Money has been pouring into taxable accounts at a faster rate than 401(k)s and IRAs, a reversal of a long trend resulting from wealth being increasingly concentrated among older investors.

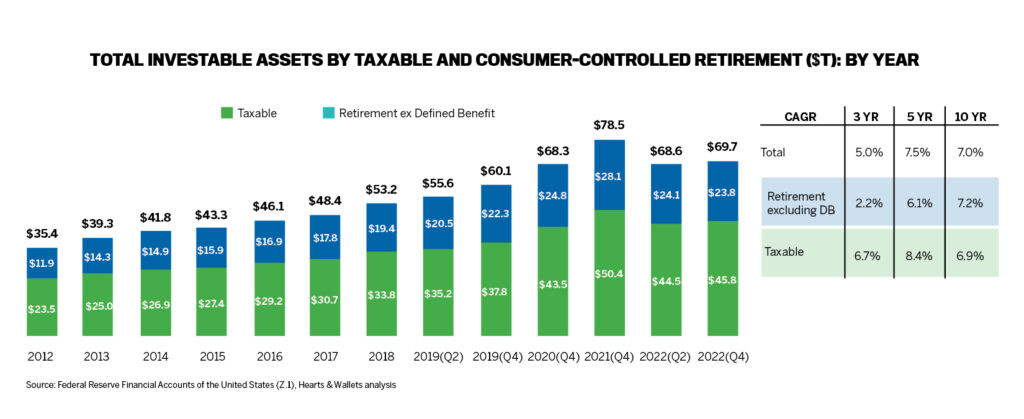

The compound annual growth rate in taxable accounts as of the end of 2022 was 6.7% over three years and 8.4% over five years, versus 2.2% and 6.1% among retirement accounts, according to recent data from consumer research firm Hearts & Wallets. Those figures differ from the 10-year compound annual growth rates of 6.9% in taxable and 7.2% in retirement.

“Virtually all of the assets in the U.S. are concentrated in older households,” said Laura Varas, CEO of Hearts & Wallets. “As their assets are growing, they have to be in taxable accounts,” as they have maxed out contributions to individual retirement accounts, 401(k)s and other tax-advantaged options, she noted.

It’s also a result of increasing wealth inequality. There are about two million households with at least $5 million to invest, accounting for a total of $33.4 trillion in assets, while there are more than 110 million households with less than $500,000, representing $8.2 trillion, according to Hearts & Wallets data.

About $51 trillion in assets, or 74% of the total $70 trillion U.S. retail investing market, is held by people 55 or older, the firm reported.

But the taxable accounts story isn’t just reflective of the wealthiest investors. In the era of meme stocks, uncertainty caused by Covid and technological advances, people with smaller asset bases are interested in investing, with a focus on liquidity and emergency savings. Those with $5,000 to $100,000 to invest have 73% of their assets in taxable accounts, close to the 74% seen among investors with more than $10 million.

“Taxable accounts are growing in popularity with young people in part due to the popularity of online platforms such as Robinhood or Acorns,” Landon Tan, founder of Brooklyn, New York-based Query Capital, said in an email. “Many young people think they ‘should be investing’ but aren't aware that retirement accounts also contain investments, but with a tax advantage. So when they open investment accounts online, they may not be making a conscious choice about opting for flexibility but rather a default decision based on marketing.”

Uncertainty and inflation are factors to consider as well.

“As life has become more expensive to fund, many clients have tighter budgets than they might have 50 years ago. I advise clients that it is worth paying a premium for liquidity,” Eric Amzalag, owner of California-based Peak Financial Planning, said in an email. “It is scenario-specific, but those clients that do not have significant disposable income or significantly high savings rates are good candidates for this line of thought.”

High-earning midcareer clients can hit their maximum annual contributions to tax-advantaged accounts quickly, so for those who want to invest 20% to 30% of their gross income, taxable accounts are a necessity, Eric Roberge, CEO of Boston-based Beyond Your Hammock, said in an email.

“Both [accounts] are for long-term growth, so will be invested with a significant exposure to equities,” he said. “The taxable account provides supplementary retirement income support if needed but can also be used for just about anything since there are no restrictions on when and how you can use the money.”

The taxable accounts trend doesn’t reflect poorly on the defined-contribution savings system, which continues to grow, Varas noted. However, the recent emergence of state-sponsored automatic IRA systems doesn't yet appear to have had much effect on the savings habits of younger, lower-income workers, she said.

What the taxable accounts growth trend does mean for advisors is that it's crucial to consider more retirement income strategies with so many clients who are entering retirement or on the verge of it, she said.

“The key question now is, ‘How do you get the money out of these accounts?’” Varas said.

That also leads to a question about how to handle inheritances, said Catherine Valega, founder of Winchester, Massachusetts-based Green Bee Advisory.

“I'm seeing more of this — and the Secure Act's sabotage of the lifetime beneficiary withdrawals from inherited IRAs added to the demand for taxable accounts,” Valega said in an email. “Typically, we don't get to taxable accounts until you've maxed out your retirement plan savings options, but once you do, we'll manage tax-efficient portfolios that are liquid, flexible and if inherited still qualify for the step-up in basis.”

Retirement accounts still represent the biggest buckets for people with investible assets ranging from $75,000 to $5 million, Hearts & Wallets data show.

“With respect to younger investors, they should strive to maximize contributions to tax-favored accounts. One, it is savings for their future. Two, they benefit immensely from time on their side. Three, their assets have the potential to grow faster because of the tax shelter,” said Kashif Ahmed, president of Bedford, Massachusetts-based American Private Wealth. “Whether young or older, my advice is always to focus on asset location, before allocation.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound