"We're harming savers worldwide with low and negative interest rates," he says.

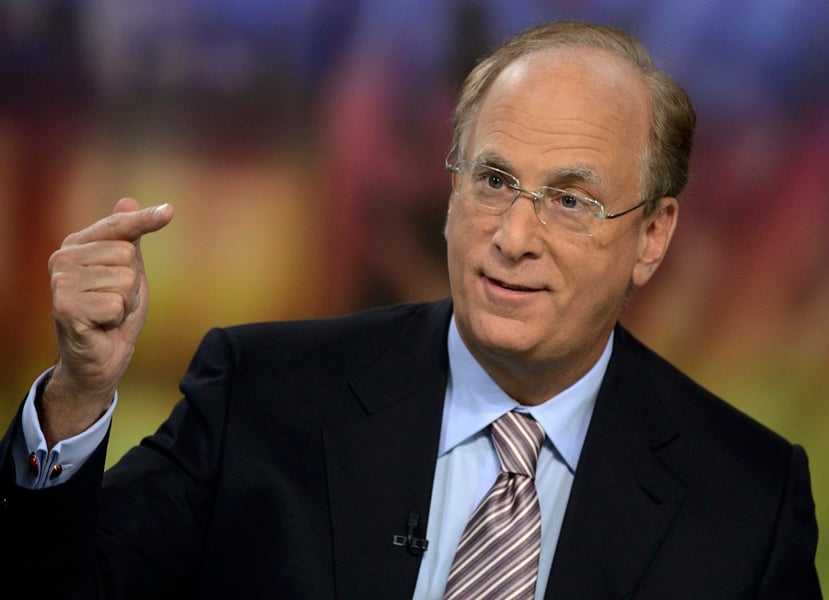

Larry Fink, chairman and chief executive of mutual-fund behemoth BlackRock, uses his hands a lot when he talks. Nothing wrong with that; some of the world's best orators have a hard time keeping their mitts down when they speak. Heck, Bernie Sanders seems to have hypnotized half of the Democratic Party with his hand jive.

However, Mr. Fink had one problem on Wednesday. He seemed to be trying to let his right hand do all the talking during an interview with Erik Schatzker on Bloomberg Television. But eventually, that left hand simply could not remain silent any longer and rose up proudly to be heard. What it had to say was loud and clear: "I am in a world of pain!" Visible on the middle finger nail (watch for it at 3:50 of this video) was the type of black-and-blue coloring familiar to any do-it-yourself home-improvement enthusiast who hammered aggressively at a nail &mdash: and missed terribly.

At publication time, it was unknown if a hammer mishap was indeed the cause of this particular injury. (Indeed, Mr. Fink's $25.8 million compensation in 2015 does make it hard to imagine him having much contact with a hammer.) However, one thing is clear: When it came to what he had to say, Mr. Fink hit the nail on the head.

It's not that he said anything unique or particularly groundbreaking, it's just that he said it in a clear and comprehensible way, and his status as the head of a company with $4.7 trillion in assets under management gives him a podium that's a lot harder to ignore than some crank with a blog. With a Federal Reserve decision looming later in the day, and virtually no one expecting an interest-rate increase, Mr. Fink made it clear he believes the dependency on monetary policy to spur economic growth has gone on far too long and that it's time for fiscal policy to take over.

SAVER'S NIGHTMARE

"We're harming savers worldwide with low and negative interest rates," he said. People save for events -- buying a house, sending their kids to college, retirement, etc., he said. When rates are near or below zero, they're forced to save even more to meet those goals, and consumer confidence and spending suffer as a result. "The psychology of people who are near retirement is fear -- fear that they're not earning enough to meet the needs of the lifestyle they desire."

As for the stock market, which in the U.S. has been mostly flat to lower on a rolling 12-month basis this year and is closing in fast on the one-year anniversary since its last record, Mr. Fink sees it continuing to be "anemic to declining" unless government spending starts taking the place of monetary policy as the driver of growth.

"If we see a path toward more fiscal policy and more investing in infrastructure going into 2017, we could see a second leg of the rally in equities," he said. "We could see monetary policy changing rapidly, and if that's the case you would see rising rates, faster than we forecast."

Again, none of this is exactly original thinking. In fact, Mr. Fink himself has been making similar arguments for a few years now. And there is one glaring flaw with this argument that relegates it to the wishful thinking category: Congress is unlikely to pass anything stimulative this year, just like the past few years, so calls like Mr. Fink's are unlikely to be heeded until 2017 at the earliest. And who knows what the government will look like at that time. (Some are even speculating about a role for Mr. Fink in Washington, just like they have for years.)

Absent a political sea change, monetary policy is all there is, warts and all.

Regardless, some arguments are worth repeating, or even banging the table about. Just use your right hand to do the banging, Larry. That left hand could use some rest.

Michael P. Regan is a Bloomberg Gadfly columnist covering equities and financial services. He has covered stocks for Bloomberg News as a columnist and editor since 2007.