The financial advice business isn’t what it used to be — and many in the profession say that’s a good thing.

With investment management effectively being outsourced to the dizzying number of model portfolios and home office research services available, stock picking just isn’t the main selling point of an advisor’s services anymore. Instead, we live in a renaissance of financial planning, where understanding, empathy and communication are critical and clients increasingly value help with goals like retirement, college planning, emergency savings and even vacation budgeting.

Rob Isbitts has been there. He was an advisor for 27 years, as a chartered financial analyst focused on investments, until he sold his practice three years ago to a certified financial planner. He also spent the better part of three years as the lead portfolio manager on a mutual fund.

“The only reason I was able to get away with it … was because i started doing it in the ’90s, and the clients were very loyal,” said Isbitts, who today runs Sungarden Investment Publishing, an investment research firm, and is founder of the newsletter ETF Yourself.

“The investment selection has been commoditized,” he said. “That doesn’t mean that i would discourage any new entrants from the business, starting with a small boutique RIA, like I did … you have to be beyond unique in order to make it — or you have to have basically what hedge fund managers do.” The latter is a pile of money managed for friends and family, he said.

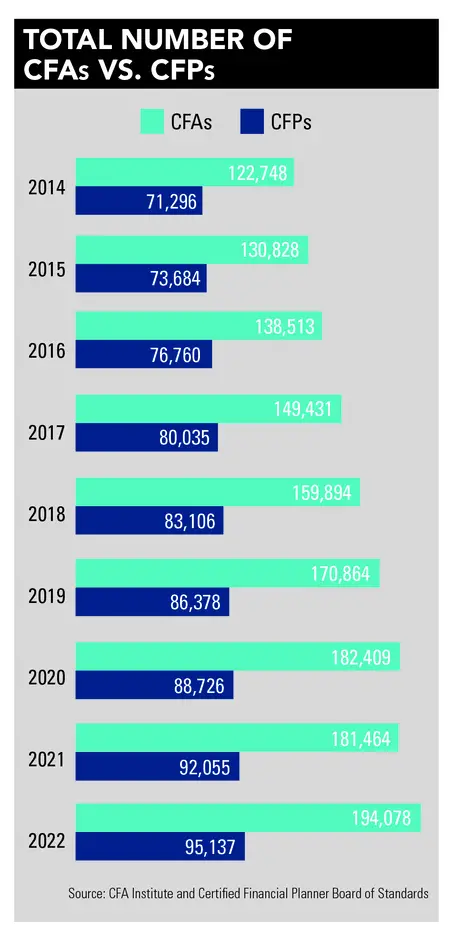

The numbers of CFA and CFP designations have each risen steadily over the past 10 years. Although CFAs have outpaced CFPs during that time, that trend has recently changed.

Since 2014, the number of CFAs globally has increased by over 61%, going from 122,748 to 198,185, according to figures from the CFA institute. During that time the number of CFPs in the U.S. rose by about 37%, to 97,575, up from 71,296, data from the Certified Financial Planner Board of Standards show.

But since 2020, the number of CFPs is up by 10%, while the number of CFAs is up 8.6%.

“Consumers definitely want help that goes beyond investment selection,” said Laura Varas, CEO of consumer research firm Hearts & Wallets. “When people get rich, let’s say $5 million and up … they become very focused on their investment goals. But everybody else in America, 98% of households, is focused on life goals.”

The average number of those goals has been increasing, and people are having to balance competing financial priorities. Ten years ago, 42% of people said they had between three and five financial goals, and 18% said they had no such goals at all, according to Hearts & Wallets data. Last year, those figures were 55% and 10%, respectively.

But interestingly, the most commonly cited goals people had were not directly about investing. Forty-eight percent pointed to building an emergency fund, followed by 43% who said they wanted advisors to help them plan financially for a vacation. Behind those goals were having enough money to work less when older (39%) and being able to stop work fully in retirement (32%). People cited investing goals such as generating current income, capital preservation and capital appreciation about as much as they said they wanted financial planning around buying a new car or buying real estate, at more than 20%, according to Hearts & Wallets.

Addressing all those financial goals isn’t something that robo-advisors can do, or at least not do very well, Varas said. Only one out of five financial advice sources — ranging from robos to full-service human advisors — covers three or more of the financial goals people pointed to. That makes the services financial advisors provide more distinctive than most professionals realize, she said.

The demand for comprehensive financial planning doesn’t vary dramatically by the amount of wealth someone has. Generally, more than 70% of people said it’s important to them, though the rate was highest among households with $1.75 million to $2 million in assets, at 85%. However, its importance dipped among households with $8 million to $10 million, with less than 60% citing it as important, the Hearts & Wallets data show.

It’s also something that people value more with age. About 70% or more of baby boomers said every year since 2010 that personal financial advice was important to them. That rate was slightly lower for Gen Xers, though it has increased for that generation over time. In 2010, only about 35% of millennials said it was important, though that rate has since nearly doubled.

But the types of financial goals people focus on varies by asset level, with the exception of taking a vacation, which more than 40% of groups across the board cited. While less than half of households with $100,000 to $500,000 in assets said that investment-related goals were important to them, more than 60% of those with $3 million or higher prioritized them.

“The cruel irony is that the more money you have, the easier and safer it is to take more risks with your money,” Varas said. “When you’re trying to save for the incredible amount of $100,000, fireworks should go off,” she added, as capital appreciation isn’t the main factor that carries people over that line.

People’s financial situations are more complex than in the past, in part because the middle class largely doesn’t have pension plan coverage, and taxes are convoluted, said Nadine Burns, CEO of financial planning firm A New Path Financial.

As an example, she points to a recent client whose father “worked hard to grow his wealth with investment selection, [and] he did very well with the help of an investment advisor.” However, when the father died, the investment advisor ensured the inheritance went to the person who is now her client, who will pay a higher tax rate on the amount than his siblings. He is dispersing big chunks of the assets to those siblings, who will not be taxed on the amounts they receive, Burns said in an email.

“What did it matter that the father earned and made great investments; he just lost over 40% of his net worth to federal and state taxes,” she said. “Maybe a CFP professional with an estate planning attorney could have worked to save this. I personally believe everyone can benefit by having someone help them with their financial life today, someone who has their interest at the forefront.”

Barry Flagg got his CFP designation at 23 or 24 years old, making him the youngest on record as of 1987. Now 61, he calls himself the “oldest youngest” CFP holder and says he’s seen the transformation in the industry firsthand.

“The financial planning/wealth management profession used to be almost synonymous with investment selection, management and accumulation, and is now definitely evolving/expanding to address changing client needs for decumulation and risk management,” Flagg, managing director at Triangulum Financial Partners, said in an email. “This evolution/expansion of services has exposed insurance products as the last, largest, most neglected and often worst-performing asset in clients’ financial/estate plans, particularly for the wealthy.”

There was also a notable shift in the business following the dotcom bust, Ashley Folkes, managing partner of Inspired Wealth Solutions, said in an email.

“Over two decades ago, when I embarked on my career, our primary strategy involved presenting innovative concepts to attract clients. Individual stocks and technology mutual funds were all the rage during the dotcom bubble era,” Folkes said.

The business has since transformed, with “fee-only” and “fiduciary” now being used by many, a development that stemmed in part from increased compliance enforcement to help weed out unethical advisors, he noted.

“When i became a certified financial planner years ago, it opened my eyes to the importance of comprehensive planning and its impact beyond mere portfolio returns,” he said. “Our discussions now revolve around meaning, purpose, legacy and how all the elements of your financial life fit together.”

Younger clients are also averse to long-term contracts and high fees, Kassi Fetters, owner of Artica Financial Services, said in an email.

“They want to be set up to run down the correct road to achieve college, house and retirement funding but don’t see the need to pay 1% of their AUM from their 30s into their 50s. And, contrary to most advisors, I agree with them,” Fetters said. “Until younger clients have a larger portfolio, they have a complex financial situation or business, all they really need from an advisor is a path to run down for success.”

The internet has been transformative for independent financial advisors in allowing them to show what they can offer beyond off-the-shelf investment strategies and demonstrating to consumers that they have many choices, Eric Amzalag, CEO of Peak Financial Planning, said in an email.

“For the last 50 years, the wealth management industry has done a great job of destroying its credibility via opaque fees, poorly performing products and slimy sales strategies,” said Amzalag, who is an active YouTuber. “Many of my clients come to me after working with an advisor in the fee-based, corporate world because they are tired of the lack of attention, lack of transparency around fees and the lack of apparent skill that their prior advisor had.”

While he would not necessarily discourage people from pursuing CFAs rather than CFPs, the latter could be harder for artificial intelligence to replace because of the personal aspect of planning, Isbitts said.

“It’s always been a people business,” he said. “The recognition by the industry of just how much of a people business it is has grown.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound