Los Angeles faces tens of millions of dollars in additional borrowing costs after the City Council told anti-Wall Street protesters it intends to cut ties with banks involved in financial wrongdoing, Administrative Officer Miguel Santana said.

The city may have to pay $27.8 million in termination fees and replacement costs if it's prohibited from doing business with banks providing letters of credit for just one infrastructure program, Santana said yesterday in a memo to Mayor Antonio Villaraigosa. Debt service would climb $14.9 million a year if it has to refinance commercial paper into long-term debt at higher rates, Santana said in a telephone interview.

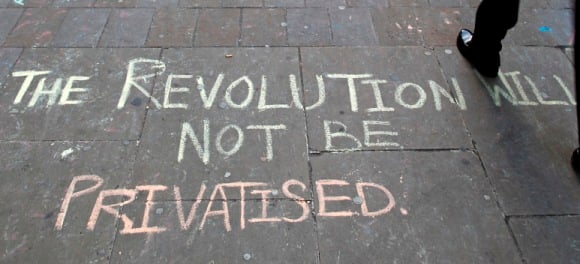

Council members in the nation's second-largest city by population passed a resolution Oct. 12 in support of the demonstrations that started as Occupy Wall Street in New York. They promised to accelerate the issuance of “report cards” rating banks on such things as foreclosures and charitable giving. The vote followed three hours of public comment, much of it by participants in Occupy Los Angeles who've camped in front of City Hall since Oct. 1.

“The financial repercussions will be immense” if his office is prohibited from doing business with many of its current lenders, Santana said in the report.

RELATED ITEM Advisers, what do you think about Occupy Wall Street?

Council member Richard Alarcon, who sponsored the resolution, said Santana's reaction showed Occupy Los Angeles is having an effect.

“Many of the banks we're targeting have pleaded guilty to fraud,” Alarcon said. “There are an ample number of other institutions that acted legally who can do these transactions. The Occupy L.A. movement has put this issue front and center.”

Santana said implementation of the report-card program has been delayed as city employees wrestle with questions such as how to compare institutions as diverse as Bank of America Corp. (BAC), the largest U.S. lender by assets, and De la Rosa & Co., a Los Angeles-based investment bank focused on municipal-bond underwriting.

RELATED ITEM Do Wall Street bigs sympathize with protesters?

Los Angeles in 2008 sued more than 30 institutions it accused of engaging in abuse related to financial derivatives and bid-rigging, Santana said. Two of the three letter-of-credit providers for the Municipal Improvement Corporation of Los Angeles Commercial Paper Program are defendants in the lawsuit, according to Santana.

The council on Oct. 11 approved a list of banks and underwriters that the city may use for lending. The council struck down a portion of the resolution that would have allowed Santana's office to hire the institutions without council approval, however.

The council's decisions on which banks to use may affect finances at other city departments, including its harbor, airports and municipal utility, Santana said.

--Bloomberg News--