With the future of the Labor Department’s proposed retirement security rule currently under review, advisors remain focused on their clients’ rollovers from 401(k) plans.

Whether this event is spurred by a job change or happens as the client enters retirement, it’s a crucial time for investors. It also provides RIAs with a unique opportunity to showcase and maintain their partnership with their clients.

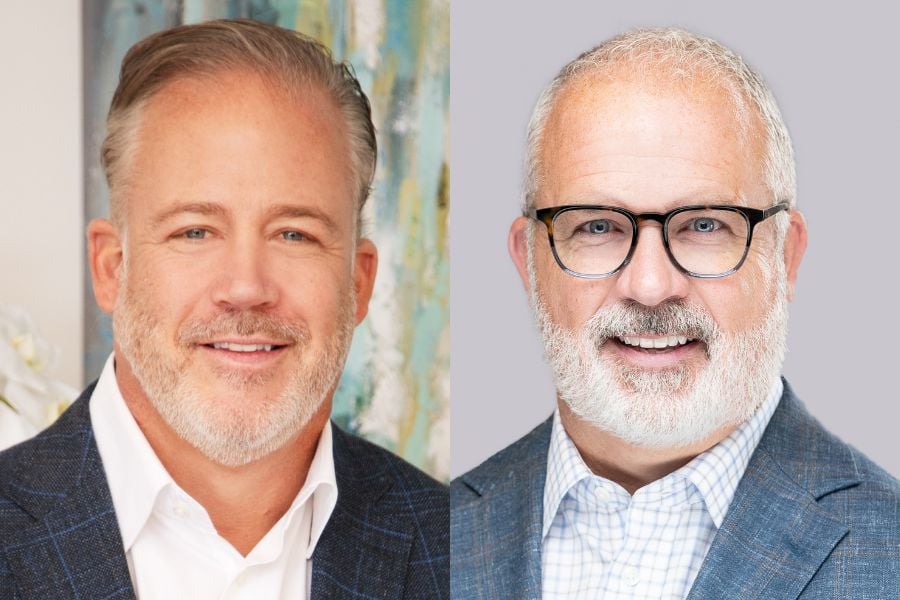

While the retirement security rule, the latest iteration of the DOL’s fiduciary rule, continues to cause controversy, the spirit of the regulation is to make sure advisors are educating plan participants at the highest level, says David McBee, financial advisor at Concurrent, an independent firm.

Essentially, McBee says, advisors should be instructing the client on the entire financial planning process -- everything from the pros and cons of a 401(k) plan, the limits of what the product will provide the client, how much it costs to work with a financial advisor, and the cost differentiator and the benefits that one might gain outside of a 401(k).

“That information needs to be given with this fiduciary mindset of, it’s really got to be fully disclosed, that these are your options,” McBee said.

“Making an educated decision and setting expectations for participants of what they should expect to get for different levels of costs is valuable. I believe it is much easier for any investor to grow their money than it is to create a distribution process. I think more people will fail trying to create income in retirement than they did trying to grow their money during work,” he said.

McBee says the spirit of the rule is good because while 10 or 15 years ago, everyone was likely advised to move their savings out of a 401(k) plan when they retired, many now need to stay in the plan.

“401(k) plans have added things like managed accounts or managed solutions that are a little bit more sophisticated than just a standard fund lineup,” McBee said. “Not everybody needs to hire a financial advisor. Not many do. There's just certain distribution or income solutions that you can't find in many 401(k) plans so going through that process of education to that participant is important and I think, in a lot of ways, it's probably very valuable.”

The retirement security rule makes participants aware that there are inherent conflicts of interest between their choices, McBee added, and that it doesn't necessarily mean that one is better or worse than the other.

“To pick a good asset allocation of low-cost growth funds and have a high deferral rate in your 401(k), many people can accomplish that. Moving into the retirement phase, and understanding inflationary risk, interest-rate risk, trying to generate income and still have growth and total return, there's a lot of factors going for a retired person,” McBee said. “Getting some advice, in my opinion, is valuable for those people.”

Education and 401(k) plans aren’t everything, however. Jack Elder, director of advanced markets at CBS Brokerage, an independent insurance brokerage that services RIAs, says insurance strategies can also play a part in safeguarding an investor’s legacy. During the income accumulation phase, investors should make sure they have enough term insurance to complete the retirement plan. Nearing retirement, however, the risk changes.

“No longer are we looking at income replacement as the biggest risk, it's capital preservation,” Elder says. “In that case, I might use an annuity [with] which I'm taking risk off my balance sheet, giving to a life insurance company, and it protects my principal and gives me some growth.”

Income annuities are “one of the big ones,” he said, adding that second to that are the costs of long-term care.

“Long-term care expenses are growing drastically and having some protection in place protects the assets under management, and therefore protects the wealth transfer plans, because the assets won't be consumed by long term care expenses,” Elder said.

McBee cited a recent conversation with a plan participant about the participant’s frustration that the plan didn’t offer a brokerage window that would let him trade stocks in the plan. The reason for that, McBee says, are 401(k) plans, from a corporate standpoint, are built as a funding vehicle.

“They're built for the broad population of employees; they're not built as a trading system for a few. They're really built to help people accumulate effectively, by using payroll deduction, by offering things like the Roth option, or even some plans now offering after tax contributions to roll over to Roth,” he said.

“That's a key factor for people to understand,” McBee added. “If you really want an individualized experience, 401(k) is not always the best option because it's built for the broad population of that company.”

As for how RIAs can help support clients during life transitions, Elder noted that well positioned RIAs are actively involved in any aspect of their clients’ lives that begins with “the dollar sign.” And when clients are planning for all aspects of their retirement, they’re also thinking about their legacy.

“How do I preserve, grow, protect my wealth? How do I prepare my children for to receive wealth?” he said. “These are the money-in-motion times, the aspect that the RIA needs to lead with, is when the dollar signs are involved. How do you set things up so that child has a greater chance of being a good steward of wealth?”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound