The Trump administration moved Thursday to end several emergency pandemic lending programs at the Federal Reserve, triggering a rare public rift when the central bank objected to the Treasury Department’s instruction.

Treasury Secretary Steven Mnuchin, in a letter to Fed Chair Jerome Powell, sought a 90-day extension for four of the central bank’s emergency lending programs, while requesting five other programs expire on schedule on Dec. 31 and the Fed return unused funds, allowing Congress to re-appropriate $455 billion and spend the money elsewhere.

The Fed responded in a short statement that it “would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy.”

The conflict -- a rare public rift between the Fed and the Treasury -- comes as the U.S. recovery faces increasing pressure from a resurgent coronavirus pandemic and follows months of deadlock between Republicans and Democrats over the size and type of additional fiscal stimulus. Removing some of the emergency programs has the potential to leave the economy more vulnerable as President-elect Joe Biden prepares to take office in January.

“I am befuddled. It adds insult to injury to an economy that is about to be flooded by the surge in COVID cases, hospitalizations and deaths,” said Diane Swonk, chief economist at Grant Thornton. “If anything, Treasury should be shoring up the storm wall of these facilities.”

Yields on 10-year Treasuries dropped about two basis points amid the news to end Thursday at 0.83%. U.S. stock futures pared gains into the close, and S&P 500 emini contracts were down about 0.9% early in the Asia session Friday.

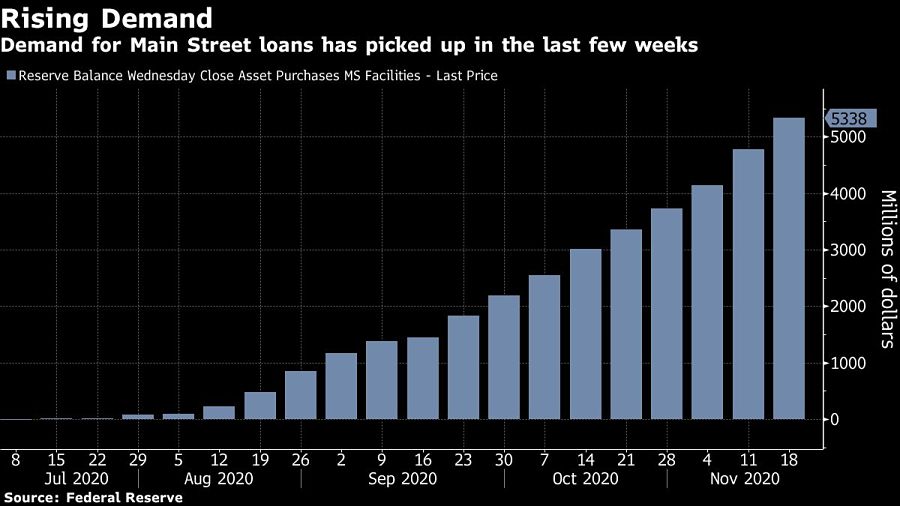

The emergency programs created by the Cares Act, the stimulus President Donald Trump signed earlier this year, were set to expire at year-end. Mnuchin is seeking to end the primary and secondary market corporate credit facilities, the Municipal Liquidity Facility, the Main Street Lending Program and the Term Asset-Backed Securities Loan Facility.

“The economy has responded very strongly, but there are still areas of the economy that need more support,” Mnuchin said in an interview. “That’s why I’m encouraging Congress to reallocate this money.”

The secretary sought a 90-day extension for the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, the Money Market Mutual Fund Liquidity Facility and the Paycheck Protection Program Liquidity Facility.

The Fed programs were launched this spring to stabilize markets and extend credit to U.S. companies as the COVID-19 pandemic took hold. They helped quell the panic but take-up has been relatively low -- which the Fed says is a sign that they’ve worked.

Republicans in Congress have used that to argue that they are no longer needed and the billions of dollars sent to the central bank to set them up can be deployed better elsewhere. Democrats, as well as the central bank, say that removing the safety net of these programs as the virus surges again through the country is not a good idea.

“I do think it’s critical that the 13(3) programs, the public market backstop programs and programs that support Main Street and the PPP, that they continue beyond year-end. I think that’s very important,” Dallas Fed President Robert Kaplan said earlier Thursday in an interview on Bloomberg Television, referring to the section of the Federal Reserve Act providing the authority for emergency lending.

Republican Sen. Pat Toomey of Pennsylvania praised Mnuchin’s move. “With liquidity restored,” the programs should expire, “as Congress intended and the law requires,” Toomey said in a statement Thursday.

The Fed’s intervention into corporate bond markets was particularly effective, staving off a massive wave of bankruptcies. But the government support also stoked record amount of issuance and ultra-low rates, resulting in worries that credit markets were overheating and taking too much risk.

While investors had expected the buying program to continue well into next year, market watchers were relatively sanguine about the demise -- for now.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound