The SEC’s approval of spot-price bitcoin ETFs means that the digital asset finally has an entry point into 401(k) plans – but don’t count on it appearing on investment menus anytime soon.

Instead, retirement investors will most likely be able to access bitcoin ETFs through 401(k) plans’ brokerage windows and, eventually, through asset allocation products like target-date funds. Given the extreme volatility of bitcoin and the range of opinions about its future, only a small proportion of a portfolio should be devoted to it, proponents say.

“Because these are ordinary ETFs, they are immediately available in self-directed accounts,” said Ric Edelman, founder of Edelman Financial Engines. For people who are active investors or traders in 401(k) plans, that access is meaningful – but those who are in default investment options or choose funds from the plan menu might not get bitcoin exposure for a while.

There are a couple of reasons for that. Because the ETFs are new, they haven’t been incorporated into any target-date products that would seek to add them. Additionally, 401(k) plan sponsors are widely risk-averse when it comes to making changes, including adding what is essentially a new asset class. Guidance in 2022 from the Department of Labor also tempered expectations, as the regulator urged fiduciaries to “exercise extreme care” when considering the addition of bitcoin to their plans.

Further, ETFs are few and far between in 401(k) plans, in part because record-keeping systems weren’t designed around intraday trading.

Allocating 1 percent to 5 percent of assets to bitcoin can have advantages, as that range is small enough to protect investors from harm if the digital asset fails, but the potential for outsize price appreciation could have a materially positive effect on portfolios, said Edelman, who’s co-founder of the Digital Assets Council of Financial Professionals.

“This is the best of both worlds – it reduces risk in the portfolio but improves returns,” he said.

The lack of correlation to stocks and bonds also makes bitcoin advantageous as a diversifier, said Mike Alfred, who runs hedge fund Alpine Fox, which focuses on bitcoin and bitcoin-related equities. Alfred also co-founded retirement plan ratings firm BrightScope, as well as fintech Digital Assets Data.

“From a mathematical standpoint, it’s kind of foolish not to include it in 401(k) plans,” he said. “It’s just another asset class. It’s not different from emerging markets, gold, or other commodities. Once the gatekeepers understand the asset class, it invariably ends up in these plans.”

Famed Yale chief investment officer David Swensen, who died in 2021, began incorporating bitcoin into the university’s endowment in 2018 through investments in venture funds. Swensen’s “Yale model” of investing, developed along with Dean Takahashi, for many years delivered strong returns by focusing on alternative asset classes rather than traditional stocks and bonds, Alfred noted.

The best manifestation within 401(k)s, at least in the near future, would be inclusion of bitcoin ETFs within asset allocation funds that are used as the defaults, he said.

“People need to understand that this is coming,” Alfred said.

It’s also evident that people want bitcoin, said Edelman, who projects that $150 billion will flow into bitcoin ETFs within three years, with the price of bitcoin reaching $150,000.

“Employers who respond to those workers’ demands will improve employee morale by demonstrating their responsiveness to this new opportunity,” he said. “This is an opportunity for forward-thinking advisors and employers.”

Of course, changes in the 401(k) world are slow to happen, and the consultants who help shape investment menus may not see incentives to add bitcoin soon, Edelman noted.

The fact that the digital asset is available in an ETF format helps address the concerns the DOL has cited with bitcoin, but the regulator’s stance will nonetheless be slow to soften, he said.

Currently, there are means of accessing bitcoin through 401(k)s, including through Fidelity’s Digital Assets Account, which has not caught on quickly, Edelman said. But the fact that Fidelity is among those with a spot bitcoin ETF is significant, given that it is one of the biggest retirement plan providers.

“This will make it very easy for millions of 401(k) plans to make this ETF available,” Edelman said.

Meanwhile, the biggest 401(k) provider, Vanguard, has indicated that it is not planning to offer access to spot bitcoin ETFs.

“Vanguard is getting a lot of criticism – and deservedly so – for denying millions of investors from making their own investment choices,” Edelman said.

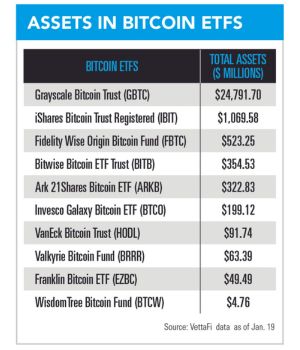

Since the SEC begrudgingly approved 11 spot bitcoin ETFs on January 10, nearly $2 billion flowed into the products in the first three days of trading, according to figures from Reuters.

Mike Harris, associate professor of retirement studies at the College for Financial Planning, said the excitement reminds him of the tech bubble or the housing market in 2007. In cases with such intense investor interest, there is a risk that valuations are already at a high point, he said.

“I would be astounded if a 401(k) investment committee would say, ‘Hey, we’ll let people invest in the bitcoin ETF.’ Their liability on that would be pretty huge,” Harris said. That said, small holdings within an asset allocation product could be more reasonable, he said.

In individual retirement accounts, people should limit their bitcoin exposure, particularly if they are in or near retirement, he noted.

It’s helpful to keep in mind that if people see significant investment losses, the returns needed to make up for those in future years are higher, Harris said. “This is like dynamite – which is really helpful if you’re digging a hole.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound