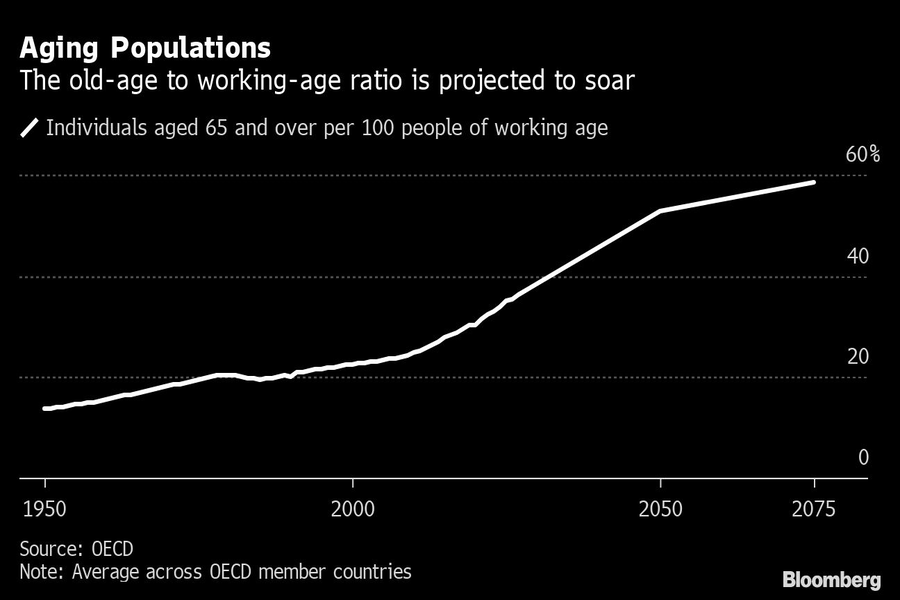

It’s the slowest moving financial crisis of our time. Public finances are buckling as retirement promises made to previous generations collide with the realities of an aging population.

State pension costs in developed economies, often already the biggest single area of government expenditure, are projected to soar and leave scant room for other spending priorities. Back in 1980, pensions consumed about 5.5% of GDP, and by 2040 that could top 10%, according to the best available data from the Organization for Economic Cooperation and Development.

Yet despite near-universal agreement from economists that we’ll all need to work for longer, save more or receive less, reform efforts are in trouble. Nearly half of OECD countries haven’t passed legislation to increase the normal retirement age. Some are softening planned reforms as the political and social backlash escalates.

Underlying the impasse is a deep-seated popular fear that a comfortable retirement could once again become something only the privileged get to experience. Prior to the expansion of state pension systems in the 20th century, which aimed to break the link between old age and poverty, working up until your death was commonplace. It was only the rich who could reasonably expect comfortable leisure time at the end of their lives.

“Making people wait longer to claim their pensions falls most heavily on those who can least afford to wait,” said Beth Truesdale, a research fellow at the W.E. Upjohn Institute for Employment Research in Michigan. “Precarious working conditions, family caregiving responsibilities, poor health and age discrimination make it difficult or impossible for many to work into their late 60s and beyond.”

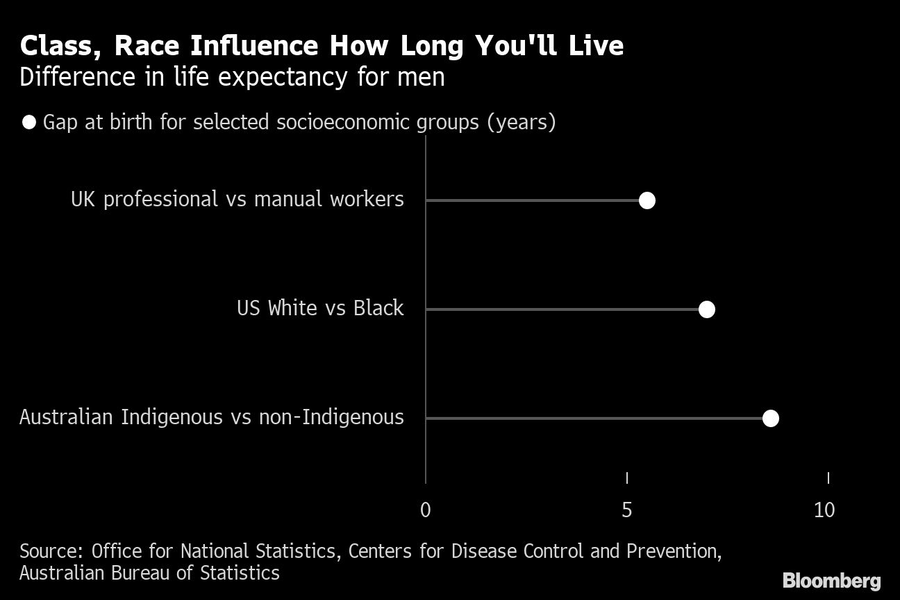

After all, it’s easier to contemplate working for longer if you are sat behind a desk rather than laboring on a building site. And the uncomfortable fact is that ethnic minorities and the poor experience more ill health and die earlier than their richer compatriots.

But even for the better-off, there is a sense that those yet to retire are losing out.

“For a person of my age, the statutory pension is like one of those Scottish mountains,” Natalie Elphicke, 52, a U.K. member of parliament, said in a recent debate on raising the retirement age. “It is an optical illusion: as we get ever closer, it seems that there is just that bit further to go.”

This all makes changing retirement conditions a huge political challenge. France is currently experiencing major strikes over pension reforms. In Ireland and Canada, authorities have already walked back planned age-eligibility rises. In China, where the population shrank last year, reforms have been repeatedly delayed. In other countries, there are campaigns to lower requirements for specific disadvantaged groups.

“There’s a limit as to how far people are prepared to accept it, ” said Claire Matthews, associate professor at Massey University Business School in Palmerston North, New Zealand, who supports some further rises in her home country. “Some countries have reached the limit already.”

One of those pushing back is Dennis, a 65-year-old Indigenous Australian who prefers to use his first name only. He works as a tour guide at Melbourne’s Royal Botanical Gardens, educating visitors about plants as well as Indigenous culture and history.

He’s the main plaintiff in a landmark legal attempt to lower the pension age for Indigenous people due to a persistent gap in life expectancy that he sees as the direct result of colonization. Just 70% of Indigenous men live long enough to access the government pension, compared with 86% of the general population, according to a study from Curtin University.

Dennis’ childhood memories of growing up in the small town of Cherbourg in Queensland are punctuated by a seemingly endless stream of funerals.

“A lot of them weren’t even reaching 30. You’d hear people crying at night because they lost a loved one,” Dennis, a proud Wakka Wakka man, said. “Then you’d hear sobbing all around you.”

Aboriginal and Torres Strait Islanders, who comprise about 3% of the population, experience high levels of disadvantage. Those now at retirement age are part of a generation where many worked for employers that stole part or all of their wages and where government policy saw Indigenous children forcibly removed from their parents. Poor health and working prospects have persisted, with only about half of prime working age Indigenous people in employment, according to government data.

Adjusting the pension for the gap in life expectancy would be fair, said Yorta Yorta woman Nerita Waight, chief executive officer of the Victorian Aboriginal Legal Service, one of the organizations running the legal case.

“It’s hard to actually think of an Aboriginal person I know who’s been able to retire at a decent age,” Waight said, adding that many Indigenous people work right up to the end of their lives.

That’s a situation most advanced economies thought consigned to history.

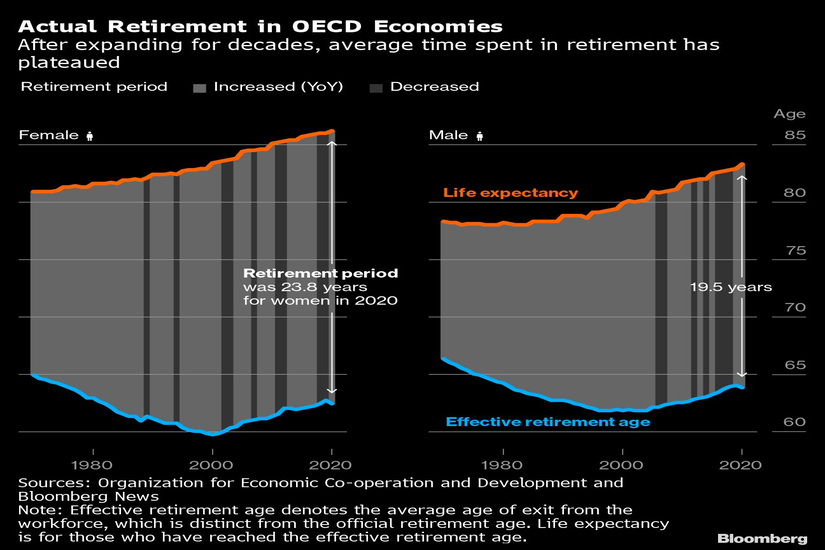

Indeed, throughout the late 1970s and 1980s — against the warnings of economists — politicians in many developed countries responded to chronic unemployment by lowering state pension ages in an attempt to create more job opportunities for the young.

Then from the late 1990s onwards, with the growing realization that fertility rates were in long-term decline and there would be far fewer workers in the future to support longer-living retirees, policymakers abruptly switched tack.

Trouble was, getting caught behind the demographic curve meant big changes were needed quickly. In most cases this didn’t happen, leading to increasingly dire warnings from experts about the sustainability of systems.

In the U.S., for example, by 2034 Social Security will only have the money to cover about 80% of scheduled payments unless government action is taken, according to its trustees.

Even reforms that might seem relatively restrained to an outsider can spark popular revolt. More than 1 million people joined marches across France on both of two days of protests in January against President Emmanuel Macron’s plan to overhaul its pension system, and unions plan more action in February.

His changes include raising the minimum retirement age from 62 years old to 64 and accelerating the implementation of a 2014 reform to increase the minimum period of contributions to access a full pension. The reforms could help eliminate the system’s deficit by 2030, according to the government.

The plans have been met with outrage from unions. They say changing the typical age will hurt the least well-off as many will have already worked the required contribution years by 62 — whereas those who spend longer in education won’t reach the minimum before 64 anyway.

As the system will continue to allow people in certain demanding jobs — like police officers — to retire earlier than the standard cut-off, it’s those in physical jobs that don’t meet this intensity threshold among the most dismayed.

Elodie Ferrier, 45, has worked as a salesperson in a clothing store in French city Poitiers for the past 20 years. Picking up bulky boxes means she already has back problems and the thought of working further into her 60s fills her with fear.

“I’ve worked for years, all day, going up and down stairs, carrying boxes,” Ferrier said. “For people in similar situations, two more years of this is dreadful."

And there is widespread popular sympathy for her plight. Opposition to the pension reform stands at 65%, according to a recent poll by Elabe for BFM TV.

A previous attempt to reform French pensions in 2019 triggered some of the longest transport strikes in French history.

Underpinning the retirement dilemma is that in most countries, overall life expectancy and how long you can expect to stay in good health are strongly correlated to social and economic privilege.

Unemployment benefits are typically lower than public pensions, making any period between leaving the workforce and pension eligibility hard, especially for people without private savings. And of course, many companies still aren’t that interested in hiring older workers.

“As the state pension age continues to get higher, potentially we’re going to see that increases in poverty will get more severe,” said Laurence O’Brien, research economist at the Institute for Fiscal Studies.

There is currently speculation the U.K. government is considering bringing forward the planned increase to 68. The last increase from 65 to 66 more than doubled poverty rates among 65-year-olds, according to the IFS.

Furthermore, gains in healthy life expectancy — and hence the ability to enjoy retirement — have lagged behind overall life expectancy as the incidence of chronic non-communicable diseases has grown.

While there are indications that even before the Covid-19 pandemic life expectancy increases had slowed, experts argue against putting off reforms.

“Governments just have to face up to this issue,” said actuary David Knox, a Melbourne-based senior partner at Mercer and author of an annual global pensions index. “If you’re going to keep paying out more and more money, you’ve got to generate that money from somewhere and therefore tax rates would have to increase.”

Other options include means testing — as some countries such as Australia already do — lowering payouts, redirecting spending from other areas or issuing more debt.

Continuing to raise standard retirement ages while carving out specific exemptions for disadvantaged groups is an option, but there are concerns about mission creep.

Consider Mexico for example. In 2019, the president established a new government-funded pension plan in which the minimum age for the Indigenous population was 65 years, compared with the standard 68. The differential lasted only about two years before efforts to expand the program led to the qualifying age being lowered for all.

That has allowed 11 million people across the country to get regular payments, yet the state is quickly racking up potentially unsustainable costs, said Fausto Hernández Trillo, an economics professor at Mexico’s Center for Economic Investigation and Teaching. There is now another campaign to further lower the age for Indigenous people.

A number of countries, notably in Europe, are trying more flexible access rules. In Norway, there are higher benefits for those who stay in the workforce longer and Finland is among those which has linked future age-increases to life expectancy.

Neither approach is a panacea. In the U.S., claiming Social Security at 62, rather than the full retirement age of 67, brings about a permanent 30% haircut in benefits. Yet many Americans, particularly those in poor health, aren’t able to wait. And life expectancy increases typically aren’t even across society.

Of course, many people are happy to work later. The refocusing of economies toward the service industry, changing attitudes to older workers, strong labor market conditions and increased part-time options make it easier to stay employed, said Terry Rawnsley, a Melbourne-based urban demographer at KPMG.

“The transition from full-time work to retirement’s become a lot more complex,” Rawnsley said. “People are making a whole range of individual decisions.”

Yet sometimes these choices don’t really feel like choices to those in less well-paid jobs. Take Catherine Gaspari, a 67-year-old from the south of France who has worked for a casino company for the past 33 years.

While she could retire now, the pension she would receive — which in France is linked to your salary — isn’t enough to meet her family’s bills at a time when the cost of living is soaring. So Gaspari is steeling herself to try and work until she is 71, as each additional year of contributions will entitle her to a larger pension.

“I’ve spent years working nights, carrying gambling machines, breaking my back, my legs, my hands, manipulating heavy machines. I’ve been around smokers all day who’ve ruined my health,” she said. “How much longer can this last?”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound