In the business of financial planning, a client’s emotional needs can be just about as important as portfolio allocations.

Among a set of investors whose assets are diversified across account types, the top area where they say advisors provide value is “manag[ing] my investments with expertise, optimizing for growth and risk management,” according to data from Morningstar’s recent Voice of the Investor survey. But that category was only slightly more important than a more qualitative aspect: “Makes me feel more secure about my financial future.”

“I think about good financial advisors as ‘well-being’ advisors,” said Meir Statman, a behavioral finance researcher, speaking at the Morningstar Investment Conference in June. “It means crossing the boundary between finance and life.”

He also calls them “financial physicians,” which carries the responsibility for good bedside manner.

“If you speak to clients about their lives, about the many dimensions – family, friends, health, and so on – and you speak with them about their points of pain, you are going to get a client for life,” he said.

And that is critical given the importance of referrals. Clients refer an advisor “because they say, ‘This advisor really listens to me, truly cares about me. And I think [they] may care about you as well,’” Statman said.

Of course, that isn’t lost on good advisors, but that doesn’t make having conversations about feelings simple, he said.

“Those conversations are difficult. It’s easy to talk about finances. But family problems, mental illness – that’s difficult,” he said. “The traditional work of financial advisors is now done as well and as cheaply by roboadvisors. If you insist that you are just doing the pie chart [presentation], you’re not going to have a business for very long. You must cross the boundary.”

Doing so can be important for justifying fees that are multiples of what roboadvisors charge. A finding from Morningstar’s survey was that if people say they like their advisor, they seem to feel that fees are justified. And the more involved an advisor is in working with them, preferably through in-person meetings, the better.

“If they are satisfied with their advisor, price doesn’t matter,” said Joe Agostinelli, senior director of market research at Morningstar. “It’s a relationship business. They come at it from that financial-first model, or an emotional one. A mix of both is important.”

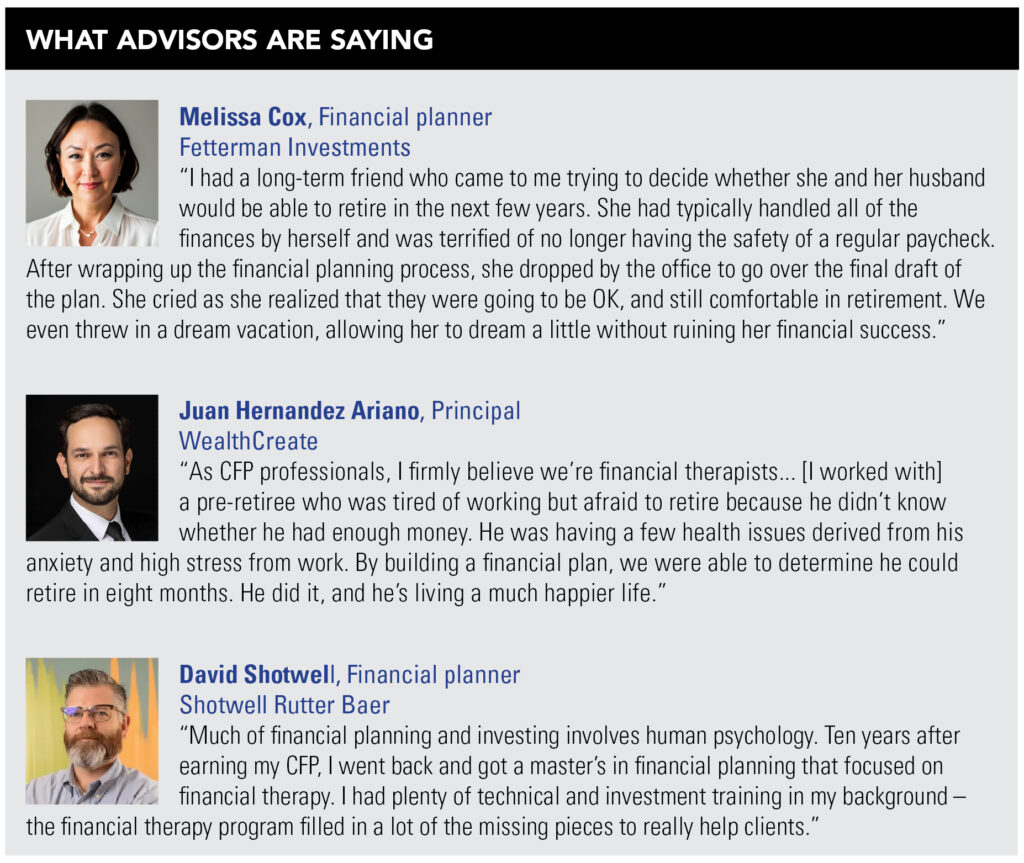

Byrke Sestok, co-founder of Rightirement Wealth Partners, said he sees his role as being a financial therapist.

“Math is straightforward and exact. Making decisions about how you spend your money is as emotional as it is financial,” Sestok said in an email. “It is fascinating to see how people will prioritize spending and how two similar purchases can come with two entirely different sets of emotions.”

In a recent case, he helped a client rationalize paying for a whole-house generator and installation costing $20,000.

“Everything they have they saved and accumulated from their own employment and efforts. Spending this much on one item was not comfortable for them. However, the client has medical needs, and loss of power for an extended period of time could mean loss of life,” he said. “The generator was necessary for protecting today. Without it there was a distinct possibility there could be no tomorrow.”

Emotional connections with money are often unconscious, financial planning author Martha Adams said in an email.

“Without prioritizing emotional support around money, we ultimately keep trying to change our feelings about financial actions and decisions with more information about financial actions and decisions. Yet, we can often see that, over time the desired financial changes haven’t been achieved,” Adams said.

“Prioritizing emotions around money at their source is the missing piece of the financial conversation. In my experience, this has been and continues to be incredibly important to clients, as it makes the conversation truly their own and takes the advisor-client relationship from talking with the intimidating expert to the approachable specialist.”

Advisors also help keep people from making rash decisions, an area where a background in psychology might be more helpful than an education in finance.

“People think advisors get you higher returns,” Statman said. “No – advisors prevent you from doing stupid things.”

That could mean calming nerves and discouraging people from selling stocks in a down market, he said.

“What matters is knowing enough about financial matters and knowing a whole lot about human behavior,” he said. “That is going to change your job from a career to a vocation.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound