As financial professionals, we're trained to talk about money. In fact, our training tells us it's OK to talk about money. But for everyone else, it's a different story.

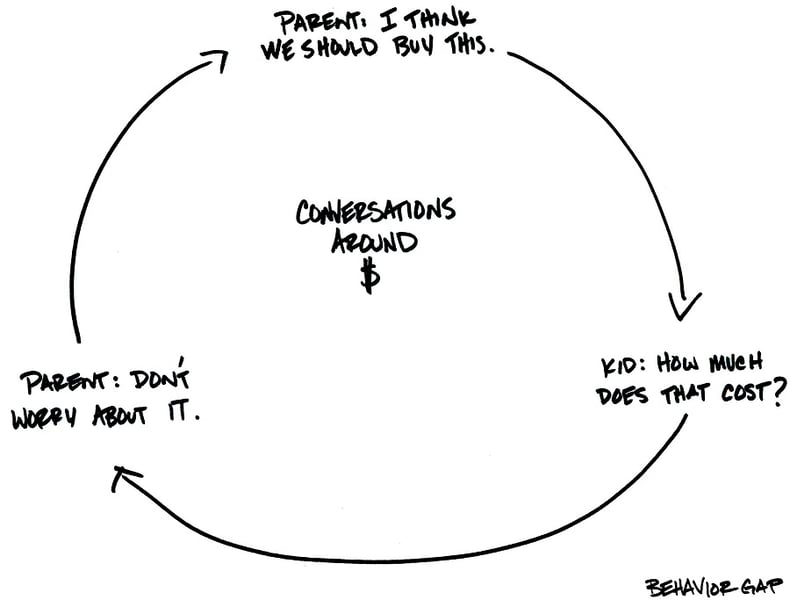

I can still remember as a kid that my parents didn't talk about money, sex, religion, or politics in "polite company." That just wasn't done. Over time, it became clear that "polite company" included just about everyone when the subject involved money. I'm betting many of you had a similar experience.

Think about where that leaves people. We've been told for years to not talk about money. We may even be extending that restriction to our kids. So what happens when we face really complex decisions involving money? Who do we talk to when we've been told to not talk about money?

(More from Carl Richards: What separates advisers from algorithms)

For just a minute, I want you to pause and recognize the sacred opportunity we have as financial professionals. We can create opportunities for people to have these conversations, to learn that it's OK to talk about money. We have the chance to teach people how to have important money conversations with their spouses, their kids, and even their business partners. That's a huge thing for our industry.

Plus, it's an important step on our journey towards becoming better communicators. As long as people feel uncomfortable talking about money, we'll have a hard time helping them learn how to make better decisions. We need to show clients that they can talk to us about these important, and sometimes complex, issues. And it starts by letting people know it's OK to talk about money in the first place.

Carl Richards is a certified financial planner and the director of investor education for the BAM ALLIANCE. He's the author of the weekly "Sketch Guy" column at the New York Times, and a frequent keynote speaker at financial planning conferences and visual learning events around the world. In 2015, he published his second book, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money (Portfolio, 2015).You can learn more about Carl and his work at BehaviorGap.com.