You're probably familiar with the phrase, "People don't care how much you know until they know how much you care." It may seem trite and overused, but as a real financial adviser, it defines much of what we should be doing. All signs point to it being true because of a couple realities.

First, people are making some of the most important decisions they'll ever make in your office. And second, those decisions will have to come after navigating spreadsheets and stories, the science and art of investing, and technical concepts that get tangled up in feelings. As the cherry on top, this process happens while also dealing with irreducible uncertainty.

Now, think about it from the client's perspective. How would you feel if you walked into an office and someone started pushing "solutions" at you without pausing to know what you think, what you need and what you feel?

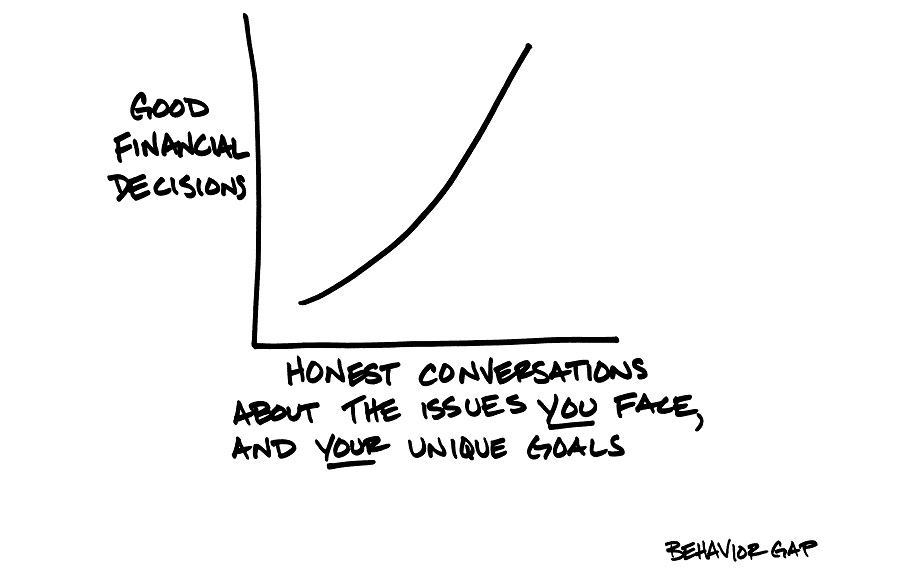

It's critical that we understand the need to demonstrate how much we care about our clients before we demonstrate how much we know. We need to take the time to ask really good questions and listen carefully to the answers. We need to diagnose before ever thinking about giving a prescription.

On paper, everything I've just written seems logical, but based on the stories I hear, we're skipping this step or dismissing its value. I'm begging you, please don't. Clients need to feel understood before they'll take your advice.

In no way does this discount or undermine the value of your technical skill as a real financial adviser. But it does acknowledge that we care enough to connect with our clients on their level, and by listening to their answers, we can offer options that fit their needs.

Once you master the caring before sharing process, you'll also discover that clients are often less concerned with the nitty-gritty details of a particular solution. Don't get me wrong, of course, you'll still disclose and make sure they understand what they're agreeing to. But because they know you know them and their needs, they will trust you.

It just happens to make the process of getting them from A to B more straightforward. Clients want to know what you think, and they're willing to trust your judgment.

I know this process doesn't come easily to every adviser. So if it's something you struggle with, I talk about it in more detail in the free mini course I created for advisers. You can sign up at BehaviorGap.com. And please remember that it's the simple, seemingly small things, like showing you care, that will ensure your long-term success as a real financial adviser.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, "The One-Page Financial Plan: A Simple Way to Be Smart About Your Money" (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.