to an accelerated rehabilitation program to sidestep a criminal conviction. After one year of supervision, charges against him will be dismissed.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound