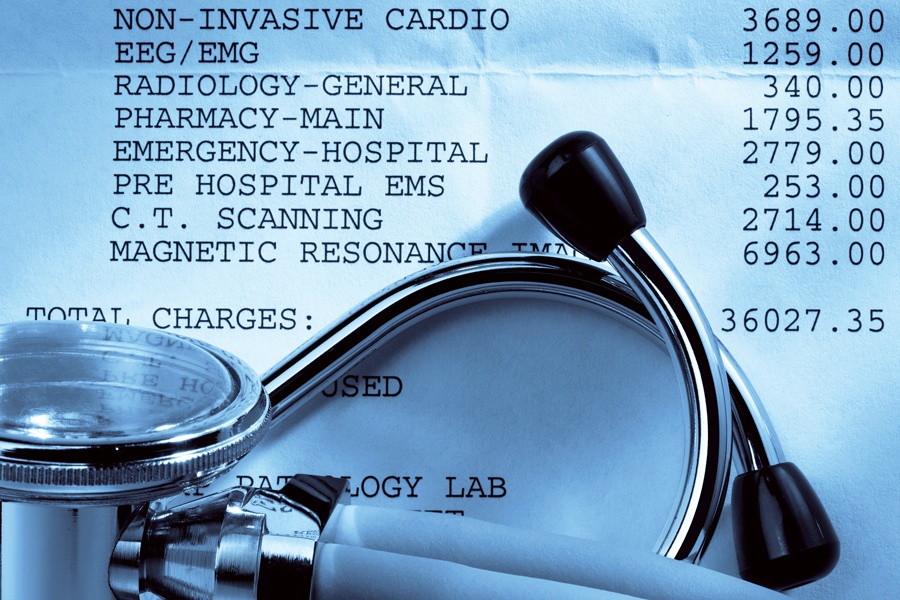

Like most things this year, the cost of retirement health care is going up.

Even worse, most Americans are way off in their estimate of how much more it will cost.

A 65-year-old couple retiring in 2022 can expect to spend an average of $315,000 in health care and medical expenses throughout retirement, according to Fidelity’s 21st annual Retiree Health Care Cost Estimate. That's up 5% from last year's estimate of $300,000 and has nearly doubled from Fidelity's original estimate of $160,000 back in 2002.

The 2022 estimate for single retirees is $150,000 for men and $165,000 for women, according to the study.

Fidelity’s estimate assumes both members of the couple are enrolled in traditional Medicare, which covers expenses such as hospital stays, doctor visits and services, physical therapy, lab tests and more through Medicare Part A and Part B, and prescription drugs in Part D.

Fidelity first calculated its Retiree Health Care Cost Estimate in 2002 as a way of building greater awareness of health care costs as individuals approach retirement. Privately held Fidelity holds assets under administration of $10.5 trillion, including discretionary assets of $4.0.

Fidelity’s research also found that Americans' expectations about high their health care expenses will be after they stop working are far from accurate.

According to the study, couples retiring this year assume they will spend only $41,000 on health care expenses in retirement, or $274,000 less than Fidelity’s analysis. Furthermore, more than two-thirds (68%) of those surveyed by Fidelity believe that associated costs will remain under $25,000.

Ron Mastrogiovanni, president and CEO of HealthView Services, which provides health care cost projection software, generally agrees with Fidelity’s health care cost estimates for a 65-year-old couple. However, after personalizing projections, he said costs could be more than triple Fidelity's projections.

"Based on coverage, health conditions, state of residence and expected retirement income, costs for a 65-year-old couple retiring this year can range from approximately $300,000 to over $1 million," Mastrogiovanni said.

The bright side, however, is that the number of people who feel prepared increases among those who have a health savings account. Nearly half (47%) of HSA holders say they are ready for their health care retirement expenses, according to the Fidelity survey, compared to just 27% of those who don't have an HSA.

An HSA allows account holders to pay for qualified medical expenses in a tax-advantaged way by making contributions tax-deductible. HSA account money also can be spent tax-free for qualified medical expenses, and any potential growth is tax-free as well.

"Financial advisers should not be surprised at the upward trend in retirement health care costs, or at least not as surprised as the investors surveyed," said Tom West, creator of the Lifecare Affordability Plan. "COVID has accelerated health care costs and health care access trends that have been visible for more than a decade. One tiny silver lining of our COVID-impacted world might be a heightened sensitivity to the real financial risk that Americans face in their health care futures."

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound