After 15 years of contributions at Bain, retirement account valued at up to $102M; best investor ever?

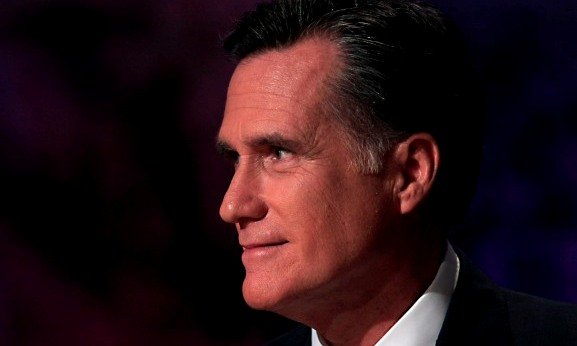

The most mysterious of the unexplained mysteries about Mitt Romney's considerable wealth is how he was able to amass between $21 million and $102 million in his individual retirement account during the 15 years he was at Bain Capital LLC.

How did he do it, given the relatively small amounts that the law permits to be contributed to such a plan on an annual basis? Romney has not explained this conundrum, and seeing as he wants to become president, he would be wise to start talking -- if for no other reason than there might be many Americans who would like to emulate what he did.

During Romney's tenure at Bain Capital -- from 1984 to 1999, although a recent Boston Globe article uncovered Romney having a role at Bain until 2002 -- the firm used a so-called SEP-IRA, which is like a 401(k) retirement plan but is funded entirely by the employer and has a much higher maximum contribution: about $30,000 annually during the period Romney was at Bain. Assuming Romney maxed out these tax-deferred contributions, he would have invested roughly $450,000 in his SEP-IRA during his years at Bain.

Skilled Investors

While there are limits to the amount that can be contributed tax-deferred to an IRA, there are no restrictions on the amount of money that the contributed capital can earn and can continue to earn, on a tax-deferred basis, even after the contributions have stopped. (The Internal Revenue Service will get its pound of flesh from Romney when he takes the money out of the IRA.) The only limit is the skill, or luck, of the IRA's owner. If you are the Warren Buffett of IRA investors, it is conceivable that you could turn $450,000 into as much as $102 million -- an increase of 227 times -- but not very likely, especially as in the last decade or so, the stock market has been a roller coaster. Mere investing mortals would be lucky to still have $450,000 in the account. (The median American family has $42,500 in traditional IRAs, according to the Investment Company Institute.)

So how did Romney do it? Of course, we don't know, but there have been several theories propagated to fill the considerable gap in knowledge left by Romney's ongoing silence. Mark Maremont, a Pulitzer Prize-winning reporter at the Wall Street Journal (and a former classmate of mine at journalism school), has suggested that -- perfectly legally -- Romney contributed to his IRA using the low-basis, low-value stock he received as a partner at Bain Capital in the various buyouts the firm did while Romney was there.

For instance, after Bain bought Domino's Pizza in 1998 for $1.1 billion, Bain partners (and the limited partners who went in on the deal) were able to get a slice of the equity of the company. Given the high leverage put into the pizza maker to finance its purchase, it's a safe bet there was very little equity value at the start, meaning that shares with little book value could be contributed to the IRA.

If Romney put $30,000 worth of Domino's Pizza stock into his 1998 SEP-IRA, it is conceivable that it would be worth many times that amount when Domino's went public in 2004. If Romney did the same thing over and over again during the 15 years he was at Bain doing leveraged buyouts, it is conceivable that the $450,000 would increase greatly in value.

Of course, not every deal Bain did worked out. But let's say Romney was prescient and put into this hypothetical IRA only the stock of the buyout companies that did well, returning to investors a whopping 10 times their money. (This is very rare but conceivable.) Even so, that would turn Romney's $450,000 into $4.5 million. If the money was also compounded and reinvested over the years and became, say, $10 million, that would still leave another $11 million to $92 million of unexplained value sitting in the presumptive Republican Party presidential nominee's IRA.

Mighty Oak

This great mystery seems to have troubled others, as well. On July 3, Current TV host Jennifer Granholm, a former Democratic governor of Michigan, invited Edward Kleinbard, a law professor at the University of Southern California, on her show to discuss how Romney could have accomplished this remarkable feat. There were “only two possibilities,” Kleinbard told Granholm. Either “from a little acorn, a mighty oak grew very, very quickly, extraordinarily so,” Kleinbard explained, causing Granholm to interject, “What little acorn could grow to be $101 million? I want to get some of that acorn!”

The other possibility, Kleinbard suggested, was not dissimilar to what Maremont theorized: that Romney contributed limited-partnership interests in Bain's buyouts to his IRA. What was “quite troubling” to Kleinbard is that he suspected Romney may have contributed these interests to his IRA at a fraction of their market value -- “pennies on the dollar” -- and well below what he might have charged you or me. When the buyouts became successful, Kleinbard proposed, the pennies on the dollar were suddenly worth real dollars.

“What's very frustrating to me about all this is that we can only talk in abstractions and generalities because, again, of the lack of disclosure,” Kleinbard said.

Without mentioning the heroics Romney has accomplished in his IRA, the New York Times editorialized on July 10 that the rest of Romney's opaque “tax avoidance” schemes -- including overseas shelters in the Cayman Islands, Switzerland and elsewhere -- amount to nothing short of a “financial black hole” that he would be well advised to explain to the public. He should put explaining his magical IRA at the top of the list.

--Bloomberg News--

(William D. Cohan, a former investment banker and the author of “Money and Power: How Goldman Sachs Came to Rule the World,” is a Bloomberg View columnist. The opinions expressed are his own.)