It was clear in a recent congressional hearing that Rep. David Scott, D-Ga., wants more of his Democratic colleagues to join him in opposing a Department of Labor investment advice proposal that has generated fierce resistance from the financial industry.

During a January 10 House Financial Services subcommittee meeting on the proposal, Scott noted that he and Rep. French Hill, R-Ark., recently wrote a letter to the DOL urging the agency to withdraw the proposal. It was signed by 50 lawmakers, including five Democrats.

Scott said a 2015 letter to the DOL expressing concerns about a previous iteration of the proposal drew 93 Democratic signatures, including that of Rep. Brad Sherman, D-Calif., the ranking member of the subcommittee.

Sherman appears to be more sympathetic to the latest version of the proposal, which would impose the fiduciary standard of federal retirement law on most investment advisors, brokers, and insurance agents making recommendations to retirement plans and plan participants and customers in individual retirement accounts. A federal appeals court vacated a similar regulation in 2018.

The DOL asserts tougher rules are needed to protect investors from advisor conflicts of interest that lead to “junk fees.” Financial industry critics say a

fiduciary-only proposal would significantly increase advisors’ regulatory costs and legal exposure, making advice more expensive and hurting investors with modest assets.

Sherman said he comes down the middle. He outlined ways the proposal could be improved but said some kind of regulation is needed. He does not want the agency to abandon the proposal as Scott, a handful of other Democrats, and dozens of Republicans are demanding.

For opponents of the rule, getting more Democrats on board is key to applying pressure to the DOL. President Biden introduced the measure at a White House event in late October, signifying that it’s an administration priority. Industry trade associations are making the rounds on Capitol Hill talking to lawmakers and their aides about what they say are the negative effects of the proposal.

“We are educating as many people as we can on both sides of the aisle so that they understand the potential impact on low- and moderate-income retirement savers,” said Lisa Bleier, managing director at the Securities Industry and Financial Markets Association. “We anticipate that there are other members of Congress who are working on letters.”

If it’s just Republicans resisting a regulation, it’s easier for the DOL to brush off criticism. Just as strong bipartisan backing can propel retirement policy, such as the SECURE 1.0 and 2.0 bills, widespread bipartisan opposition can slow or stop it.

“When you have both sides come together and support something – or in this case oppose something – we can put forth better policies for retirement savers,” said Diane Boyle, senior vice president of government relations at the National Association of Insurance and Financial Advisors.

It’s a tall order to get Democrats to turn on a Democratic White House in an election year. Micah Hauptman, director of investor protection at the Consumer Federation of America, noted that only five House Democrats signed the Scott-Hill letter and eight Senate Democrats signed a letter asking DOL to extend the proposal’s public comment period.

“That’s hardly a groundswell,” Hauptman said. “It looks like Democrats are sticking with the administration. Ultimately, we’re confident they’ll agree that workers and retirees they represent deserve advice in their best interests.”

But opponents of the rule say they’re breaking through to legislators with the assertion that the proposal will constrict the availability of financial advice.

“That is something that is really resonating as we have conversations with different [congressional] members,” Boyle said.

Dale Brown, CEO of the Financial Services Institute, said Republicans and Democrats are listening to the argument that some clients and customers could be priced out of the advice market.

“Support for access to advice for everyone is bipartisan,” Brown said.

One of the most powerful ways for Congress to stop a regulation is by cutting off funding for an agency to implement it. In meetings with lawmakers, Finseca, a financial industry trade association, is promoting a so-called rider on an upcoming appropriations bill that would prevent DOL from implementing a final fiduciary rule.

“There is an openness and receptivity,” said Finseca CEO Marc Cadin. “We have to continue to work the process.”

As Congress struggles to agree on full-year funding bills, Democratic leaders have said they oppose attaching poison pills like one to hamstring DOL.

“I’m confident President Biden would veto an appropriations bill that includes that type of rider,” Hauptman said.

It’s not clear when DOL will release a final fiduciary rule. In the meantime, opponents are looking to add Democrats to their ranks. One industry lobbyist said only one Democrat came out in strong support of the proposal at the January 10 hearing. Others who supported it did so with some reservations. He said this was progress for his side.

“There’s Democratic discontent bubbling up about this rule,” said the lobbyist, who asked not to be identified. “Even though it’s a small number now, you’re going to see it grow.”

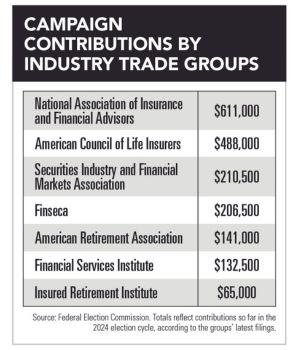

Making campaign contributions to lawmakers is an integral part of lobbying. But there’s not always a direct relationship between donations and policy positions.

For instance, financial industry trade associations almost always contribute to Republicans and Democrats on key committees, ensuring that some of their funds go to lawmakers who oppose some of their priorities. A donation may open a door to a meeting but not be the decisive variable on a vote.

“I don’t think it’s the only component in decision-making,” said Diane Boyle, senior vice president of government relations at the National Association of Insurance and Financial Advisors.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound