With household finances under pressure, some American families are finding medical expenses one bill too much, or even foregoing medical care altogether.

A poll of 1,000 U.S. adults reveals that two-thirds (67%) said that inflation is making it harder to pay medical bills in 2023, up 10 percentage points from last year, while more than a third said they are “avoiding medical care” because of debt, up from 28% in 2022.

The research from Debt.com also found that 32% said that their medical debts were in collections this year, up from 28% last year.

"Inflation may be subsiding, but the damage it wrought will stay with us for a long time," says Debt.com founder and chairperson Howard Dvorkin. "Medical debt was a growing problem before inflation, even before the pandemic. Now it's becoming a crisis."

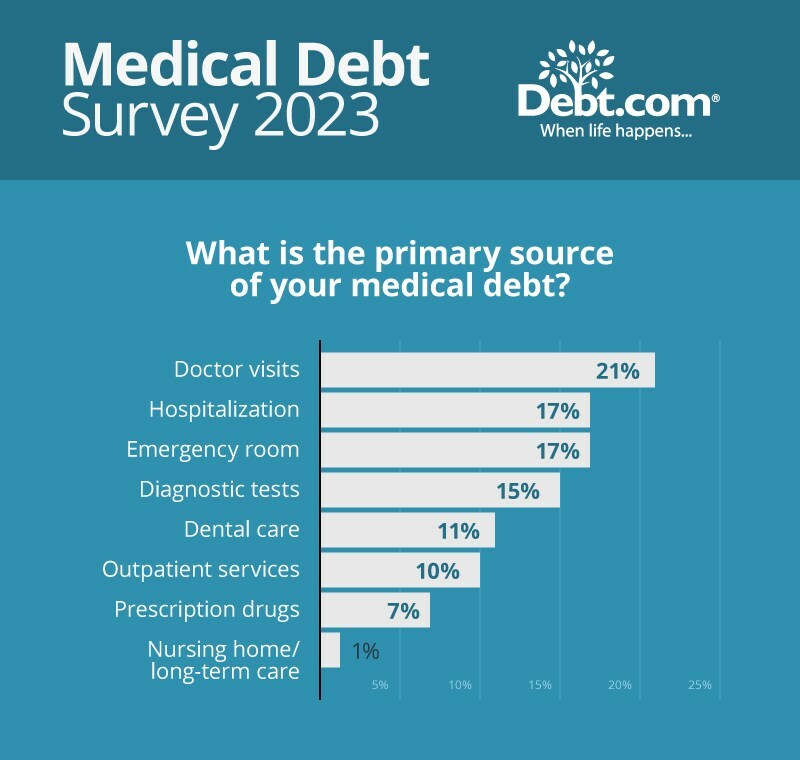

While a major illness can be very costly, routine appointments with doctors (21%) are a larger cause of medical debt than a visit to the emergency room or other hospital procedure (17%). In 2020, these were reversed with hospitalization causing 25% of medical debt while doctor’s visit was cited by 15%.

Other medical costs adding to debt burdens include diagnostic tests, dental care, outpatient services, prescription drugs, and nursing home/long-term care.

On the plus side, the level of medical debt is lower in 2023 than it was three years ago.

The survey reveals that 56% of medical debt this year is less than $500 while 15% is in the $1000-5,000 range, compared to 20% and 34% respectively in 2020.

But this is reflective of people avoiding incurring debt through more expensive medical care.

"Medical debt doesn't exist in a vacuum. It's quite likely that doctor's visits have become harder to pay because Americans have many other debts they're juggling,” Dvorkin added. “Credit card balances are approaching levels not seen in decades, and student loans aren't getting any smaller. Add in regular checkups, and it's a cumulative and pervasive problem."

However, Debt.com says that many people may be unaware of payment plans and other options for paying their medical bills.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound