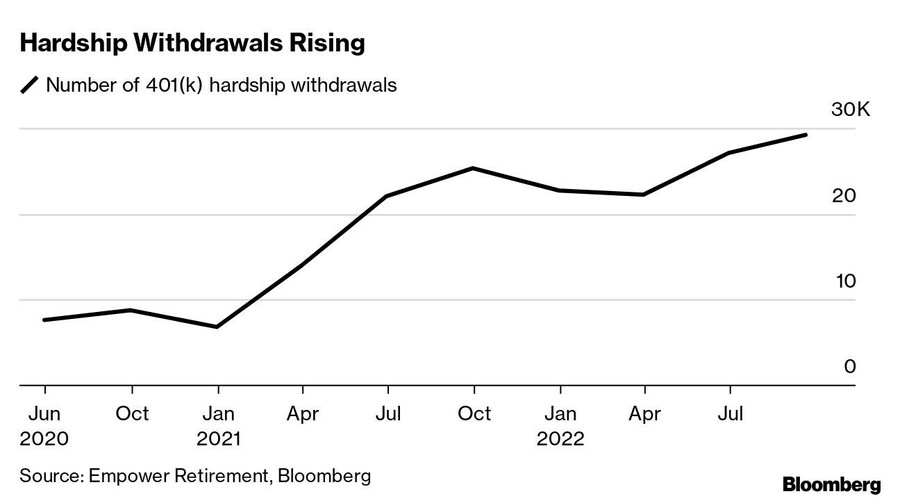

More Americans are tapping their 401(k)s for financial emergencies, with the percentage of retirement savers pulling money for hardships spiking 24% in the 12 months through Sept. 30, according to new data.

For now, the overall percentage of savers withdrawing money for sudden hardships remains low, rising to 1.3%. And about 60% of that activity came from savers with incomes below $60,000, according to a study by Empower Retirement of 4.3 million plan participants in mostly corporate retirement plans. Still, the increase speaks to the financial stress Americans are under.

“It’s intuitive that relatively lower-income people are going to be tapping resources because they have fewer options, but it’s starting to spread,” said Luis Fleites, director of thought leadership at Empower. “I wouldn’t be surprised if it continues to rise at other income levels.”

Loans against 401(k) accounts rose 13% in Empower’s study. More than half of all loans and hardship withdrawals in the 12 months through Sept. 30 were taken by Gen Xers, who are between the ages of 40 and 57.

Fidelity Investments also saw an increase in hardship withdrawals among a universe of more than 21 million 401(k) plan participants. From January through October, 2.2% of participants took the withdrawals, up from the 1.9% average for all of 2021.

In recent history, the most common reasons for withdrawals were to avoid foreclosure or eviction, followed by medical expenses, said Michael Shamrell, vice president of thought leadership at Fidelity.

An investor who pulled money out of a 401(k) a year or so ago might have had the luck to sidestep the S&P 500’s drop of about 15% since then. Anyone contemplating pulling money from the market now could be locking in losses near a low, with slumping stocks and bonds leading to average 401(k) returns of negative 23% and 27% over the past year at Fidelity and Empower, respectively.

While interest paid on a loan goes back into 401(k) accounts, borrowers will miss out if there's a sharp rally in the stock market, and there’s less money in the account, compounding tax-free, year after year.

In 401(k) plans that allow loans, you can generally take out up to 50% of your balance, up to $50,000. If you lose your job, you may be required to pay back the loan within a short window, although some companies allow former employees to continue paying the loan off in installments.

In contrast to a loan, money taken in a hardship withdrawal never goes back into a 401(k). The IRS says that to do this kind of withdrawal, savers must have “an immediate and heavy financial need.” The money might be needed to forestall an eviction or foreclosure, for funeral costs, for medical expenses, to cover expenses and losses from having one’s home or primary place of employment in a federal disaster area, to pay tuition, or to buy a principal residence. Individual plans may choose to offer withdrawals for just some of those needs.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound