529 college-savings plans across the country are increasingly making their way onto Morningstar’s honor roll, as investment options and costs have widely improved.

The company gave out gold medals this year to five 529 plans, including programs in Utah, Pennsylvania, Massachusetts, Illinois, and Alaska – the last three of which were upgrades.

That may be good news for parents, grandparents, and other family members who are turning to such plans to help save for college. 529s recently got more appealing for many, as assets from them can be eligible for rollovers to IRAs, for example. And the plans can also be used for an expanded range of needs, rather than just for attending traditional colleges and universities.

There were about $464 billion in 529 college savings plans as of August, up from $441 billion at the end of 2023, according to Morningstar.

In total, there were 11 states whose 529 plans were promoted in Morningstar’s medalist system. At the same time, nine states saw their grades slipping, and their medal status was downgraded.

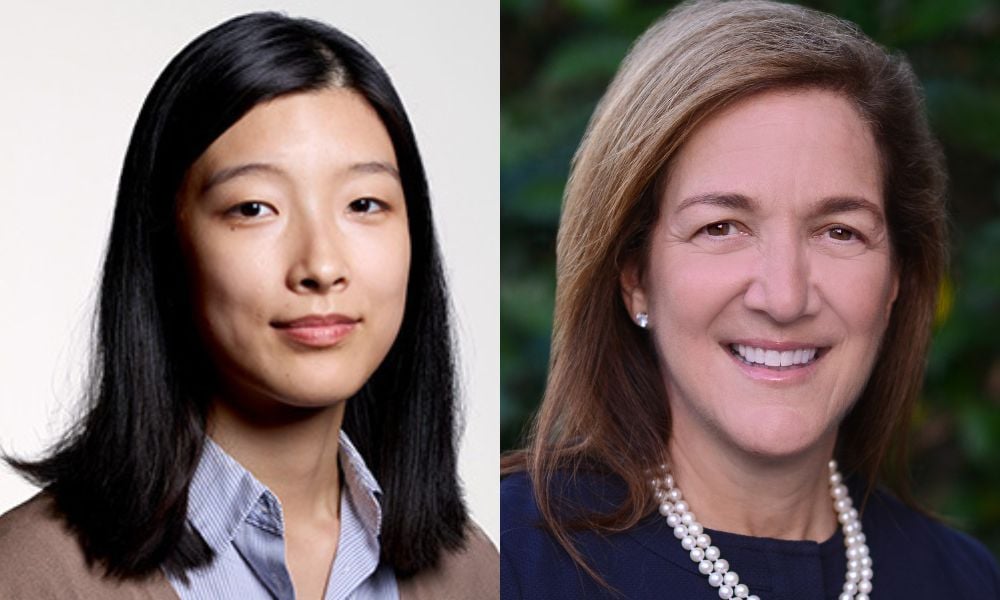

“When Morningstar first launched the analyst ratings for 529 plans, there were many more plans that our analysts would steer investors away from. That is no longer the case,” said Hyunmin Kim, manager research analyst at Morningstar. Even plans with a neutral rating have tax benefits, Kim said.

“They can all be appealing options to save for college or higher education. Overall, the options have improved a lot in terms of quality and cost efficiency.”

There were more gold medalists this year due to a methodology change Morningstar implemented. This year, it placed more emphasis on the “process” and “parent” pillars and less on “people,” changes that brought some plans’ grades up and others down. Half of a plan’s score is now related to process, which evaluates asset allocation, fund selection, management, and menu design, Kim said. And a quarter of the score is now based on “parent,” or the level and quality of stewardship of the plan by the state sponsor. The remaining “people” component accounts for 25 percent of a score, and it examines the management of the age-based or target-enrollment portfolios within a plan. Plan fees previously accounted for 30 percent of a score and are now evaluated differently.

Morningstar gave silver medals to 14 plans and bronze medals to 13. It rated 21 as neutral and six as negative. Those with the negative ratings are the direct-sold plans in Nevada, Rhode Island, South Dakota, and Wisconsin, as well as the advisor-sold plan in South Carolina.

Overall, 529 college savings plans have grown up in recent years.

Among the highly rated plans, “almost all of them have a solid history of fee reduction,” Kim said. “We like to see plans being affordable – and if they are employing active management, being cost efficient at that.”

Industrywide, an improvement has been seen in the asset-allocation products used within plans, which mostly are no longer mirror images of asset managers’ target-date retirement funds.

“529 investing has its own investing nuances to consider,” Kim said. “The decumulation, or spending, period for higher education is much shorter than retirement,” at four to six years, rather than 40.

That makes the duration management at the end of a glide path a different matter.

Less than a decade ago, the target-enrollment or age-based funds in 529 plans used “steps” that jarringly shifted asset allocations at certain dates, which in some cases could have detrimental effects, depending on market conditions. Fund providers have moved away from that design, using smaller steps, or smoother glide paths, along the way.

“That structure has made a lot of sense – that has been a marked improvement,” said Andrea Feirstein, managing director of AKF Consulting, who works with numerous states on their programs.

Separately, plans have been more willing to open up asset management to more than one provider, which has improved the diversity of investment options, Feirstein said.

Fees have also been an ongoing area of change.

“Year over year, you just see a greater focus making these plans affordable for people. You see that in the direct market, because you don’t want fees to eat up people’s savings,” she said. “States have appropriately done everything they could do lower the cost of these investments.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound